Introduction

Over the past 1000 years, the world has witnessed the rise and fall of numerous fiat currencies. This historical journey, closely examined through the lens of Ray Dalio's work on long-term debt cycles and the cyclical rise and fall of empires, provides valuable insights into the dynamics of global monetary systems. As we stand on the precipice of potential transitions in the world's reserve currency, the US dollar, this article explores the past, present, and future of global currencies, with a particular focus on the role of Bitcoin.

The Historical Perspective

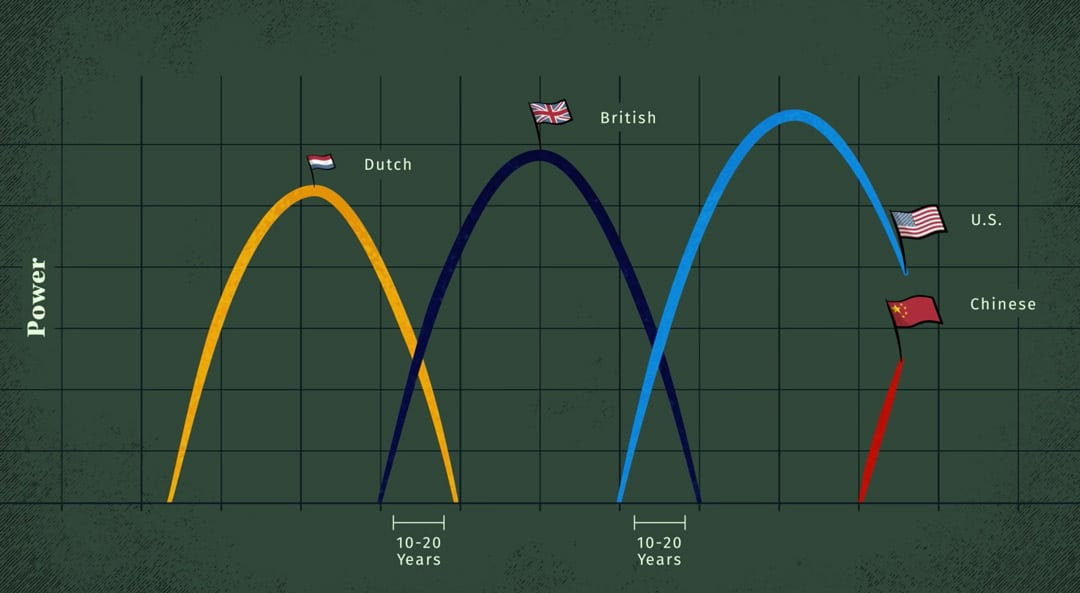

Throughout history, empires have risen and fallen, often coinciding with the ascendancy and decline of their respective currencies. The transition from one dominant currency to another has followed a cyclical pattern. For instance, the Spanish real and Dutch guilder once held prominence before the British pound and, subsequently, the US dollar took over as the world's reserve currency.

Ray Dalio's theory of long-term debt cycles suggests that these transitions are linked to economic and financial imbalances, which eventually lead to the decline of the incumbent currency and the rise of a new one. This pattern can be seen in the decline of the British pound during the 20th century and the ascension of the US dollar.

The US Dollar's Reign and Its Challenges

For the past century, the US dollar has reigned as the world's primary reserve currency, underpinned by the economic and military might of the United States. However, history suggests that this status may not last indefinitely. Several factors challenge the dollar's hegemony:

Debt Accumulation: The US has accumulated substantial levels of debt, which, if left unchecked, could erode confidence in the dollar's stability.

Economic Competitors: Rising economic powers, like China, have ambitions to challenge the dollar's dominance, potentially creating a multi-polar currency system.

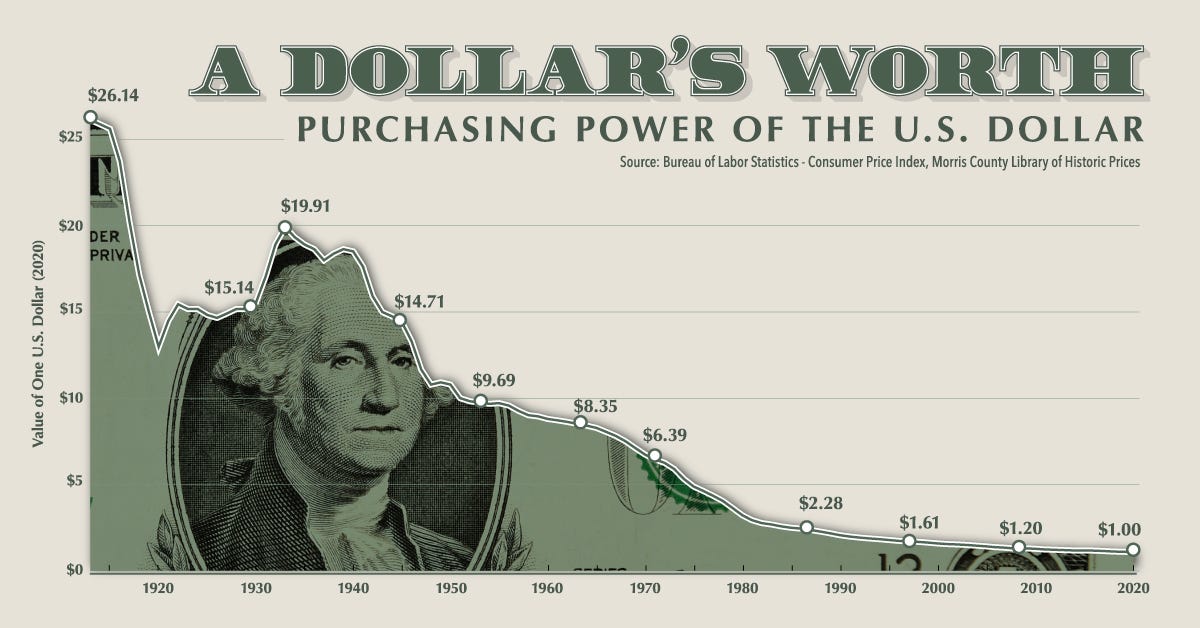

Inflationary Pressures: Persistent inflation or currency devaluation can undermine faith in a currency's long-term value.

Is Bitcoin the Next Reserve Currency?

One candidate for the role of the next global reserve currency is Bitcoin. Advocates argue that Bitcoin's decentralized nature, fixed supply, and borderless transactions make it an attractive alternative to fiat currencies.

Arguments in Favor of Bitcoin as the Next Reserve Currency:

Decentralization: Bitcoin operates independently of any central authority, reducing the risk of manipulation that is common with fiat currency regimes.

Digital Gold: Bitcoin is often compared to gold, acting as a store of value in times of economic uncertainty. Bitcoin is much easier to transfer, store and secure. Bitcoin also has absolute scarcity (21,000,000 hard cap), in contrast to gold which can continue to be mined (on land for now and eventually deep oceans and even asteroids!). Indeed, Bitcoin can be used directly for payments either by transacting on chain or using the Lightning Network.

Global Acceptance: Bitcoin's growing global adoption and use as a means of exchange contribute to its candidacy:

A Look at Bitcoin Adoption

·A quick reminder about why Bitcoin is such a remarkable financial innovation: Absolutely scarce (21M maximum coins) Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

Arguments Against Bitcoin as the Next Reserve Currency:

Volatility: Bitcoin's price volatility raises concerns about its suitability as a stable reserve currency. As global adoption continues and fiat currencies collapse, at some point in the future, Bitcoin’s volatility will no longer be an issue as it becomes the global unit of account. This will require a new way of thinking in terms of “sats” (a sat is 1/100,000,000th of a Bitcoin), versus “dollars.”

Regulatory Hurdles: Governments around the world are grappling with how to regulate, control and tax cryptocurrencies, potentially hindering Bitcoin adoption. While this could slow it down, regulatory hurdles seem unlikely to stop Bitcoin adoption. Ultimately, the game theory of Bitcoin that operates for individuals who are stacking sats would also apply to central banks / governments. Bitcoin is the best money we have ever known, and fiat currency is arguably the worst. Bad money drives out good money, which means people will hoard Bitcoin, gold, silver, real estate and anything else that holds value better than fiat. I believe of all these options, Bitcoin is the best one.

Central Banks will eventually need to own some Bitcoin (just as they own gold today) to maintain a hard monetary reserve base as currencies collapse in value.

Alternative Options

While Bitcoin is a frontrunner, there are other potential candidates for an emergent global reserve currency:

Digital Currencies: Central banks worldwide are exploring the concept of central bank digital currencies (CBDCs). This is not a good thing and could be a gateway into a social credit scoring system similar to the one implemented in China where your money can be cut off if you don’t do as you are told by the state. “We’re sorry. Card declined. You have purchased too much meat this month.” We definitely don’t want this.

Gold-Backed Currency: A modernized version of John Maynard Keynes' Bancor concept could involve a currency indexed to a basket of fiat currencies and backed by gold reserves. In many ways, the rumored BRICS currency is very similar to this proposal and we may yet see this as a challenger to the dollar in the next several years. The only problem with gold backed currencies is that over time, the government’s desire for more money to fund social spending, wars or other political initiatives is too tempting. Ultimately, the currency is debased by issuing more paper than can be backed by gold held by the central bank, ending that currency regime. In 1971, the US suspended convertibility of the dollar into gold, thereby breaking its gold backing. For more on that, check out my recent post here:

The Closing of the Gold Window in 1971 and Its Economic Impact

·The year 1971 marked a pivotal moment in global monetary history when President Richard Nixon made a historic decision to close the gold window, effectively ending the direct convertibility of the US dollar to gold. This move, although initially termed as "temporary," had far-reaching consequences that reshaped the global financial landscape. The events…

Protecting Your Financial Future

In times of potential currency transitions, individuals should consider strategies to protect their financial well-being:

Diversification: Spread your assets across different asset classes, including Bitcoin, precious metals, and traditional investments (except bonds - see below).

Financial Education: Stay informed about global economic trends and Bitcoin developments to make informed financial decisions.

Risk Management: Manage your risk by understanding counterparty risk as well as individual investment risks. Who is holding your investments and can you trust them or could you get the rug pulled on you? As far as individual investment risks, traditionally sovereign bonds have been favored as a “risk free” investment, especially in tumultuous times. However, bonds are probably not a great investment in times like these because of the risk of currency inflation, hyperinflation or collapse other than maybe very short term (six months or less) US Treasury bills. Even stocks of solid companies can suffer in this environment. Hard assets with no counterparty risk such as real estate, gold, silver or Bitcoin may be a better choice than long-term treasury bonds or speculative stocks. Prepare for the worst, hope for the best. How bad can it get? Read The Mandibles:

Lessons from "The Mandibles" by Lionel Shriver and the Role of Bitcoin in Shaping the Future

·Lionel Shriver's novel, "The Mandibles," offers readers a glimpse into a dystopian future where the collapse of the United States economy leads to a society struggling to survive. There are some spoilers in here, so if you haven’t read the book I’d suggest you do so first, but I promise not to ruin the whole story for you! While the story presents a g…

Conclusion

The rise and fall of fiat currencies over the past millennium teach us that economic and geopolitical forces are always in flux. Bitcoin stands as a formidable contender for the next global reserve currency, but fiat will not go down without a fight. As individuals, it is prudent to stay vigilant, diversify our assets, and stay informed in this ever-evolving monetary landscape. Whether Bitcoin or another candidate ultimately assumes the role of the next reserve currency, history teaches us that change is inevitable, and adaptability is key to financial security in tumultuous times.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here:

![Thomas Gresham quote: [Gresham's Law]: Bad money drives out good money. Thomas Gresham quote: [Gresham's Law]: Bad money drives out good money.](https://substackcdn.com/image/fetch/$s_!LpJW!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fdd637cc0-f5f3-4774-80ce-ed4ac0f810a6_850x400.jpeg)

![EN | PT ] CBDCs are a problem - CBDCs são um problema EN | PT ] CBDCs are a problem - CBDCs são um problema](https://substackcdn.com/image/fetch/$s_!j_dl!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe945196d-ef67-4186-81f4-1e93f1c2f8ff_500x280.jpeg)