A quick reminder about why Bitcoin is such a remarkable financial innovation:

Absolutely scarce (21M maximum coins)

Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

The Bitcoin network operates independently of all legacy financial systems; it is the first digital global payments infrastructure

No counter party risk when self-custodied

Trustless; Bitcoin is not controlled by any person or group

A hedge against fiat currency debasement / collapse in the same way that gold is, but doesn’t have gold’s drawbacks of difficulty to validate, store, transfer and secure - especially in large amounts

Vital to Bitcoin’s future is adoption and there are many ways to measure it. I thought I would take some time to go through each of the metrics this week and see where we have been, where we are and where we are headed.

Number of Bitcoin Addresses

Bitcoin adoption has grown significantly since its inception in 2008, as measured by number of unique Bitcoin Addresses:

2008-2010:

During Bitcoin's early years, its adoption was primarily limited to the tech community in North America and Europe. According to data from blockchain analytics firm Glassnode, there were less than 100 unique Bitcoin addresses in 2009. By the end of 2010, the number of unique addresses had increased to around 1,000.

2011-2013:

During this period, Bitcoin saw a significant increase in adoption, particularly in Europe and North America. According to Glassnode, the number of unique Bitcoin addresses grew from around 10,000 in 2011 to over 1 million by the end of 2013.

2014-2016:

This period saw a relative slowdown in Bitcoin adoption, with the number of unique Bitcoin addresses growing at a slower rate. According to Glassnode, the number of unique Bitcoin addresses increased from around 1.3 million in early 2014 to around 4 million by the end of 2016.

2017-2019:

Bitcoin adoption saw a resurgence during this period, as Bitcoin's price began to rise again. According to Glassnode, the number of unique Bitcoin addresses grew from around 5 million in early 2017 to over 20 million by the end of 2019.

2020-Present:

Bitcoin adoption has continued to grow, with the number of unique Bitcoin addresses surpassing 36 million by early 2021, according to Glassnode. Total number of addresses is over 1.1 billion currently, as noted in chart below. Bitcoin adoption is growing in various regions, including North America, Central America, Europe, Asia, and Africa.

Companies, Governments and Funds Holding Bitcoin

In recent years, a growing number of companies have added Bitcoin to their balance sheets as a hedge against inflation and a store of value. Governments have either seized Bitcoin in law enforcement actions (like the US) or have been active purchasers of Bitcoin like El Salvador. Also, there are several funds holding physical Bitcoin for investors.

Here’s the top 25 public companies holding Bitcoin:

Here’s the list of private companies, governments and top 15 funds that hold Bitcoin:

Bitcoin Lightning Network

The Bitcoin Lightning Network is a layer-two scaling solution built on top of the Bitcoin blockchain that enables faster and cheaper transactions. It works by creating a network of payment channels that enable users to transact with each other off-chain.

According to data from 1ml.com, a website that tracks Lightning Network statistics, the number of Lightning Network nodes has grown significantly over the past three years:

In May 2020, there were around 6,500 Lightning Network nodes.

In May 2021, the number of Lightning Network nodes had grown to over 12,000.

As of May 2022, there were over 17,000 Lightning Network nodes.

This represents a growth of over 160% in the number of Lightning Network nodes in two years. This growth is a positive sign for Bitcoin adoption, as it demonstrates increasing interest in and usage of the Lightning Network.

It's also worth noting that the capacity of the Lightning Network has also grown significantly. As of May 2022, the Lightning Network has a capacity of over 3,000 BTC, which is up from around 800 BTC in May 2020. This growth in capacity further highlights the increasing use and adoption of the Lightning Network.

Overall, the growth of the Lightning Network and the increasing number of Lightning Network nodes are positive indicators of Bitcoin adoption, as they demonstrate increasing interest and usage of the network for fast and cheap transactions.

Currently, there are 16,358 nodes, slightly less than a year ago but more importantly the network capacity has grown to 5,395 BTC which is a significant increase from last year:

Nation State Adoption

El Salvador: In September 2021, El Salvador became the first country in the world to adopt Bitcoin as legal tender. The government passed a law that made Bitcoin a legal currency in the country, alongside the US dollar.

Central African Republic: In April 2022, the Central African Republic approved Bitcoin as legal tender.

There are several countries that have a relatively friendly (at least at the moment) stance on cryptocurrencies, including Bitcoin. This could lay the foundation for further adoption in each of these jurisdictions. These include the following:

Switzerland: Switzerland is often regarded as a haven for cryptocurrencies due to its friendly tax laws and regulatory environment. The country is home to the Crypto Valley Association, which is an organization that promotes the development of blockchain and cryptocurrency businesses.

Malta: Malta is another country that has created a regulatory framework that is friendly towards cryptocurrencies. The country has even been dubbed the "Blockchain Island" due to its efforts to attract cryptocurrency and blockchain businesses.

Estonia: Estonia has been at the forefront of the digital revolution for years, and this includes cryptocurrencies. The country has a progressive regulatory environment and even offers an e-Residency program that allows people to start and run businesses online.

Singapore: Singapore is known for its business-friendly environment, and this includes cryptocurrencies. The country has taken a proactive approach to regulating cryptocurrencies and has even developed a payment system called Project Ubin that uses blockchain technology.

Japan: Japan was one of the first countries to recognize Bitcoin as an acceptable form of payment (not legal tender), and it has a friendly regulatory environment for cryptocurrencies. The country also has a significant number of businesses that accept Bitcoin as payment.

South Korea: South Korea is another country that has taken a proactive approach to regulating cryptocurrencies. While there have been some crackdowns on exchanges in recent years, the country is generally seen as friendly towards cryptocurrencies and has a significant number of users and businesses that accept Bitcoin.

United States: While the US regulatory environment for cryptocurrencies can be complex and uncertain, there are a number of states that have taken a friendly approach to cryptocurrencies. Wyoming, for example, has passed a number of laws that are friendly towards blockchain and cryptocurrency businesses.

Some additional details on state regulation of Bitcoin include:

Wyoming: Wyoming has passed a number of laws that are friendly towards blockchain and cryptocurrency businesses. For example, the state has passed laws that exempt cryptocurrencies from state property taxes, allow for the creation of special-purpose depository institutions for cryptocurrency businesses, and provide legal clarity for cryptocurrency custody.

New York: In 2015, New York created the BitLicense, which is a license required for businesses that deal with cryptocurrencies. While the BitLicense has been controversial, it has also provided some regulatory clarity for cryptocurrency businesses operating in the state. Although with the recent mining ban, New York doesn’t seem to be very Bitcoin friendly.

Ohio: In 2018, Ohio became the first US state to allow businesses to pay their taxes using Bitcoin. While the program was short-lived and was ultimately discontinued, it was seen as a significant step towards the adoption of cryptocurrencies in the US.

Colorado: In 2019, Colorado passed the Digital Token Act, which exempts certain cryptocurrencies from state securities laws. The law provides regulatory clarity for blockchain and cryptocurrency businesses operating in the state.

California: In 2018, California passed a law that allows for the use of blockchain technology for corporate recordkeeping. The law provides a legal framework for the use of blockchain technology in the state and is seen as a positive step towards the adoption of blockchain and cryptocurrencies.

If you want to take a deeper dive into the status of 2023 state cryptocurrency legislation, I found a good source here. Thirty-nine states, Puerto Rico and the District of Columbia have introduced or pending legislation regarding cryptocurrency, digital or virtual currencies and other digital assets in the 2023 legislative session. Of note, are both Wyoming (enacted measure protecting disclosure of private cryptographic keys) and Texas (pending proposals supporting Bitcoin economy in the state, opposing a central bank digital currency and constitutional amendment guaranteeing the right of the people to own, hold, and use a mutually agreed upon medium of exchange, including cash, coin, bullion, digital currency, or privately issued scrip, when trading and contracting for goods and services), as shown below:

Meanwhile, Europe recently passed comprehensive crypto legislation. It remains to be seen whether this will help or hurt Bitcoin adoption in that region. Here’s a brief summary:

The European Markets in Crypto Assets (MiCA) act, which was proposed in September 2020 and passed in September 2021, aims to create a comprehensive regulatory framework for cryptocurrencies and related services in the European Union (EU). The act is expected to bring greater regulatory clarity to the cryptocurrency industry in the EU and provide a level of consumer protection.

In general, regulatory clarity and consumer protection can be seen as positive steps towards wider adoption of cryptocurrencies, including Bitcoin. However, some critics argue that the MiCA regulations may be too burdensome for smaller crypto businesses, potentially stifling innovation in the industry.

It's also worth noting that the MiCA regulations have not yet been fully implemented and that the impact of the regulations on Bitcoin adoption in the EU will depend on how they are enforced and interpreted. Overall, while the MiCA regulations may create some challenges for smaller crypto businesses, they are expected to bring greater regulatory clarity and consumer protection, which could ultimately help to foster wider adoption of cryptocurrencies like Bitcoin in the EU.

Transaction Volume

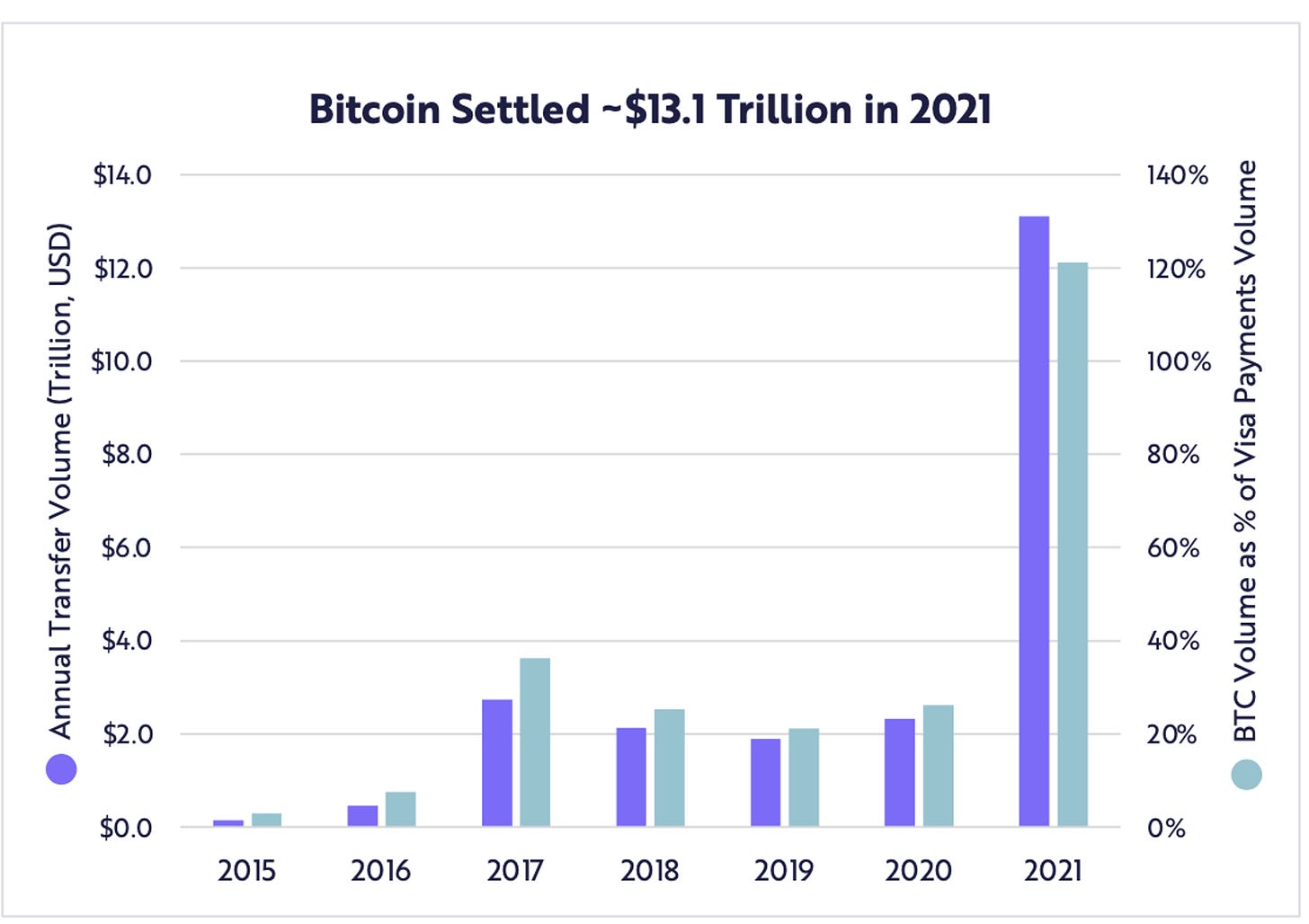

Another metric to look at for Bitcoin adoption is transaction volume. After holding in a range of $2 - $3 Trillion per year between 2017 and 2020, Bitcoin’s cumulative annual transfer volume in 2021 surged 463% from the prior year to $13.1 trillion, just ahead of Visa's number, ARK analyst Yassine Elmandjra wrote in the report titled “Big Ideas 2022,” citing data from Glassnode, Visa and FRB services.

Here’s another chart from Glassnode that shows a clear uptrend in transaction counts over the past seven years:

Bitcoin ATM’s

The number of Bitcoin ATM’s, where you can convert to and from fiat currency, is another metric that is worth watching. According to Coin ATM Radar, the number of Bitcoin ATMs grew from around 500 in 2016 to over 30,000 as of May 2021. The growth has been relatively steady, with around 6,000 Bitcoin ATMs added in both 2019 and 2020. Currently there are almost 34,000 ATM’s located all over the world as noted in the map below:

Google Search Volume

According to Google Trends, the worldwide search interest for "Bitcoin" has generally increased over the past five years. The peak for search interest in Bitcoin was in December 2017, when Bitcoin's price hit an all-time high. The search interest then declined for a few years before picking up again in late 2020 and early 2021. It declined after peaking in 2021 but seems to have leveled off recently. The search activity seems to correlate with the Bitcoin price cycle.

Merchant Adoption

The number of merchants accepting Bitcoin is difficult to measure, but according to data from BitPay, a leading Bitcoin payment processor, the total number of transactions processed by BitPay merchants increased from around 200,000 in 2017 to over 1.1 million in 2020. There is a pretty large and growing number of merchants that accept Bitcoin.

Hash Rate

The hash rate of the Bitcoin network is a measure of the total computational power that is being used to secure the network by solving complex mathematical problems in order to validate transactions and create new blocks. In other words, the hash rate measures the amount of computing power that miners are dedicating to the Bitcoin network to compete for the chance to add new blocks to the blockchain and receive newly minted Bitcoins as a reward. The higher the hash rate, the more secure the Bitcoin network is against potential attacks, as it becomes increasingly difficult for a malicious actor to take control of the network or perform a 51% attack.

According to Blockchain.com, the Bitcoin network's hash rate has grown significantly over the past five years, from around 2 exahashes per second (EH/s) in May 2016 to over 180 EH/s in May 2021 and almost doubling to 347 EH/s today. There have been some fluctuations in the hash rate, but overall the trend has been upwards.

Conclusion

While Bitcoin is still in the early stages of adoption, it has already demonstrated its potential as a powerful tool for enabling borderless and decentralized financial transactions, protecting against inflation, and promoting financial autonomy. Despite challenges and risks, including regulatory uncertainty and market volatility, the grassroots movement behind Bitcoin is growing stronger every day, driven by individuals and communities who recognize the need for sound money that is free from government manipulation. As we continue on this journey, education and outreach will be critical to spreading awareness and understanding of Bitcoin's benefits and potential. With hard work and perseverance, I believe that Bitcoin will be a major force for positive change in the years to come, enabling greater financial freedom and opportunity for people around the world.

In case you missed it, last week I wrote about how we can manage the transition from the fiat system to a Bitcoin system. Check it out here:

Managing the Transition to A Bitcoin Future

We are living in truly extraordinary times. While the fiat world continues its slow, inevitable decline, we see the signs everywhere including inflation, bank failures, insane financial market gyrations, ever expanding sovereign debt, war and Fourth Turning-level global social unrest. Meanwhile, Bitcoin rises as a better way to store and transmit valu…

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Nice writeup bud

Great analysis. Comprehensive, detailed, everything we want to know about the state of Bitcoin adoption in May 2023. You should do this kind of analysis every year ;)