For this week’s post, I wanted to focus on the US residential real estate market nationally to see whether it’s time to buy, sell or hold. Of course, all real estate is local and some markets that have been more in demand will fare better and others will fare worse than the average, but looking at the national data is instructive.

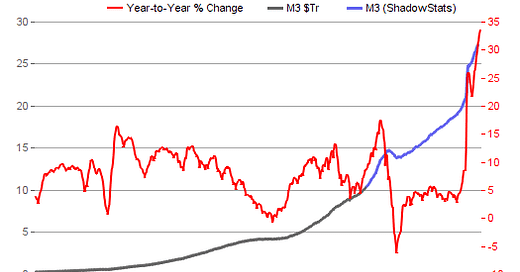

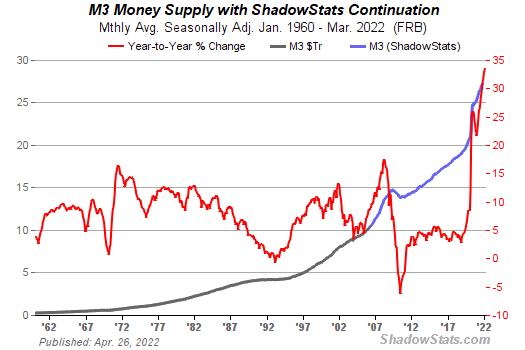

First things first. As a backdrop, the dramatic increase in money supply since 2020 has flooded the world with dollars, and those dollars have found their way into all sorts of assets - including stocks, bonds, cryptocurrencies, private companies, and also real estate:

Meanwhile, inflation expectations have driven up the cost of a 30-year fixed rate mortgage from an all time low of 2.65% in January 2021 to 5.25% as of May 2022 (almost double):

As a result of post-pandemic demand fueled by low rates, excess cash, work from home dynamics, urban flight and some demographics like Millenials looking to buy their first home, home prices have skyrocketed 57% above the peak before the Great Financial Crisis (as measured by the Case-Schiller national home price index):

If that doesn’t feel like a “bubble,” I’m not sure what does. For comparison, here’s a chart of the S&P 500 (the recent dramatic sell-off is hardly a blip in the long term trend therefore the stock market bubble is for the most part intact):

Meanwhile, existing home sales are significantly below year ago levels and although existing home sales inventory is rising, it’s lower than year ago levels. This indicates there will continue to be supply constraints at least in the short term, which assuming demand stays relatively strong, should support prices:

A major demand headwind however, is that monthly mortgage payments are 36% higher than last year due to rising prices and higher interest rates. If monthly mortgage payments continue to rise along with prices and interest rates, that could begin to significantly impact demand, which would ultimately impact prices. One other factor to consider is institutional ownership of single family real estate which has increased dramatically in recent years. If these institutions become net sellers of real estate, that could result in a big increase in supply of available homes and potentially drive prices down. Institutional share of purchases recently hit a record as noted by Redfin in the chart below:

Will the “smart money” “dump on retail” like they have been doing in the stock market recently? Only time will tell, but it might not take much of a further increase in treasury bond rates to cause investors to prefer owning 10-year treasuries at a 3%-4% yield with no risk of principal loss (other than inflation!) over owning a piece of real estate yielding 4%-5% with risk of principal loss due to inflated market pricing. George Gammon recently explored this idea in one of his podcasts and I think he’s right on point. We need to watch this.

One other factor to consider is that adjustable rate mortgages are now 11% of total loans and 19% by dollar volume (highest demand since March 2008) as reported by CNBC recently. For those who lived through the Great Financial Crisis like I did, that’s not good news at all. If interest rates continue to rise due to inflation, those borrowers could be facing nasty surprises when their loans adjust in a few years. On the other hand, if we have a recession, the lower interest rates won’t help because job losses will make it difficult to support mortgage payments. Then the foreclosures will follow, adding more inventory to the market resulting in a downward price spiral (flashback to 2008 GFC).

My overall view is that if you are living in a home and have an affordable low rate mortgage payment (especially if you refinanced in the last few years at low rates), stay put unless you have a good reason for moving like relocating for a new job, retirement, family reasons, etc. I have known people in the past who have tried to take advantage of market peaks by selling their home and renting to “wait for the market to crash and then buy back in.” I don’t think that’s a good move since the market may not crash as low as you think and meanwhile you are subjecting yourself to rising housing payments as a renter, which could be substantial, especially as more people are priced out of buying a home and have no choice but to rent. Indeed, in a high inflation environment a long-term fixed rate mortgage is an asset since you are paying back your loan in dollars that are losing value over time.

If you own investment property, maybe take a look at whether it makes sense to sell and do a 1031 exchange to diversify your holdings into different properties / asset classes (see my post here on 1031 Exchanges) or just take the cash and buy something else that isn’t in a bubble (maybe another hard asset like gold/silver or Bitcoin, all of which are well off recent highs). As an investor, I wouldn’t be a buyer of residential real estate in the current market environment.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.