In my last housing update in November, I noted that while there was plenty evidence of a slowing market, it wasn’t looking as much like a crash as a controlled demolition. This month, I looked at the same data and I continue to see no evidence of an impending crash, but rather what may be a healthy correction. Perhaps the biggest factor is low supply coupled with declining mortgage rates. The declining mortgage rates are linked to declining long term US Treasury bond rates, which ironically are due to fears of a recession this year or next. Of course a recession and accompanying job losses wouldn’t be good for the housing market since that leads to foreclosures and a rise in supply, but for right now at least, the data isn’t showing that. This is something we’ll have to continue to watch throughout the year.

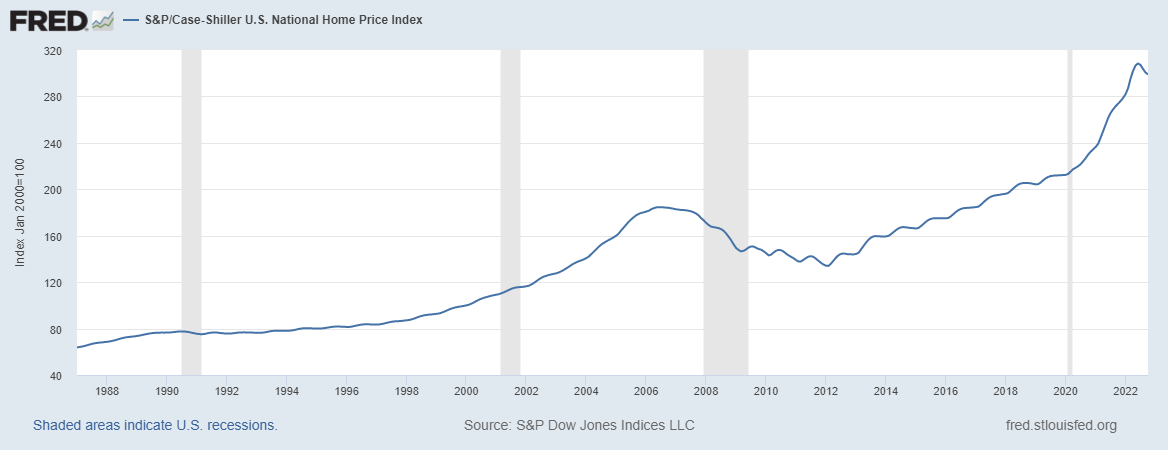

First chart is the Case Schiller national home price index, which continues to correct from the peak reached in June 2022.

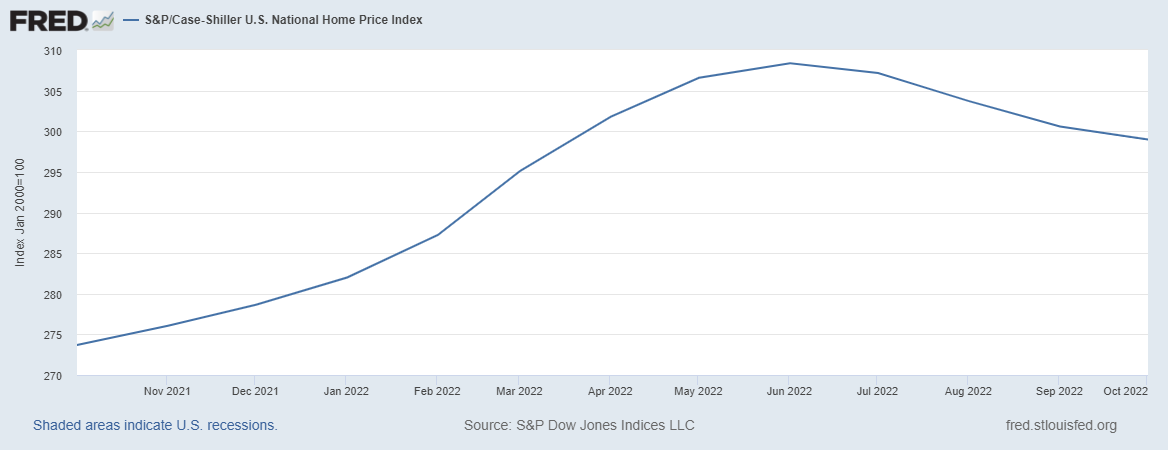

Looking at the last 12 months, the rate of home price decline is relatively moderate:

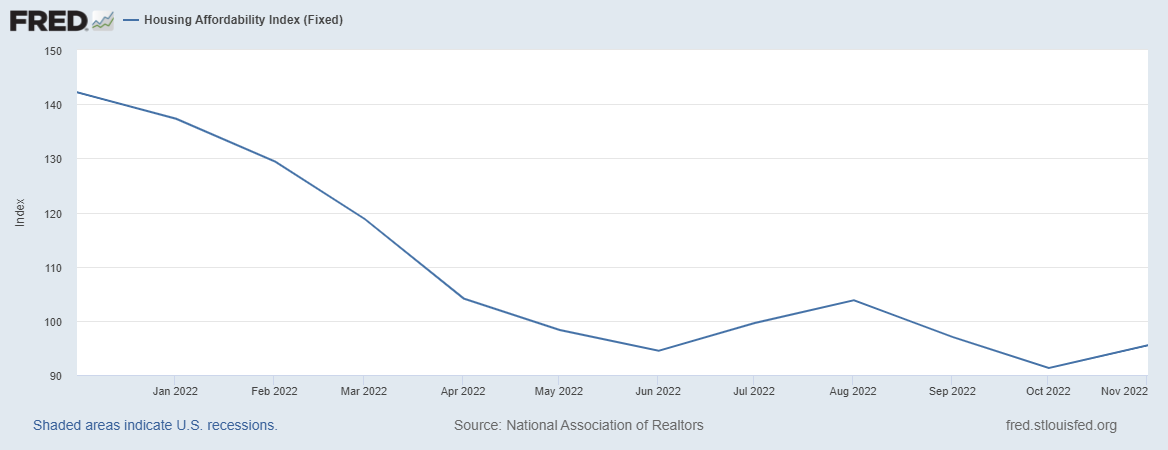

The big story is mortgage rates have reversed their recent strong uptrend, which has given a lift to home buyers and sellers alike, although affordability relative to the recent lows is still a problem.

Looking at affordability, it bottomed late last year and has been trending up which is a positive sign.

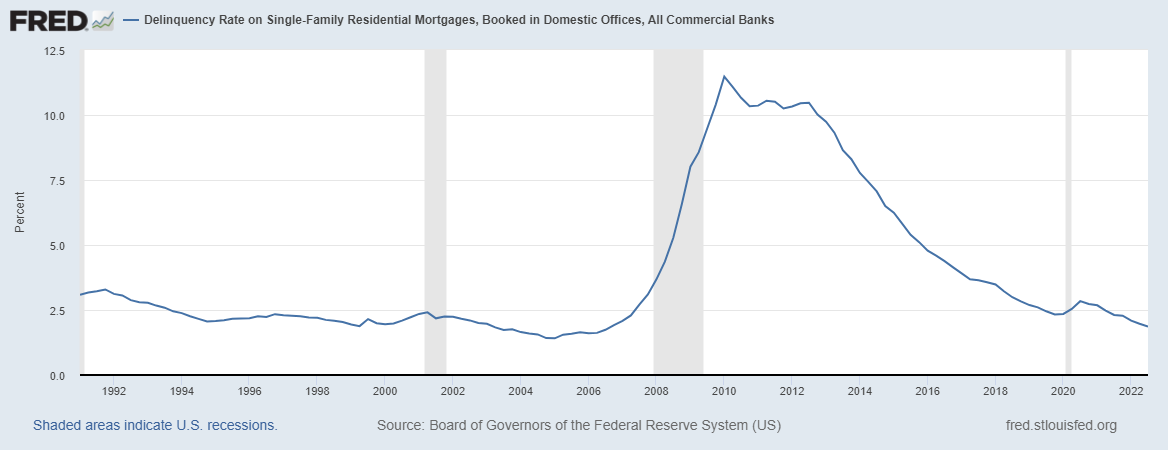

The delinquency rate on single family mortgages continues to be low and trending lower. In a really bad recession, this can reverse in a hurry as we saw in 2008, but we will have to watch what happens with the much anticipated recession this year (or next).

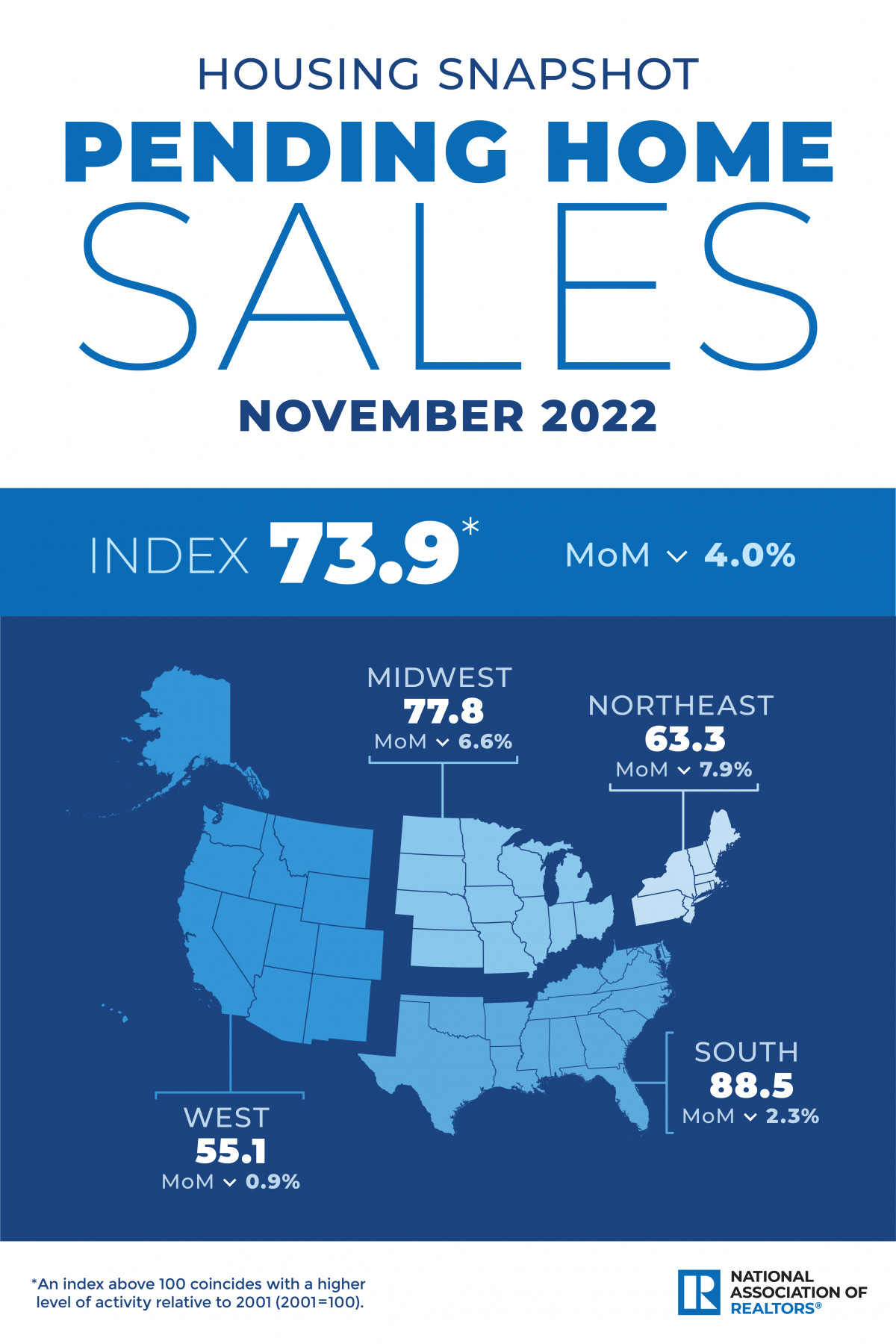

Here’s the National Association of Realtors’ recent snapshot of existing home sales (as of November 2022). Inventory remains low, sales volumes continue to drop and price appreciation is lower compared to last time we looked at this.

The pending home sales data also shows more weakness, especially in the West since the last time we looked at this. The South continues to see the strongest level of activity, followed by Midwest, then Northeast and then the West.

Another data point I like to look at is the NAR’s Realtors Confidence Index. As you can see below, all indicators are relatively flat:

The REALTORS® Confidence Index (RCI) survey gathers on-the-ground information from REALTORS® based on their real estate transactions in the month. This report presents key results about market transactions.

Highlights

First-time buyers represented 28% of buyers, unchanged from one month and up slightly from one year ago.

26% of buyers were all-cash sales, nearly unchanged from 26% last month and 24% in November 2021.

61% of respondents reported properties sold in less than one month. This is down from 64% a month ago and 83% in November 2021.

Homes listed received an average of 2.3 offers, nearly flat from October 2022 when it was 2.4 and down from 3.8 in November 2021.

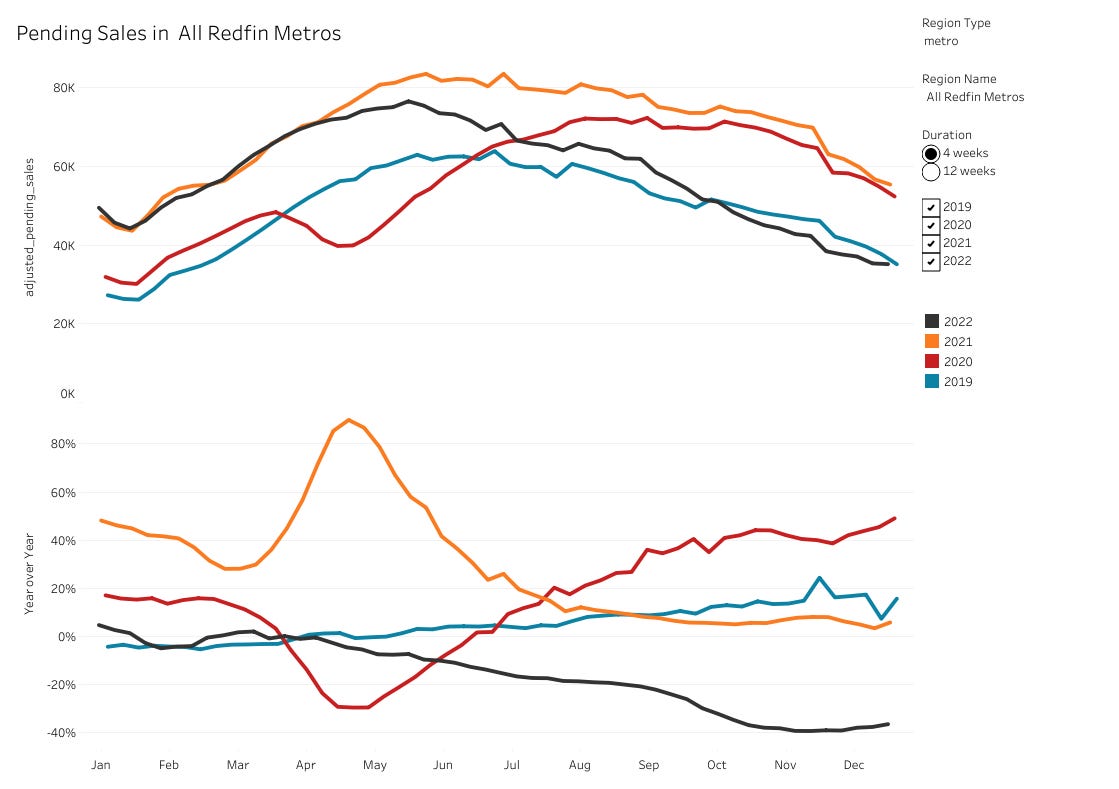

Redfin has a treasure trove of housing data on their website that I like to look at. Pending home sales for 2022 continue to mark four year lows, but seem to be bottoming on a year over year percentage change basis, which is a good sign.

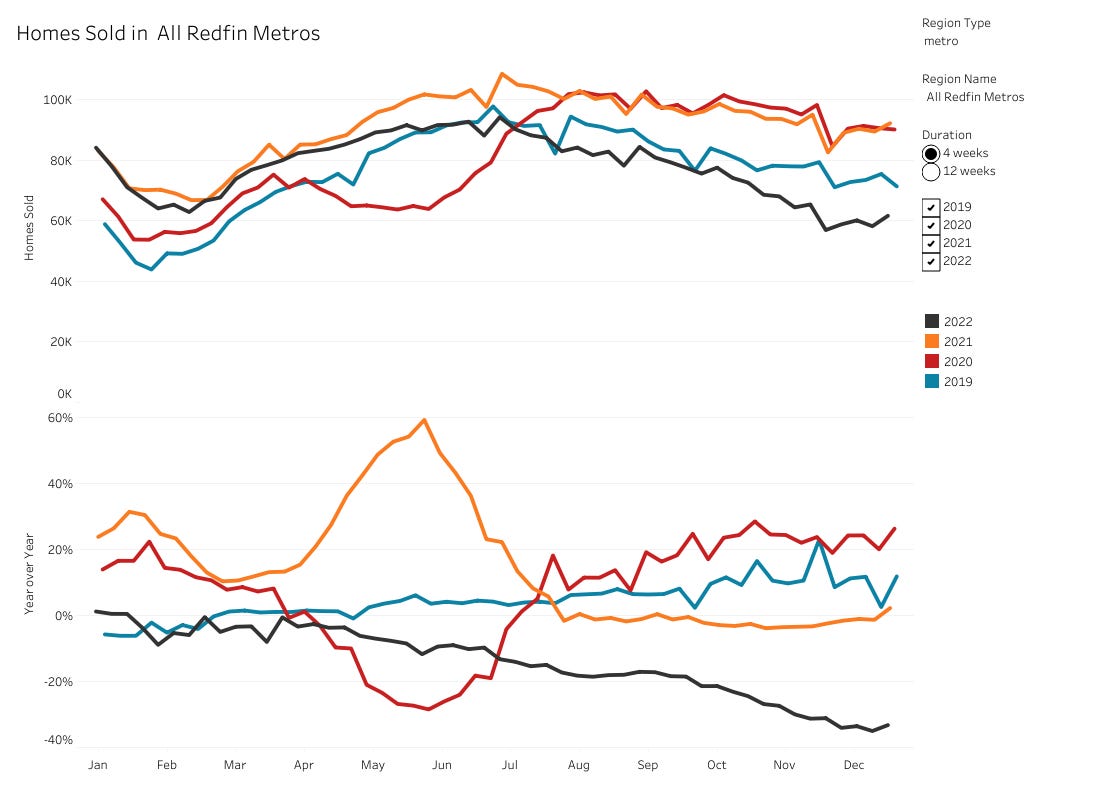

Similar to pending sales, homes sold are also at four year lows but look to be trending up from these levels.

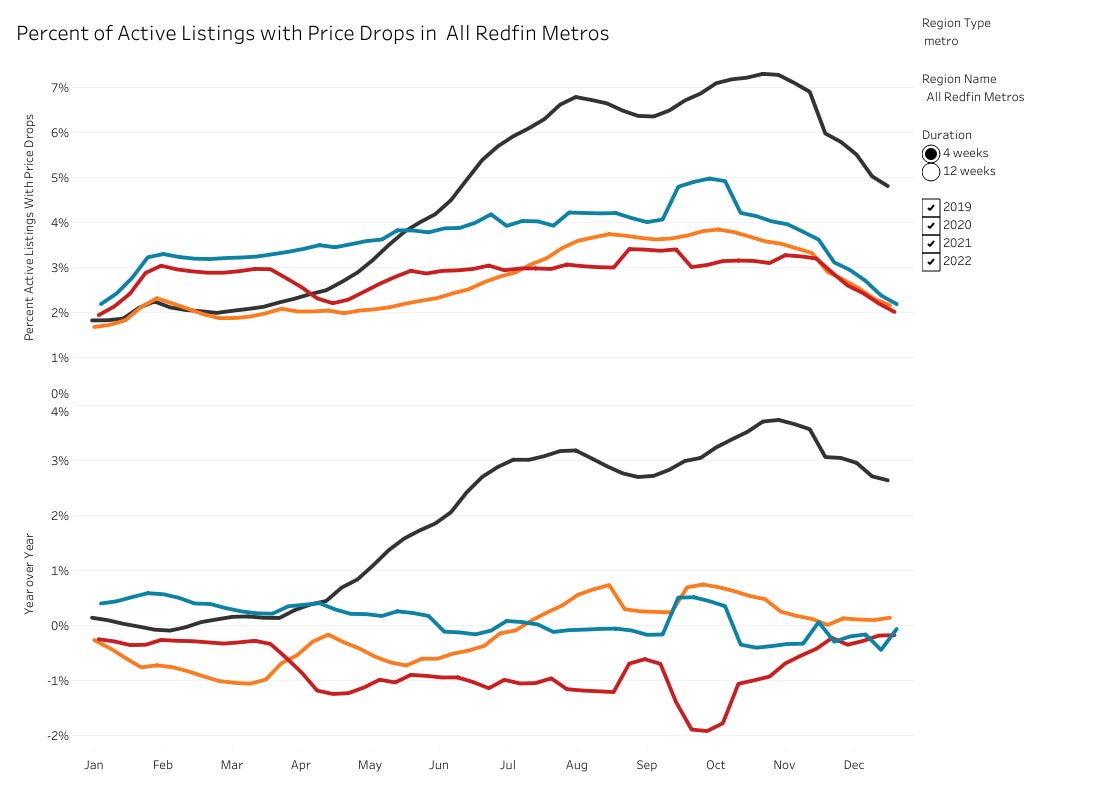

A data point that I think is particularly important is price drops. As you can see after reaching a massive four year peak late last year, the trend is clearly down (although still elevated compared to the past four years).

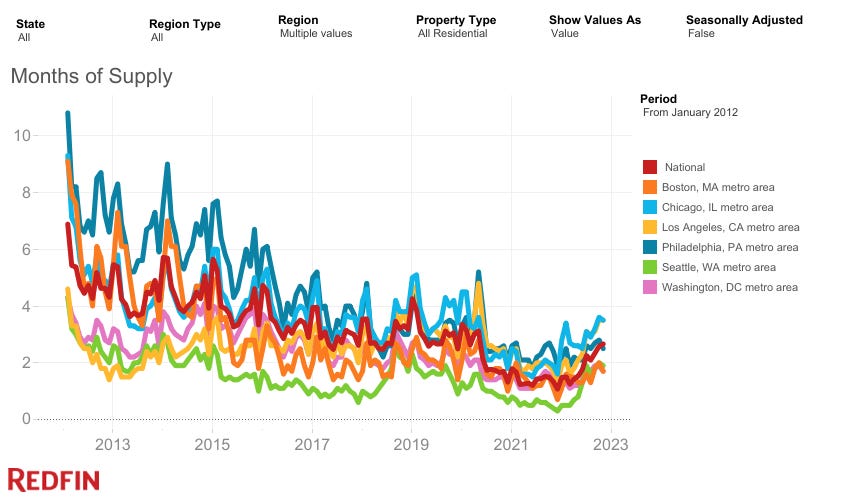

Housing supply continues to be constrained when looking back ten years, although supply has been rising recently after bottoming last year. There are two schools of thought on supply. One is that sellers have unrealistic pricing expectations and are pulling homes off the market that don’t sell right away and are just waiting to re-list. Locally, I have been seeing a lot of these “back on market” listings, which are either this case or they fell out of escrow and needed to be re-listed. I have seen pretty aggressive price reductions in my area (Southern California), but that’s mostly because prices simply went up too far too fast. Another school of thought is that sellers are hesitant to move and incur a significantly higher mortgage rate (less home for higher monthly payment) and so are less inclined to leave their current home unless forced to by life (new job, growing family, etc.). Either way, low supply has a stabilizing effect on the market.

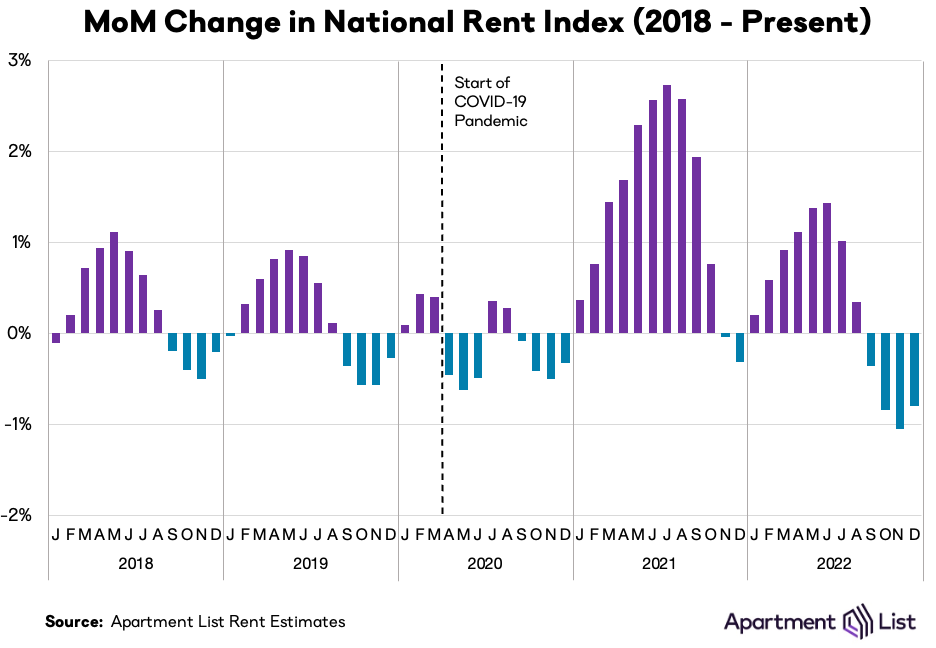

At the same time, while rents have increased substantially since the pandemic, they seem to be cooling recently:

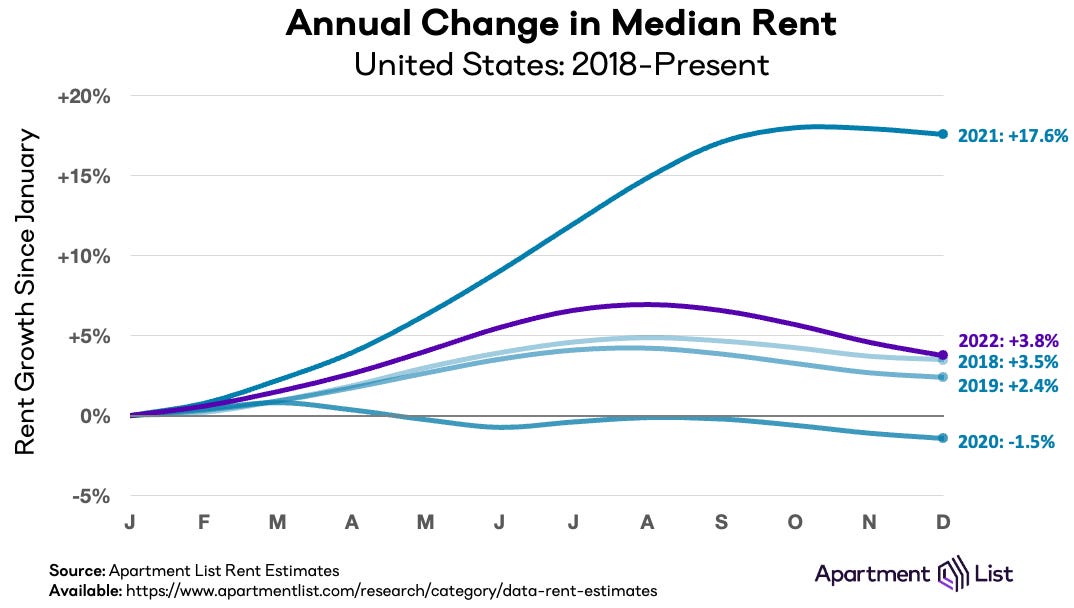

Here’s another look at the data, which shows that 2022 rent growth at 3.8% is returning to a more “normal” level after outsized growth in 2021:

Apartment List concludes their review of the data:

Conclusion

With December’s 0.8 percent decline, rent prices have now dipped nationally for four straight months. We closed out 2022 with full year rent growth just shy of 4 percent, a rate that is slightly above pre-pandemic levels. The recent cooldown seems to suggest a shift in market conditions that goes beyond seasonality alone, as demand cools and supply constraints continue to abate. This seasonal dip is likely to persist through the winter, but as moving activity picks back up in the spring and summer, we are likely to see a return to positive rent growth. We expect that 2023 will be a year of flat to modest rent growth, but it is unlikely that prices will fall significantly throughout the year.

If you are looking to buy a home and not in a hurry, it seems like it might make sense to wait a six months for prices to continue to correct and see at what level mortgage rates stabilize. Renting should continue to get more expensive, but at a much slower pace after the big run-up the last couple of years and in high cost of living areas, it’s probably still cheaper than buying a home for the time being. I look at owning a home as more of a way to fix my housing cost and less as an investment. If you can afford the payment, have a fixed mortgage and plan to stay there for a long time, you probably shouldn’t worry too much about the market. There’s no question owning a home is a great way to build wealth over time with a fixed rate mortgage and steady inflation thanks to the Fed. I have talked to people who recently sold their home for 4x to 10x what they paid for it many years ago and I always ask the same question “Is the house 4x / 10x better than when you bought it?” They just laugh. Of course it isn’t! That’s the inflation!

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.