The year 1971 marked a pivotal moment in global monetary history when President Richard Nixon made a historic decision to close the gold window, effectively ending the direct convertibility of the US dollar to gold. This move, although initially termed as "temporary," had far-reaching consequences that reshaped the global financial landscape. The events leading up to the decision, the subsequent economic shifts, and the contemporary implications highlight the complex interplay between monetary policy, economic dynamics, and societal changes.

On August 15, 1971, President Nixon addressed the nation in a televised speech, announcing the suspension of the dollar's convertibility into gold. He justified this decision as a response to the mounting economic challenges, including trade deficits and the depleting gold reserves. Nixon emphasized that this action was temporary and aimed at safeguarding the interests of the American people. However, the implications of this decision would reverberate through the decades to follow.

In the years and months leading up to the momentous decision to close the gold window in 1971, several key factors converged to create a complex economic landscape that prompted President Nixon's historic action:

1. Trade Imbalances: One of the central drivers was the growing trade deficit faced by the United States. The 1960s had seen an increase in imports, particularly from countries like Germany and Japan, which resulted in a significant outflow of US dollars to pay for these imports. This drain on US gold reserves raised concerns about the sustainability of the Bretton Woods system, which pegged currencies to the US dollar, and in turn, the US dollar's convertibility to gold.

2. Speculative Pressure: As doubts about the US dollar's stability and convertibility increased, speculators began capitalizing on the mismatch between the dollar's official fixed value and its perceived value in international markets. These speculative pressures put further strain on the US gold reserves.

3. Inflation and Monetary Policy: The late 1960s also witnessed rising inflation in the United States. A combination of factors, including increased government spending due to the Vietnam War and domestic social programs, contributed to inflationary pressures. The US government's decision to finance these endeavors by printing more dollars further fueled concerns about the dollar's long-term value.

4. Run on Gold: In the face of these economic challenges, there was a growing fear of a "run on gold." As doubts about the US dollar's convertibility intensified, foreign governments and central banks began exchanging their dollar holdings for gold, straining the US gold reserves and further undermining confidence in the dollar's stability.

5. Pressure to Devalue the Dollar: To address the trade imbalances and preserve the dwindling gold reserves, there were increasing calls for the United States to devalue the dollar against other major currencies. However, such a move was politically challenging and carried its own set of economic risks.

6. The Decision to Close the Gold Window: Faced with these mounting economic pressures, President Nixon made the unprecedented decision on August 15, 1971, to suspend the dollar's convertibility into gold. This decision effectively severed the last link between the dollar and gold, freeing the US government from its obligation to exchange dollars for gold at a fixed rate.

By closing the gold window, President Nixon aimed to buy time to implement economic measures to address the trade imbalances and inflationary pressures. He framed the decision as a temporary measure to protect the US economy, citing the need for a "new economic policy." However, the move marked a departure from the Bretton Woods system and ushered in a new era of flexible exchange rates and floating currencies.

In the aftermath of the decision, the international monetary system underwent significant changes, as countries shifted towards floating exchange rates and alternative forms of international monetary cooperation. This marked a turning point in the history of global finance and set the stage for the economic dynamics that would follow in the decades to come.

Post-1971 Economic Changes

Following the closing of the gold window, the value of gold underwent a significant transformation. No longer tethered to a fixed exchange rate, gold became a speculative investment and a hedge against inflation. This transition led to increased price volatility but also presented opportunities for investors to diversify their portfolios.

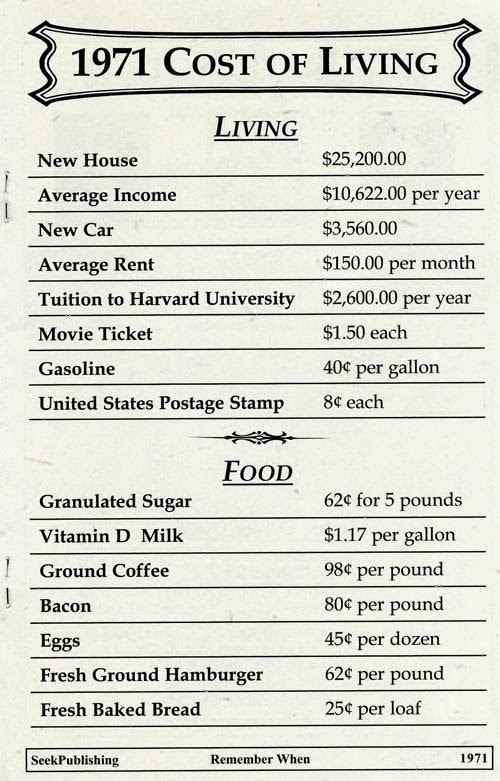

The purchasing power of the US dollar underwent a steady decline since 1971 due to the erosion of its value through inflation. This erosion is evident when considering the cost of living changes. In 1971, the average cost of a new car was around $3,500, whereas by the present day, this cost has escalated to around $40,000. Similarly, the average price of a new home has surged from around $25,000 in 1971 to over $300,000 today. Basic groceries that cost a few dollars in 1971 now command significantly higher prices.

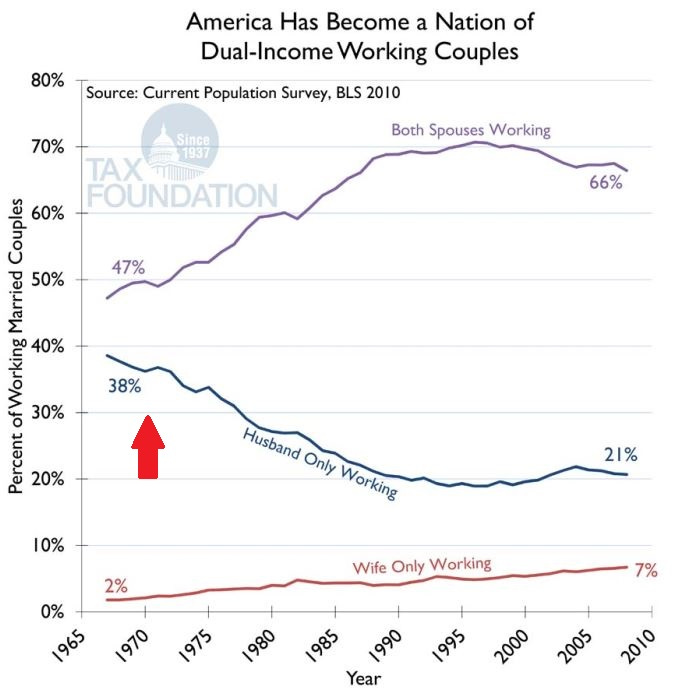

The rise in living costs has necessitated a shift in household dynamics. In the 1970s, it was relatively common for a single income earner to support a family. However, the disparity between wage growth and inflation has meant that many families now require both spouses to work in order to maintain their standard of living.

This shift has transformed family structures and altered societal norms.

Bitcoin as a Hedge Against Fiat Depreciation

Amidst this economic evolution, the emergence of cryptocurrencies, particularly Bitcoin, has gained prominence as an alternative store of value. Bitcoin's decentralized nature and fixed supply – capped at 21 million coins – contrast with the fiat money system that allows for unlimited money creation. This key attribute has led some to view Bitcoin as a hedge against further depreciation inherent in the fiat monetary system.

Bitcoin's borderless and censorship-resistant nature makes it an appealing option for individuals seeking to protect their savings from the risks associated with centralized financial systems. Its limited supply and deflationary properties stand in stark contrast to the inflationary tendencies of traditional currencies.

Indeed, Bitcoin is hope, as I wrote in this post almost exactly a year ago:

Bitcoin is Hope

While the mainstream media likes to focus on the negatives of Bitcoin, such as bear market price action or its use of energy, I have continued to feel a strong sense of growing optimism about the changes that Bitcoin can help bring about, not only in our economy but in society more broadly.

Conclusion

The closing of the gold window in 1971 by President Nixon initiated a series of economic changes that have fundamentally altered the global financial landscape. The shift in the value of gold, the eroding purchasing power of the dollar, changing costs of living, and transformed family dynamics illustrate the intricate relationship between monetary policy and societal dynamics. In the present day, the rise of Bitcoin as a potential safeguard against fiat currency debasement, with many qualities similar to and superior to gold, can be a source of hope for a better future. As we navigate the current era of an increasingly chaotic economic and social environment, understanding the lessons of history and the potential of Bitcoin and other freedom technology is a matter of survival.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here:

gr8 article. Im with you but only have a slightly different point of view as to the btc / gold,silver solution. we agree on source of problem just slightly different on solution. My only issue with btc is my lack of trust in computers, seems like they build in obsolescence . But ppl change their mind, Peter Schiff used to hate btc and he appears to be adopting some now, so who knows what could happen. btw, great graphics, can I borrow some of Them if I credit your channel or you? I apologize for not checking out your channel until now, been overwhelmed which is no excuse - Good to say hello, keen on your writing style, you're very talented