For this week’s post, I thought I would write about the many different “rabbit holes” that Bitcoin takes you down, once you begin to understand the technology and start to think through the implications of a truly decentralized, absolutely scarce monetary asset. I have written about many of these in past posts and added a couple of links below to some past writings, but I thought a comprehensive rabbit hole list would be interesting to walk through. It was a lot longer than I realized.

Here it is:

Cryptography: Bitcoin's underlying technology, blockchain, relies heavily on cryptography. Cryptography is the practice of secure communication in the presence of third parties. It involves techniques for protecting information and communication from unauthorized access and manipulation. Cryptography can be used to ensure the confidentiality, integrity, and authenticity of information, as well as to provide non-repudiation (proof of the origin or delivery of a message). Cryptographic techniques include encryption, decryption, digital signatures, key exchange, and hash functions, among others. Cryptography is widely used in modern communication systems such as the internet, mobile networks, and electronic transactions. This can lead to an exploration of how cryptographic techniques are used in Bitcoin and other applications.

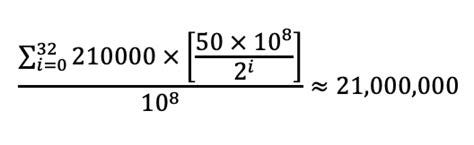

Economics: Bitcoin has a unique economic model that is often debated by economists. It’s basically math that ensures a fixed issuance. If you haven’t seen it before, this is the formula:

This rabbit hole can take you into discussions about money supply, inflation, deflation, and the role of central banks. In particular, the Austrian School of Economics is a frequent topic of conversation in the Bitcoin community. I delve a little deeper into this subject here:

Mining: Bitcoin is created through a process called mining. Bitcoin mining is the process of verifying and adding transactions to the Bitcoin blockchain by solving complex cryptographic puzzles using specialized hardware called mining rigs. These puzzles are designed to be computationally difficult, requiring miners to use significant amounts of computational power to find the solution. When a miner successfully solves a puzzle, they are rewarded with a certain amount of newly minted Bitcoin, as well as any transaction fees associated with the transactions they added to the blockchain. The mining process is critical to the security and decentralization of the Bitcoin network, as it ensures that all transactions are validated and that the blockchain remains immutable. In essence, Bitcoin mining is a competitive process that rewards miners for contributing computational resources to the network and maintaining its integrity. It is also one example of Bitcoin’s “game theory” in practice, since it is more profitable to mine (and thereby secure the network) than to attack the network. This rabbit hole can take you into discussions about energy consumption (including the monetization of otherwise wasted or stranded energy), hardware, and mining pools.

Trading: Bitcoin is a highly volatile asset that is traded on various exchanges, globally, 24 hours a day, seven days a week. Traditional financial markets are not open all the time like Bitcoin, which is significant. This rabbit hole can take you into discussions about technical analysis, trading strategies, and market psychology as well as the impact of an asset that trades literally all the time.

Privacy: Bitcoin allows for pseudonymous transactions, but it's not completely anonymous. This rabbit hole can take you into discussions about privacy-enhancing techniques such as CoinJoin, Schnorr signatures, and Taproot.

CoinJoin is a privacy-enhancing technique for Bitcoin transactions that combines multiple inputs and outputs from different users into a single transaction, making it difficult for third parties to link specific inputs with specific outputs. The idea behind CoinJoin is to obfuscate the transaction graph, which is the record of all transactions on the Bitcoin blockchain, and thereby protect the privacy of users. In a typical CoinJoin transaction, multiple users agree to combine their transactions into a single transaction with multiple inputs and outputs. This transaction is then signed and broadcasted to the network, effectively mixing the inputs and outputs from different users. As a result, it becomes difficult for external observers to determine which user is responsible for which input or output.

CoinJoin transactions can be implemented in a number of ways, including through dedicated CoinJoin services or through specialized Bitcoin wallets. Some popular implementations of CoinJoin include JoinMarket, Wasabi Wallet, and Samourai Wallet. While CoinJoin can improve the privacy of Bitcoin transactions, it is important to note that it is not a foolproof technique and may not protect against all forms of blockchain analysis.

A Schnorr signature is a type of digital signature used in cryptography to verify the authenticity of messages or transactions. It is named after the mathematician and cryptographer Claus-Peter Schnorr, who proposed the signature scheme in 1989. Compared to traditional digital signature algorithms like the ECDSA (Elliptic Curve Digital Signature Algorithm), Schnorr signatures are more efficient and offer several advantages, including:

Security: Schnorr signatures provide a high level of security against attacks, including side-channel attacks, which are not prevented by ECDSA.

Privacy: Schnorr signatures are designed to support signature aggregation, which means multiple signatures can be combined into a single signature without revealing the individual signer's identity. This can improve privacy and efficiency in multi-signature transactions.

Scalability: Schnorr signatures are more efficient and require less space than ECDSA, which can help reduce the size of transaction data and improve scalability.

Schnorr signatures were implemented in Bitcoin as part of the Taproot upgrade.

Taproot is an upgrade to the Bitcoin protocol that was implemented in 2022.

The main feature of Taproot is the introduction of a new type of Bitcoin script called "Schnorr signatures with Taproot." This script is designed to allow for more complex smart contracts while also improving privacy and reducing transaction size. One of the key benefits of Taproot is the ability to implement complex multi-signature transactions with greater efficiency and privacy. Instead of requiring all signers to be listed in the transaction, Taproot allows for a single "hidden" signature that represents all signers, thereby reducing the size of the transaction and improving privacy. Taproot also includes a new opcode called "OP_SUCCESS" that can be used to create more flexible and efficient smart contracts. This opcode allows for a transaction to be executed based on multiple possible conditions, rather than just a single condition as in traditional Bitcoin scripts.

Philosophy: Bitcoin was created with the goal of being a decentralized, trustless system that operates outside of traditional financial institutions. This rabbit hole can take you into discussions about individual sovereignty, personal responsibility, and the role of government.

History: Bitcoin has a relatively short history, but it's already had a significant impact on the world. This rabbit hole can take you into discussions about the early days of Bitcoin, the Silk Road, Mt. Gox, and other events that shaped the ecosystem.

Regulation: Bitcoin operates in a legal gray area in many jurisdictions. This rabbit hole can take you into discussions about regulatory frameworks, compliance, and the potential impact of government intervention on the ecosystem.

Altcoins: Bitcoin is just one of many cryptocurrencies. This rabbit hole can take you into discussions about the differences between Bitcoin and other coins, as well as debates about the merits of different blockchain projects. Of course, if you have been reading my work for a while, I’ll tell you that there’s no need to mess with Altcoins, and yet many of us go through our “Altcoin stage.” Bitcoin is all you need. A quick reminder about why Bitcoin is such a remarkable financial innovation:

Absolutely scarce (21M maximum coins)

Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

The Bitcoin network operates independently of all legacy financial systems; it is the first digital global payments infrastructure

No counter party risk when self-custodied

Trustless; Bitcoin is not controlled by any person or group

A hedge against fiat currency debasement / collapse in the same way that gold is, but doesn’t have gold’s drawbacks of difficulty to validate, store, transfer and secure - especially in large amounts

Adoption: Bitcoin is still a relatively niche asset, but it's gaining more mainstream attention every day. This rabbit hole can take you into discussions about the potential impact of widespread Bitcoin adoption, the “S Curve,” and the challenges that must be overcome to achieve it.

Governance: Bitcoin is a decentralized network, but there are still decisions that need to be made about its development and direction and there must be broad consensus by node operators before any changes can be implemented. If only some of the nodes want to make a major change to the Bitcoin protocol, as was the case when Bitcoin Cash or Bitcoin SV were created, Bitcoin continues on in its current form and new coins are created based on the revised protocol. This rabbit hole can take you into discussions about the various groups and individuals that contribute to Bitcoin's development, as well as debates about the best ways to govern a decentralized system.

Security: Bitcoin is a digital asset that is stored on the internet, so security is paramount. This rabbit hole can take you into discussions about best practices for securing Bitcoin, as well as debates about the trade-offs between convenience and security. This is a topic I think about a lot and have devoted quite a bit of attention to. Here’s a piece I wrote a while back about Bitcoin Security:

Scaling: Bitcoin's underlying technology, blockchain, has limitations in terms of transaction throughput. This rabbit hole can take you into discussions about the various proposals for scaling Bitcoin, including Lightning Network, SegWit, and larger block sizes.

Philosophy of Money: Bitcoin challenges traditional notions of money and value, and this rabbit hole can take you into discussions about the history of money, different schools of economic thought, and the potential for a new monetary paradigm.

Social Impact: Bitcoin has the potential to change the way people interact with money and financial institutions, and this rabbit hole can take you into discussions about the potential social impact of widespread Bitcoin adoption. This includes debates about global financial inclusion, wealth inequality, and the potential for Bitcoin to facilitate new forms of economic activity.

Legal Issues: Bitcoin operates in a legal gray area in many jurisdictions, and this rabbit hole can take you into discussions about the legal status of Bitcoin and other cryptocurrencies. This includes debates about whether Bitcoin is a currency, a commodity, or something else entirely, as well as the potential implications of different legal classifications, including how title to your Bitcoin is held (particularly important for estate planning).

Game Theory: Bitcoin game theory refers to the study of strategic interactions between participants in the Bitcoin ecosystem, with a focus on the incentives and motivations that drive their behavior. In other words, it is the study of how different actors in the Bitcoin network behave and make decisions in the pursuit of their self-interest, and how these decisions can affect the overall health and stability of the network.

One of the most important aspects of Bitcoin game theory is the concept of "incentive compatibility." This refers to the idea that the rules and incentives of the Bitcoin network are designed to encourage rational actors to behave in ways that benefit the network as a whole. For example, the incentive to mine Bitcoin is based on the fact that miners are rewarded with newly minted Bitcoin and transaction fees. This incentivizes them to use their computational resources to maintain the security and integrity of the network.

Another important aspect of Bitcoin game theory is the concept of "attack vectors." These are ways in which actors in the Bitcoin network can potentially harm the network for their own gain. For example, a miner could attempt to launch a 51% attack on the network by controlling more than 50% of the total computational power, which would allow them to rewrite transactions and potentially double-spend coins. However, such an attack would not be incentive-compatible, as it would likely lead to a collapse in the value of Bitcoin, which would harm the miner's own interests.

Bitcoin game theory manifests in many ways, including through the development of new consensus mechanisms, the design of incentive structures, and the emergence of new forms of economic activity such as hodling and speculation. By understanding the dynamics of Bitcoin game theory, it is possible to better predict and manage the behavior of different actors in the network, and to ensure the long-term stability and success of the Bitcoin ecosystem.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.