One thing I have been talking about a lot lately is the frustration I have that I can’t save my hard-earned money in dollars in a bank account and know that those dollars will buy the same amount of goods and services in the future (and most importantly in retirement) because of inflation. Even a small amount of inflation, which is the Federal Reserve’s stated policy (2%) steadily erodes your purchasing power over time. In times of higher inflation as we have seen during the 1940’s, 1970’s and today (8.6% as of the most recent report) this situation only worsens. Here’s one of my favorite charts from Shadowstats on the dollar (since 1985 the dollar has lost 40% of its purchasing power by their metrics):

One of the other problems inflation causes is that it forces us to have to save our money in investments like stocks, real estate, cryptocurrencies, art, collectibles and all other manner of assets in order to generate a higher return than inflation. The problem is this requires risk-taking and a good deal of knowledge of the respective markets. Sometimes people are extraordinarily lucky and have huge gains when the market is strong. At other times, people are crushed. The truth is, the average person is up against professionals in this game and unless you have an edge or the ability to pick great investments and hold them through market cycles (which is uncommon), you are far more likely to lose money by buying high on irrational exuberance and panic selling low. Indeed, emotions are an investor’s greatest weakness and those who can control their emotions and have a portfolio strategy tend to do better.

Inflation also encourages outright speculation using leverage (such as borrowing, options, leveraged ETF’s, etc.) which pushes investors further out the risk curve. All of this speculation drives asset prices up beyond their true values, creating bubbles and ultimately ending in a crash. One of the side effects of monetary policy and the Federal Reserve manipulating interest rates is that it destroys price signals in the market. Periods of low interest rates encourage massive risk taking and speculation, while periods of rising rates result in massive destruction of value as investors sell everything and bubbles deflate (much as they have been doing during the current bear market). Wall Street firms not only weather the storm, they profit from all the volatility and the average investor gets wiped out. A former associate of mine once had a great quote after he retired just before the Global Financial Crisis: “I’m not sure if I’m retired or just between jobs.”

Another “feature” of our monetary system is the need for expansion of credit in order to grow. That means borrowing more and more money over time by governments, companies and individuals. Indeed, many Americans have a debt cycle that looks a lot like this:

Student loan debt (these have to be paid back and can’t be removed by bankruptcy - that’s why student loan forgiveness is so popular with politicians)

Car debt

Credit card debt - I remember when I was first starting out it seemed as soon as I paid off the card something came up and I had to charge it up again, an endless cycle that literally took me years to break

Home debt - for many people is the largest debt they will ever owe, if you are lucky enough to have enough for the down payment, qualify for a loan and can afford current home prices

What happens to most people is that they get caught up in many or all of these layers of debt. This has further consequences, such as forcing people to stay in jobs they hate just because they need the money or maybe jumping from job to job to make more money, but not really finding their true calling. Ultimately, the relentless grind of inflation, speculation / risk taking to keep up with inflation and the debt pyramid keeps you completely distracted so you can’t focus on things that are more important in life like family, health, freedom or your higher purpose.

This chart shows how consumer credit has grown over time:

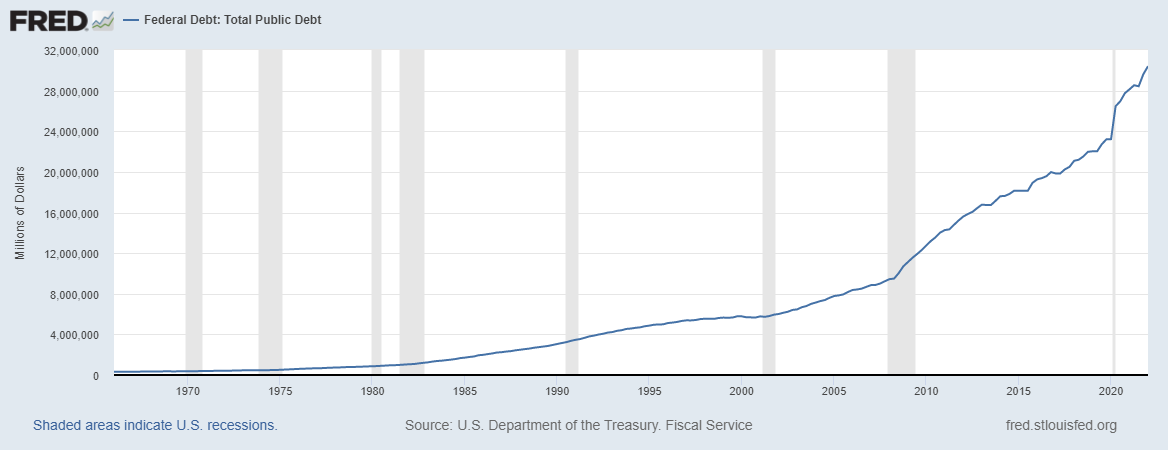

This is total Federal public debt which has also been growing substantially:

So in summary, our monetary system needs inflation in order to operate, which debases the currency over time and also needs large and ever-increasing amounts of debt to sustain and grow the economy. In the long run, the inflation and mountain of debt (and corresponding debt service) will ultimately be unsustainable. If you ever played the game SimCity, you know that if you borrow too much and run deficits for too long, eventually your city goes broke and you lose.

So what exactly is money? This is from Principles of Economics:

A Medium of Exchange

The exchange of goods and services in markets is among the most universal activities of human life. To facilitate these exchanges, people settle on something that will serve as a medium of exchange—they select something to be money.

A Unit of Account

Money serves as a unit of account, which is a consistent means of measuring the value of things. We use money in this fashion because it is also a medium of exchange. When we report the value of a good or service in units of money, we are reporting what another person is likely to have to pay to obtain that good or service.

A Store of Value

The third function of money is to serve as a store of value, that is, an item that holds value over time. Consider a $20 bill that you accidentally left in a coat pocket a year ago. When you find it, you will be pleased. That is because you know the bill still has value. Value has, in effect, been “stored” in that little piece of paper.

While the dollar and other currencies have served these purposes over the years, the last and certainly not least important aspect of money, store of value, has been an issue for fiat currencies historically and as outlined above is the main issue with the dollar today. It cannot be relied upon as a long term store of value due to debasement through inflation.

Why is gold, silver or bitcoin a better store of value than the dollar?

A few charts (these are shown logarithmically to smooth out the annual volatility and better demonstrate long term trends):

Bitcoin has steadily grown in value over time, even though it has had a lot of short-term volatility as a new asset class. It is so far demonstrating that it can be a viable long-term store of value. It can also be used as a medium of exchange and a unit of account, since Bitcoin can be sent peer to peer without the need for an intermediary and is divisible into smaller increments (called satoshis - there are 100 million satoshis or sats in one Bitcoin).

Gold has also steadily grown in value over time and has had considerably less volatility than Bitcoin. It has even recently outperformed Bitcoin as noted below. Physical gold can be used as a medium of exchange and a unit of account, but of course is more difficult to store, secure and transport especially in large quantities. Notice the big run after 1971, the year the dollar was taken off the gold standard.

Similar to gold, silver has also grown steadily in value over time but is quite a bit more volatile than gold. Like gold, silver can be used as a medium of exchange (coins) and a unit of account, but is also more difficult to store, secure and transport.

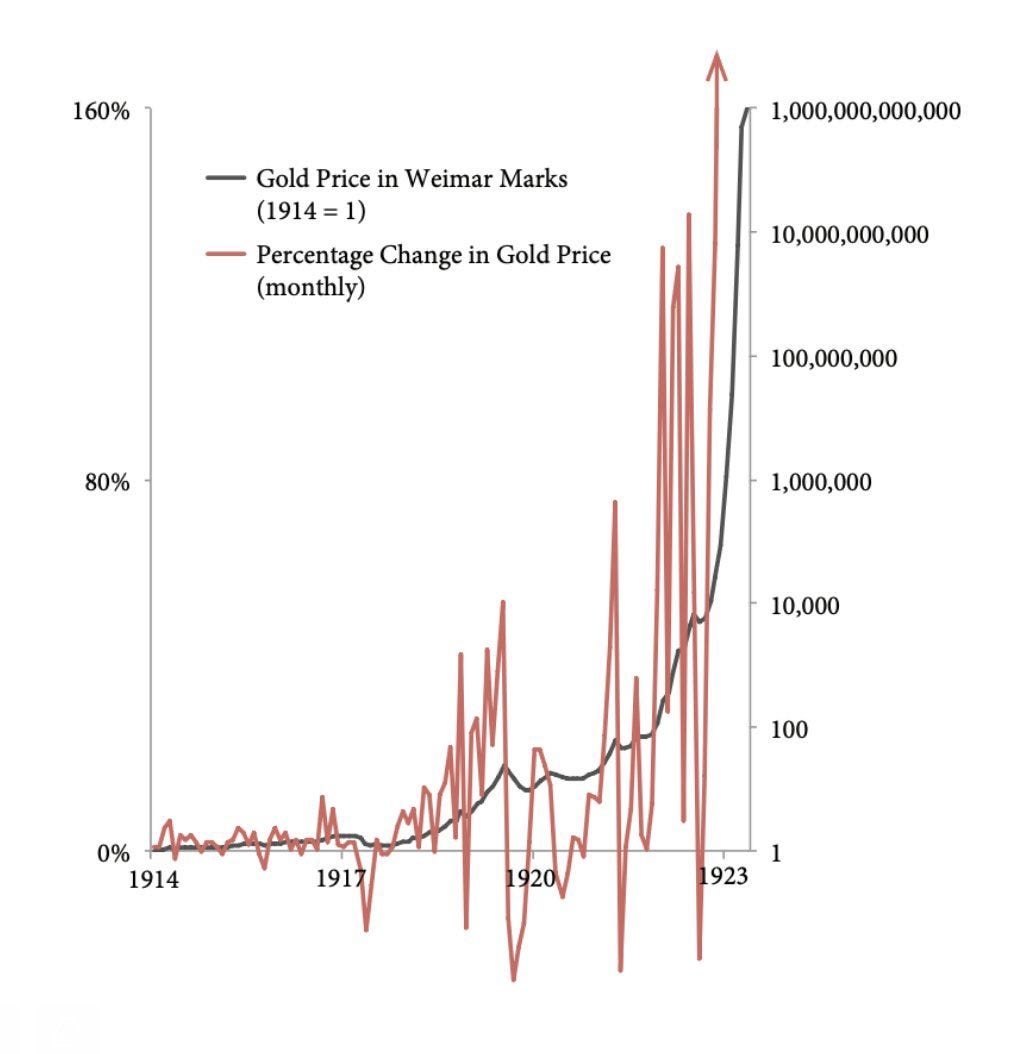

You may be asking yourself when is a good time to buy. Now might seem like a bad time due to the price action. Here’s a chart of the price of gold as well as the percentage change in the price of gold during the Weimar hyperinflation period (with all the volatility we have seen lately in all financial markets, this looks familiar):

While very few are predicting hyperinflation in the US, we have already seen it in other countries and it doesn’t take much of a loss of confidence in the currency for inflation to spiral out of control.

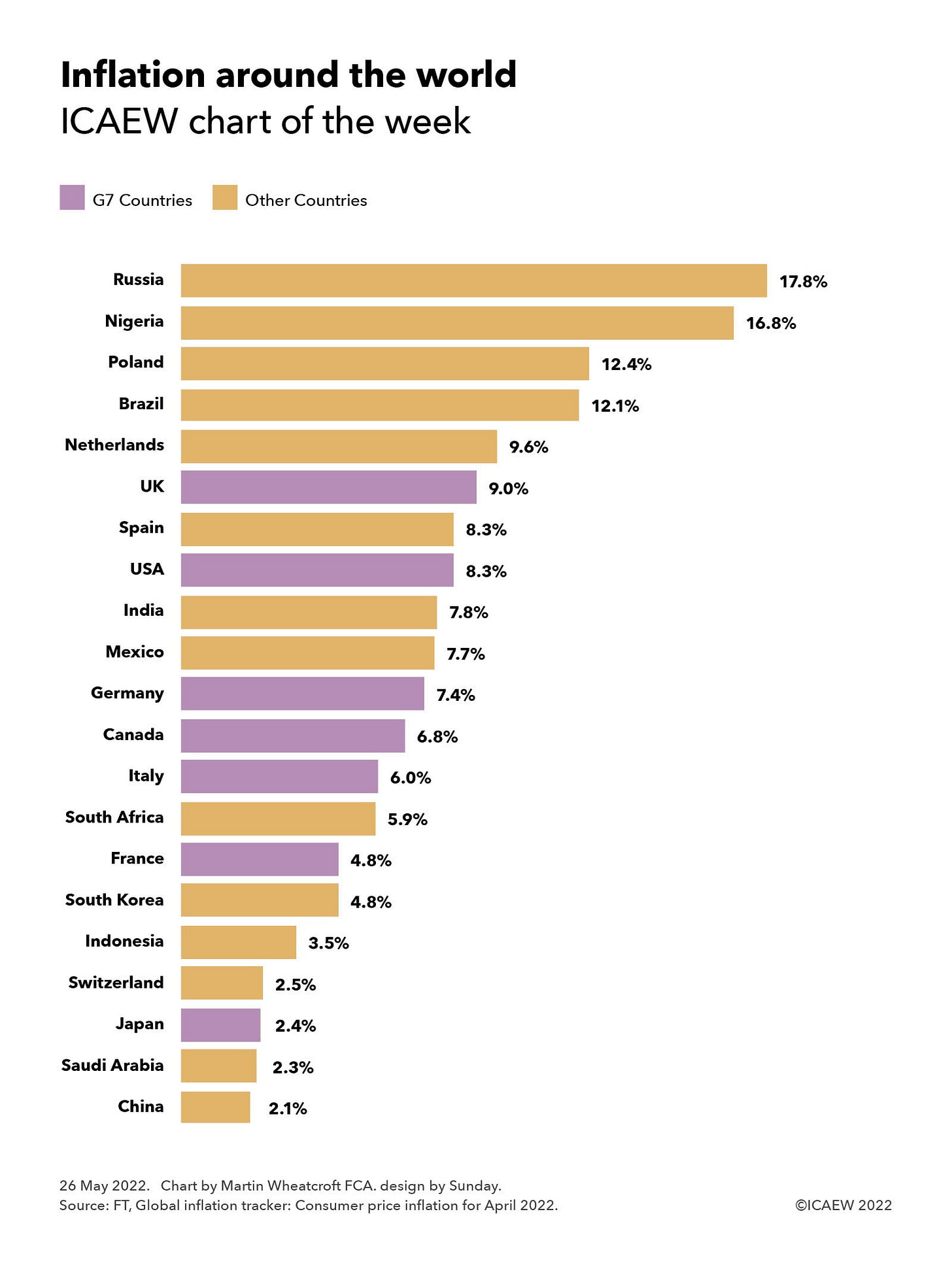

Here’s a look at recent inflation rates around the world:

An important thing to remember is that although one can always hope, it seems unlikely that nations will adopt a sound money standard voluntarily. What’s more likely is they will try to keep the current system going as long as possible until it collapses. Egon von Greyerz of Matterhorn Asset Management predicts concurrent deflation and hyperinflation will ravage the world in his recent piece here. He’s a bit of a gold bug and so sees gold, silver and commodities as the best investments during this troubled time.

WEALTH PROTECTION A NECESSITY

For the few people who have assets to protect, physical gold and some silver will perform much better than all conventional asset markets which will collapse. That trend has already started as the table above shows.

Stocks will tank and commodities will soar.

For investors this is best illustrated in the Dow/Gold Ratio. This ratio is currently 16.5 and is likely to find long turn support at 0.5. Reaching that target would involve a 97% fall of the Dow relative to gold. Sounds incredible today but bearing in mind the circumstances this level is certainly possible. See my article.

An 0.5 Dow/Gold ratio could for example mean Dow 5,000 and Gold $10,000

I would agree with the assertion that gold, silver and commodities will do well in the current global environment, but would also add Bitcoin to the mix since it has many of the same properties as physical gold, only better: self-custodied outside of banking system, absolute scarcity, easy to store and transfer. Also, Bitcoin price is at very attractive levels for long-term accumulation and although it may go lower still, dollar cost averaging and stashing away in cold storage is always a good approach for the long term Bitcoin investor as part of a diversified portfolio.

A return to sound money, whether backed by gold or Bitcoin, would be a great thing for the world. Money could be saved without concern of debasement, so the fruits of your labors can be stored indefinitely until needed. True price discovery could exist in asset markets and the elimination of massive leverage would mean credit would go to productive purposes instead of speculation. Fix the money, fix the world!

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.