Get Out of the Wall Street Casino, Start a Bitcoin Retirement Plan

Put your life's energy into something better

For many years, I obsessed about saving for retirement and whether I would have enough money. As I dutifully saved in my 401(k) early in my career and saw the balance grow, I became excited. I would tell myself: “I’m going to be just fine. I have plenty of time.” Then the crash came and then again and again. First the dot.com (2000), then the GFC (2008), then Covid (2020). At least when Covid hit, I had learned my lesson and I wasn’t in stocks. Looking back at the time of the GFC in 2008, I knew something was wrong with the economy and the markets, but I couldn’t put my finger on it. Some folks seemed to do quite well over the next few years, while others lost their jobs, their retirement savings and their homes. In addition to being terrified of losing my job (working in the real estate industry at that time was no picnic), having to support my growing family and pay all the bills (most importantly the mortgage), I was looking at possibly never being able to retire. I remember telling myself: “I’ll just work until I die, I guess.” This is just not right.

I put myself to the task of financial education by reading lots of books, starting with Rich Dad, Poor Dad and doing lots of research into many different types of investments. I figured I just wasn’t doing it right and I was sure with a little education, I could figure it out. I started a blog to write about what I was learning to continue to force the discipline of doing more research and broadening my understanding of investing, macro, etc. Real estate seemed to work best for me, but that’s because of buying at the bottom (GFC), borrowing at a low fixed rate and then letting money printing cause the asset value to go up, only I didn’t understand that at the time. I just thought I was a genius. And it killed me to have to do all this hard work and take all this risk, just to maintain or slightly grow my purchasing power over time. It was absolutely draining. I’m a very conservative person by nature and this was just ridiculous. By the way, if you have extra money and want to invest it for a nice return or to support something you think is worthy, I’m not saying you shouldn’t. I’m just saying you shouldn’t have to be an investor to “beat inflation.”

Fast forward to early 2020. I had been dabbling in Bitcoin since late 2017 as one of many “alternative investments,” but I didn’t really do the work to understand Bitcoin until early 2020. I started with a few Michael Saylor videos and then ultimately read the Bitcoin Standard, which kicked off my journey down many Bitcoin rabbit holes. Slowly, it began to dawn on me that the Wall Street Casino is not set up for the average person to win, just like a real casino. Sure, you might get lucky sometimes. Maybe if you pick the right stocks and hold them for the long term, you’ll be okay with the money printer running. However, the only one who consistently wins is the House (Wall Street), since they get to collect management fees regardless of whether you win or not. They can always front run you since they are the professionals and have better information and systems. The effort required to be an average investor, especially in today’s world of program trading and insane financialization, is a distraction from so many more important things in life.

Bitcoin was created out of the ashes of the GFC as a direct response to Central Banks and Governments debasing the currency.

Bitcoin was designed to give you something of value that appreciates as the money printers run and that no one can take away from you. Although it took a while, I found what I had been looking for all those years. A safe place to save my money. Not safe in the conventional sense (volatile fiat exchange rate), but safe from theft and fiat debasement, which are far more important in the long span of time. Your time on this earth is precious, and when you work, you are trading your life’s energy for a paycheck. Why should you expect to have the purchasing power of the money you receive today to be diminished at all? Who normalized this?

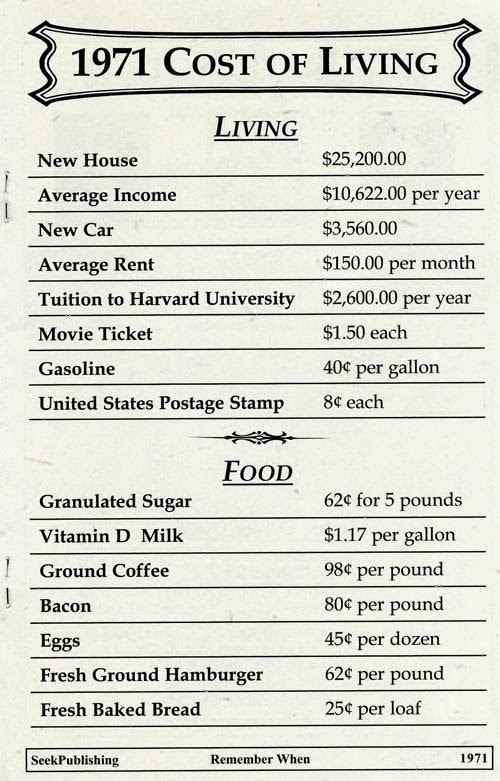

Why can’t you buy the same (or better) things in 50 years as you can today? The money is broken and inflation is a feature, not a bug. Just look at what things cost in 1971 and compare them to today and you can’t help but conclude the money is broken:

For more on what the heck happened in 1971, you might be interested in this:

The Closing of the Gold Window in 1971 and Its Economic Impact

The year 1971 marked a pivotal moment in global monetary history when President Richard Nixon made a historic decision to close the gold window, effectively ending the direct convertibility of the US dollar to gold. This move, although initially termed as "temporary," had far-reaching consequences that reshaped the global financial landscape. The events…

Today I have a pretty simple plan of saving 10% of my gross income directly into Bitcoin self-custody with each paycheck. I still have the 401(k) and some other assets for a little diversification, but I no longer worry about retirement. In fact, I don’t even worry about losing my job, because I know I can do something else somewhere else and maybe even retire a little early, thanks to Bitcoin. What’s even more amazing is that I have become merely a curious observer of markets, rather than trying to be Warren Buffett, divine the future and figure out what crappy ETF or stock to buy or sell. Who needs it? Instead, I can focus on my health / wellness, people who are important in my life, improving my own Bitcoin education while helping others do the same, and delivering value in my work.

It’s really hard to describe the feeling of calm that comes over you, no matter how crazy the economy or the markets get. In some ways, the more people panic about these things, the calmer I get. It’s truly a sense of peace. So what are you waiting for? Get out of the Wall Street Casino and start a Bitcoin Retirement Plan today! And remember to always hold your Bitcoin in self-custody as it was intended!

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

Another great article

“If you don’t believe it or don’t get it, I don’t have the time to try to convince you, sorry.”

Satoshi Nakamoto