While the mainstream media likes to focus on the negatives of Bitcoin, such as bear market price action or its use of energy, I have continued to feel a strong sense of growing optimism about the changes that Bitcoin can help bring about, not only in our economy but in society more broadly.

A quick reminder of the key fundamentals of Bitcoin:

Absolutely scarce (21M maximum coins)

Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

The Bitcoin network operates independently of all legacy financial systems; it is the first digital global payments infrastructure

No counter party risk when self-custodied

Trustless; Bitcoin is not controlled by any person or group

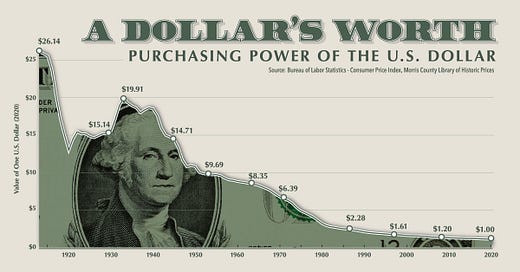

A hedge against fiat currency debasement / collapse in the same way that gold is, but doesn’t have gold’s drawbacks of difficulty to validate, store, transfer and secure - especially in large amounts

Because Bitcoin is an open, decentralized and immutable ledger, and because of the “proof of work” consensus mechanism to validate transactions, you can’t cheat the system. Day in and day out, regardless of what the price of Bitcoin is in fiat currency terms, blocks are written, transactions are processed and validated and the system keeps on working. Bitcoin is the digital embodiment of absolute scarcity and absolute truth. It is the truth and honesty of the Bitcoin protocol that is perhaps most fascinating to me, something that I align strongly with in my personal and professional life. Truth and honesty are sorely lacking in our modern financial system and by extension, our broader society. For example, just this week we have another Wall Street pump and dump scheme, this time with Bed, Bath and Beyond:

What’s worse is now BBBY might also be filing for bankruptcy (talk about a “rug pull”):

I believe at the core of many of our societal problems is a financial system that is fundamentally flawed, and the situation described above is just one of many examples where the wealthiest benefit from the system, while the poor and middle class do not. As I have written about before, survival in this world requires money, but the money is flawed in that its supply is limitless and is guaranteed to lose purchasing power over time, which forces you to have to invest and hold assets in order to preserve purchasing power.

We then go in search of investments that will “beat inflation.” Of course, financial education is not taught in our elementary schools, high schools or even colleges and so most of us are ill equipped to become investors without further education. Many people simply hand their money over to a “trusted third party” to manage their money and who get paid whether you make money or not. Personal finance seems like a pretty important subject, fundamental to survival in the modern world, and yet financial education falls on the individual to learn for themselves and to teach their children. Fortunately we have Twitter, YouTube, podcasts, Substack and many other great free sources of information to learn about personal finance, but it does take personal responsibility and commitment. My own financial education started by reading Rich Dad, Poor Dad by Robert Kiyosaki many years ago. Funny thing about personal finance is the more I learn, the more I realize I don’t know. Despite the availability of great free resources today, the general level of financial education in our society is very low and makes it easy for banks (debt) and the government (taxes) to keep the poor and middle class in what I call the Debt Cycle:

It’s true that the most highly taxed people in the US are those who are employees - most of the tax breaks benefit businesses and investors. Regardless of how you make your money, if you do have money to invest, it’s easy to lose a lot of money in the stock market, especially when bad actors are pumping and dumping stocks like I discussed earlier, but mostly due to poor financial education. There are plenty of people who end up not trusting the stock market after repeated losses, throw in the towel and just hold on to cash or bonds, which can’t possibly keep up with inflation - especially now with inflation at 8.5%.

To make matters worse, our financial system is debt based, which is to say that money is debt. A dollar is not an asset, it’s a liability of the US government (as compared to physical gold or Bitcoin, which is truly an asset and no one else’s liability). As I have written before, our system can’t grow unless debt continues to expand. When debt expands too much, we see asset bubbles created, scams, malinvestment and the like, which ultimately sets up for a crash. When debt contracts too much, all the bubbles burst, markets crash and we have a recession. We are seeing this playing out today. For many people, debt in the form of credit cards, a home mortgage, car loan or personal loans is essential as a matter of survival - keeping a roof over your family’s head, getting to work and putting food on the table. Rising interest rates and inflation make things even harder and keep you in the Debt Cycle.

For the wealthy, debt can be used to buy assets, whether that is real estate, businesses, stocks, etc. and earn a return while (thanks to the Federal Reserve) paying relatively small amounts of interest to generate that return. However, unlike the government who can borrow more or have the Fed print more money, the game is over if you can’t make your monthly payments or pay off your debt by selling assets. Furthermore, when interest rates are very low and debt is easy to come by, malinvestment and speculation run rampant causing massive market bubbles and crashes, hurting small investors in the process who have far more to lose (as a percentage of their net worth) than the wealthy and institutions. Indeed, we see a pattern of booms and busts going all the way back to the 1920’s that seem to be getting worse and more frequent in recent years (Dot.com, Great Financial Crisis, COVID Crisis, 2022 Bear Market, etc.).

Wall Street has turned everything into a casino, including the housing market, the stock market, the bond market, the crypto market, etc. In this casino, the house always wins.

Bitcoin, on the other hand, is simply honest, sound money. All you have to do is buy and hold it. With a long enough time horizon (say five to ten years), you can be comfortable knowing that the bitcoin you bought today will have at least the same purchasing power in the future and possibly even more than that, due to its absolute scarcity and growing network effect. You can also know that no one can take your bitcoin from you as long as you secure your private key, unlike bank accounts which can be “frozen” without your permission - as happened recently in Canada in response to the trucker protests. Those facts give me peace of mind and help to alleviate Debt Cycle anxiety.

A new financial system built on a Bitcoin foundation could usher in a new era of honesty and transparency in all financial dealings. Wild speculation, undisciplined lending and money that loses its purchasing power would be left in the past. This would be replaced by careful, thoughtful lending and investing, using a sound money. It would be a return to a simpler time of creating real value for the world in your work and being able to save the fruits of your labors in sound money, knowing that it’s safe and secure and will not lose purchasing power over time. Earning interest or a yield will no longer be a primary goal, since it won’t be necessary with sound money, but can offer someone who is willing to lend their Bitcoin a reasonable return for the risk they take. Most importantly, the market will set the price for the interest to be earned on those loans and not a small unelected group of bureaucrats and academics. In the same way, investing can be a choice rather than a necessity as it is in the fiat system. Bitcoin can help lead us back to a truly market-based economy and away from the centrally planned (and poorly run) economy we live in today. It can empower individuals to take control of their finances directly, eliminating the need for many of the financial intermediaries we have today and reversing decades of “everything financialization.”

For now, we live in the fiat debt based system and so we need dollars to pay for things day to day and we continue to borrow and invest as we always have with an eye to the future - one that could prominently feature Bitcoin. We continue to see massive and growing sovereign debt, inflation, market volatility, widening wealth gap, wild speculation and misallocation of resources - all signs that the legacy system is beginning to fail. Social unrest is becoming more frequent and visible throughout the world and is a reaction to the economic reality dealt by the failing system and also bad, often ridiculous political responses to today’s social challenges. All of this, especially growing debt is unsustainable and can’t go on forever without some sort of reset (in the case of debt, either inflation or default). The day will come when we can no longer “kick the can” down the road. In the end, government will push for greater control as things slowly fall apart, but I believe the people will reject the narrative that the government can solve all the problems (including controlling the weather) and will push back for more freedom. The transition to a new financial system will not be easy or painless, but it will hopefully usher in a new more positive era where our financial lives can be a bit simpler, we can enjoy more freedom and we can focus on what’s really important to us. Most importantly, Bitcoin’s truth and honesty can serve as a model for how we should conduct not only our financial affairs but also our social affairs in this new world.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.