Fiat currency is the money issued by a government that is not backed by a physical commodity like gold or silver. Instead, its value is derived from the trust and confidence people have in the government that issues it.

Here’s a simplified explanation of how it works:

Origins and History: Fiat currencies have been around for centuries, but they became more prevalent in the 20th century as countries moved away from the gold standard. The United States, for example, abandoned the gold standard in 1971, allowing the dollar to become a fiat currency. More on that here:

The Closing of the Gold Window in 1971 and Its Economic Impact

·The year 1971 marked a pivotal moment in global monetary history when President Richard Nixon made a historic decision to close the gold window, effectively ending the direct convertibility of the US dollar to gold. This move, although initially termed as "temporary," had far-reaching consequences that reshaped the global financial landscape. The events…

Value and Trust: The value of fiat currency is based on the government's decree and the trust people have in it. As long as people believe in the stability of the issuing government, they will accept and use the currency for transactions.

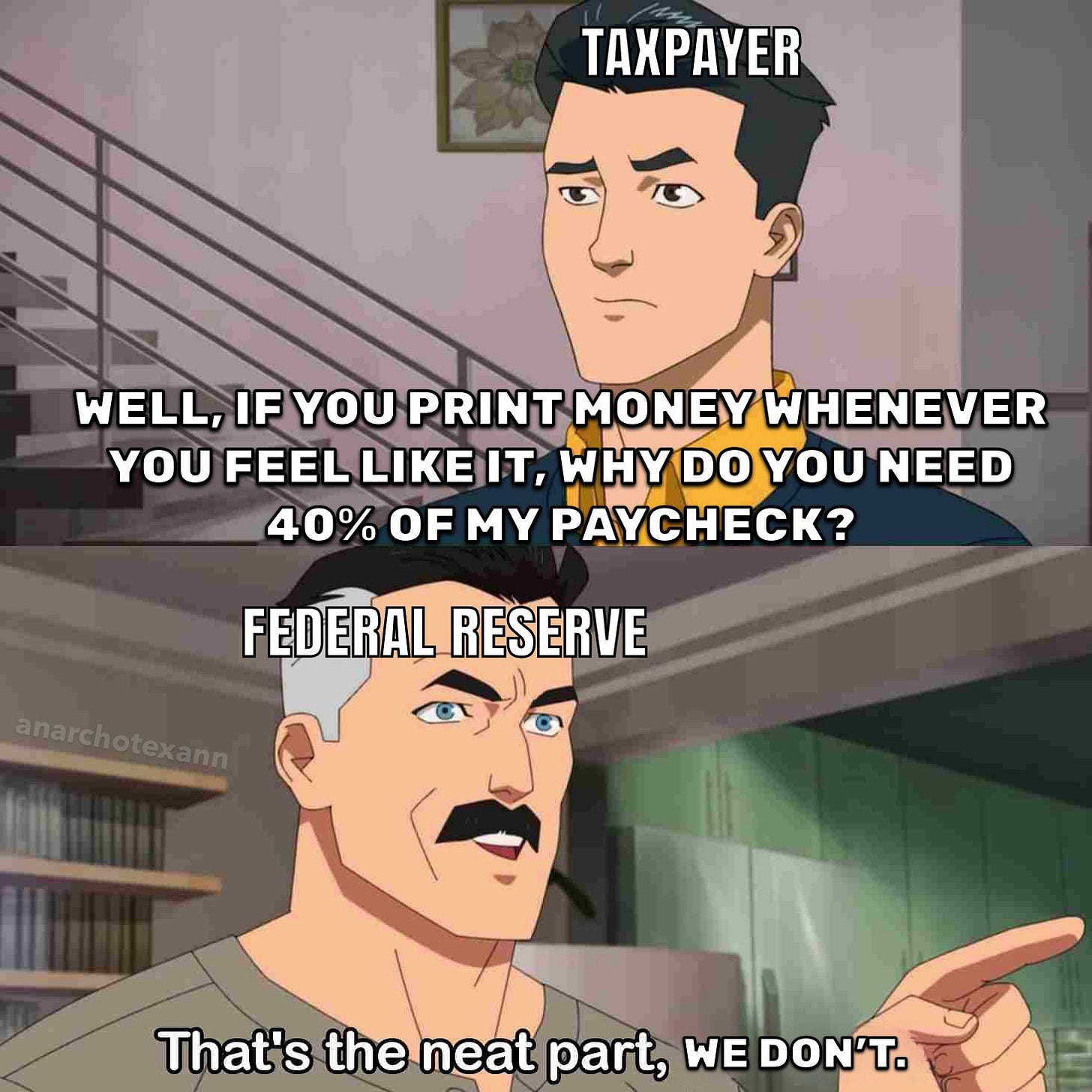

Central Bank Control: Central banks, such as the Federal Reserve in the US, have the authority to control the supply of fiat currency. They can print more money or remove money from circulation to influence economic factors like inflation and interest rates.

Rise and Fall: Fiat currencies can experience periods of inflation (where prices rise) or deflation (where prices fall). In extreme cases, this can lead to hyperinflation (a rapid and uncontrollable increase in prices) or deflationary depression (a prolonged period of economic decline).

Examples of Collapse: Throughout history, several fiat currencies have collapsed due to factors like excessive money printing, economic mismanagement, or political instability. Recent examples include the Zimbabwean dollar and the Venezuelan bolívar. For a deeper dive, check out this post:

The Evolution of Fiat Currencies: A Historical Analysis

·Since the 1500s, the world has seen a remarkable transformation in the nature of currencies, moving from commodity-based money like gold and silver to fiat currencies backed by the trust in governments. This journey through monetary history is rife with the rise and fall of global reserve currencies, each marked by its own story of prosperity, debasemen…

Impact on Dollar Holders: As the world's reserve currency, a collapse of the US dollar would have far-reaching consequences. People holding dollars or dollar-denominated assets may see the value of their holdings decline, leading to a loss of purchasing power.

Asset Allocation: In times of fiat currency instability, certain assets tend to perform better than others:

Good to Have: Real estate, gold, and stocks are often considered better stores of value during currency crises because they have intrinsic worth and can retain their value.

Not Good to Have: Cash in the bank and bonds may lose value rapidly during hyperinflation. Also, you don’t want to be a fiat borrower during deflationary periods. This is because the money you borrowed is becoming more expensive to pay back over time (versus less expensive in the ”normal” inflationary environment) - governments who are the biggest borrowers absolutely cannot have deflation for any prolonged period of time.

Bitcoin as an Alternative: Bitcoin offers hope for freedom from the pitfalls of fiat currency:

Decentralization: Bitcoin operates on a decentralized network, meaning no single entity controls it, reducing the risk of manipulation.

Limited Supply: Unlike fiat currencies that can be printed at will, Bitcoin has a finite supply, capped at 21 million coins, which prevents inflationary pressures.

Transparency and Security: Bitcoin transactions are recorded on a public ledger called the blockchain, providing transparency and security.

Global Accessibility: Bitcoin can be accessed and used by anyone with an internet connection, providing financial inclusion to billions of people worldwide.

Store of Value: Many investors view Bitcoin as a hedge against fiat currency devaluation and economic uncertainty.

Conclusion

In conclusion, fiat currencies operate on trust and government decree, but they are susceptible to inflation, hyperinflation, and economic collapse. Recent examples of collapsed fiat currencies highlight the risks associated with centralized monetary systems. Bitcoin offers a decentralized alternative, providing hope for a more stable and transparent financial future. Its unique features make it an attractive option for individuals seeking to protect their wealth from the pitfalls of fiat currency shenanigans.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

Great content! Keep it up. Love reading your articles.