Since the 1500s, the world has seen a remarkable transformation in the nature of currencies, moving from commodity-based money like gold and silver to fiat currencies backed by the trust in governments. This journey through monetary history is rife with the rise and fall of global reserve currencies, each marked by its own story of prosperity, debasement, and eventual decline. Understanding this evolution is crucial to appreciating the current landscape of global finance, especially in the context of rising debt levels, currency debasement and Bitcoin’s potential to break this cycle.

Fiat Currencies: A Historical Overview

The 1500s marked a turning point when nations began to move away from the gold and silver standard towards fiat currencies. Fiat currencies derive their value not from any intrinsic worth but from the trust people place in the issuing government. The shift was gradual, but by the 20th century, most major economies had fully adopted fiat currencies.

Here’s a partial list of notable fiat currency failures:

French Assignats (France, 1789-1796) - Issued during the French Revolution, the Assignats were backed by confiscated church lands. They suffered from hyperinflation due to excessive printing, leading to their eventual collapse.

Continental Currency (United States, 1775-1781) - Issued during the American Revolutionary War, the Continental Currency rapidly depreciated due to over-issuance, lack of backing, and counterfeiting.

Confederate States dollar (Confederate States of America, 1861-1865) - The currency issued by the Confederacy during the American Civil War became practically worthless by the end of the war due to massive inflation.

German Papiermark (Weimar Republic, 1914-1923) - Following World War I, Germany faced hyperinflation, and the Papiermark became almost worthless, leading to the famous stories of wheelbarrows of money to buy basic goods.

Hungarian Pengő (Hungary, 1926-1946) - After World War I, Hungary experienced hyperinflation, and the Pengő underwent multiple revaluations before being replaced.

Zimbabwean Dollar (Zimbabwe, 1980-2009) - Excessive money printing and economic mismanagement led to hyperinflation, with the Zimbabwean Dollar becoming practically worthless, resulting in its abandonment.

Venezuelan Bolívar (Venezuela, ongoing crisis from 2010s) - In recent years, Venezuela has faced hyperinflation and economic turmoil, severely devaluing the Bolívar and leading to a reliance on foreign currencies and cryptocurrencies.

Yugoslav Dinar (Yugoslavia, 1990s) - During the breakup of Yugoslavia, hyperinflation ravaged the Dinar, with skyrocketing prices rendering the currency nearly useless.

Argentine Peso (Argentina, multiple crises) - Argentina has faced numerous currency crises throughout its history, with devaluations and hyperinflation eroding the value of the Peso at various points.

Brazilian Cruzeiro (Brazil, 1980s-1990s) - Brazil experienced multiple currency changes and hyperinflation during the 1980s and 1990s, leading to the eventual replacement of the Cruzeiro with the Real.

The 20th century witnessed the rise of several global reserve currencies, each dominating international trade and finance during its heyday. The British pound sterling held this position during the 19th century, backed by the stability of the British Empire. However, the devastation of World War I weakened Britain's economic power, leading to the ascension of the US dollar.

The Rise and Fall of Global Reserve Currencies

The Bretton Woods Agreement of 1944 solidified the US dollar's position as the world's primary reserve currency, pegged to gold at $35 per ounce. This system provided stability and facilitated international trade. However, by the 1970s, the strain of funding the Vietnam War and domestic social programs led the US to abandon the gold standard under President Nixon. More on that here:

The Closing of the Gold Window in 1971 and Its Economic Impact

The year 1971 marked a pivotal moment in global monetary history when President Richard Nixon made a historic decision to close the gold window, effectively ending the direct convertibility of the US dollar to gold. This move, although initially termed as "temporary," had far-reaching consequences that reshaped the global financial landscape. The events…

The end of the Bretton Woods system marked a pivotal moment, ushering in an era of pure fiat currencies. The dollar retained its dominance, buoyed by the size and strength of the US economy. Yet, cracks began to show as excessive spending and growing debt levels strained confidence in the dollar.

Ray Dalio's Insights on Empires and Debt Cycles

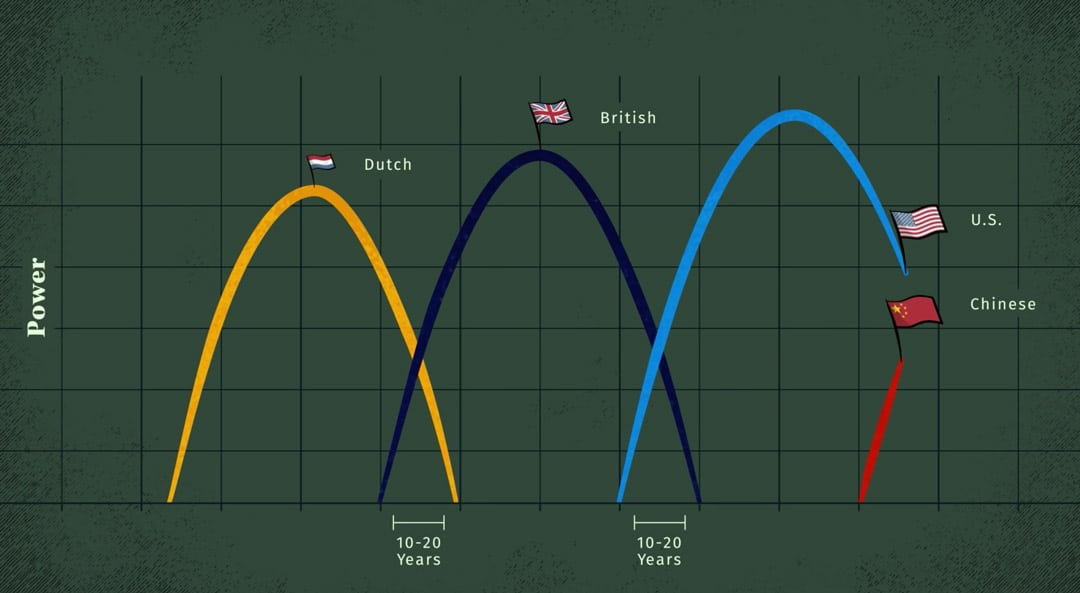

Ray Dalio's work on the rise and fall of empires and debt cycles offers valuable insights into this narrative. Empires throughout history have followed a familiar pattern: they rise, expand, accumulate debt, and eventually decline. This cycle is often accompanied by the debasement of currencies as rulers resort to printing money to finance their ambitions.

The temptation to solve political and economic problems through money printing has been a recurring theme in history. However, as Dalio notes, this path leads to currency debasement and eventual collapse. The cycle repeats as new powers rise, only to face the same challenges.

The Current Landscape: Rising Debt and Currency Debasement

Today, we find ourselves at a critical juncture with global sovereign debt levels reaching unprecedented heights. The COVID-19 pandemic prompted massive stimulus measures worldwide, further ballooning already substantial debt burdens. Countries are grappling with the challenge of servicing these debts without resorting to inflationary measures.

The risk of currency debasement looms large as central banks navigate the delicate balance between stimulating economic growth and maintaining price stability. History warns us of the dangers of unchecked money printing and the erosion of purchasing power that follows.

Bitcoin: A Solution to Fiat Currency Debasement

Enter Bitcoin, a revolutionary digital currency offering an alternative to traditional fiat currencies and gold. Created in the aftermath of the 2008 financial crisis, Bitcoin operates on a decentralized blockchain, immune to government manipulation and inflationary pressures.

Bitcoin's fixed supply of 21 million coins makes it inherently deflationary, contrasting sharply with fiat currencies prone to debasement. Its transparent and secure blockchain technology ensures trust and removes the need for intermediaries.

Breaking the Fiat Currency Boom/Bust Cycle

Bitcoin has the potential to break the cycle of fiat currency debasement that has plagued economies for centuries. Its finite supply and decentralized nature provide a hedge against inflation and government mismanagement of monetary policy. As investors increasingly view Bitcoin as "digital gold," its role as a store of value strengthens.

By offering a superior monetary technology, Bitcoin challenges the traditional notions of reserve currencies and central bank authority. It represents a paradigm shift in how we perceive and transact value, offering a glimpse into a future where currencies are not subject to the whims of political agendas.

Conclusion

The history of fiat currencies since the 1500s reveals a pattern of rise, debasement, and eventual collapse, often driven by the allure of debt-fueled growth and political expedience. Ray Dalio's insights on the cycles of empires and debt provide a sobering backdrop to this narrative.

Today, with global debt levels soaring and the specter of currency debasement looming, Bitcoin emerges as a beacon of hope. Its innovative technology promises to break the cycle of boom and bust inherent in fiat currencies, offering a path towards a more stable and transparent financial system.

As we stand on the precipice of another potential debt crisis, the lessons of history urge us to embrace new monetary technologies like Bitcoin. Whether it will indeed fulfill its promise of reshaping the global financial landscape remains to be seen, but its potential to mitigate the pitfalls of fiat currencies is undeniable. The future of money may very well be digital, decentralized, and resistant to the cycles of debasement that have defined our monetary history.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for supporting my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

Great piece! As usual.

Fiat money debasement is inevitable and that’s why central banks are pushing hard against all odds (e-naira, sand dollar, jam-dex … already failed) trying to emulate communist China e-yuan (adoption rate <50%) to centralize money even more with a touch of social control!

But that’s another topic.