It’s been a few months since my last update, so I thought it would be a good time to take a look at the US housing market again with some charts.

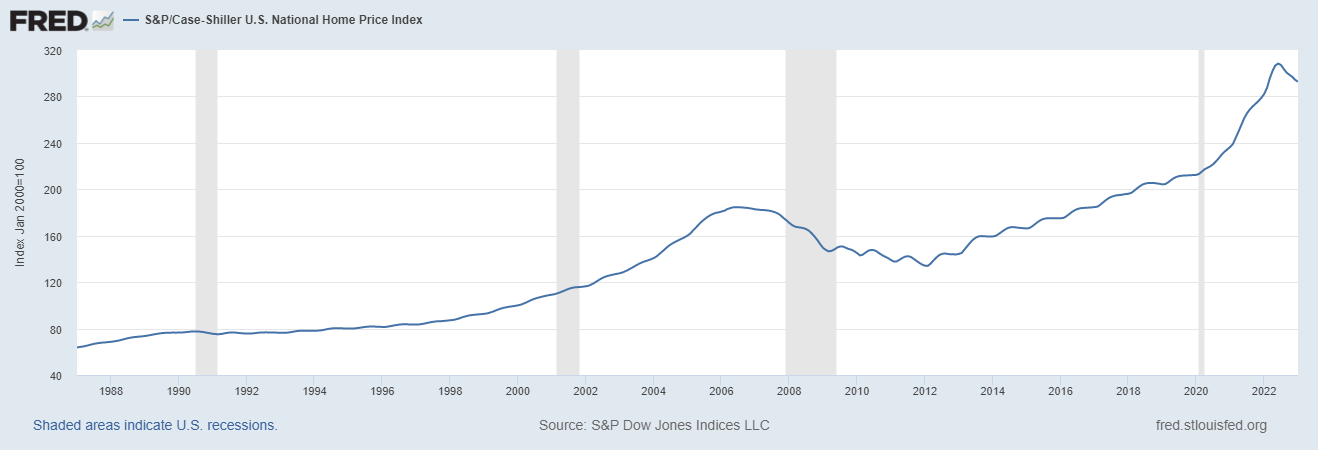

The Case-Schiller national housing index has peaked and is headed down. It always amazes me how we clearly had a bubble in 2008 and even with the recent correction, we are still at all time highs:

The 12-month data shows a slow, steady decline in prices after peaking in June 2022:

Mortgage rates have climbed significantly from 2021 and remain elevated (~2x the lows), but still low by historical standards:

Here’s a look at the trailing 12 months - insane amount of volatility with 30-year fixed rate bouncing between 6% and 7%, currently hanging around 6.5%:

Housing affordability has improved from the lows and at 100 means a family earning a median income has exactly enough to qualify for a loan to purchase a median priced home. This level of affordability is, of course, not as good as it was when rates were much lower:

Delinquency rate on single family mortgages looks good (low and heading lower), which is a positive sign until it isn’t - just look at 2008 - 2010:

Existing home sales from the National Association of Realtors show sales volume declines for the month and year over year, along with growing inventory and declining prices, which doesn’t bode well:

Pending Home Sales from the National Association of Realtors shows some upside, except in the West region which is down month over month:

Another data point is the Realtors Confidence Index published by the National Association of Realtors:

The REALTORS® Confidence Index (RCI) survey gathers on-the-ground information from REALTORS® based on their real estate transactions in the month. This report presents key results about market transactions.

Highlights

27% of buyers had all-cash sales, nearly unchanged from 28% last month and 28% in March 2022.

First-time buyers represented 28% of buyers, virtually flat from February 2023 and down from 30% in March 2022.

65% of respondents reported that properties sold in less than one month. This is up from 57% a month ago and down from 87% in March 2022.

Homes listed received an average of 3.2 offers, slightly from 2.7 last month and down from 4.8 offers in March 2022

Redfin housing data is also very helpful and pretty current. The weekly data is excellent.

Pending sales activity is tracking seasonally and well below prior two years:

Homes sold are also tracking seasonally and well below the last two years:

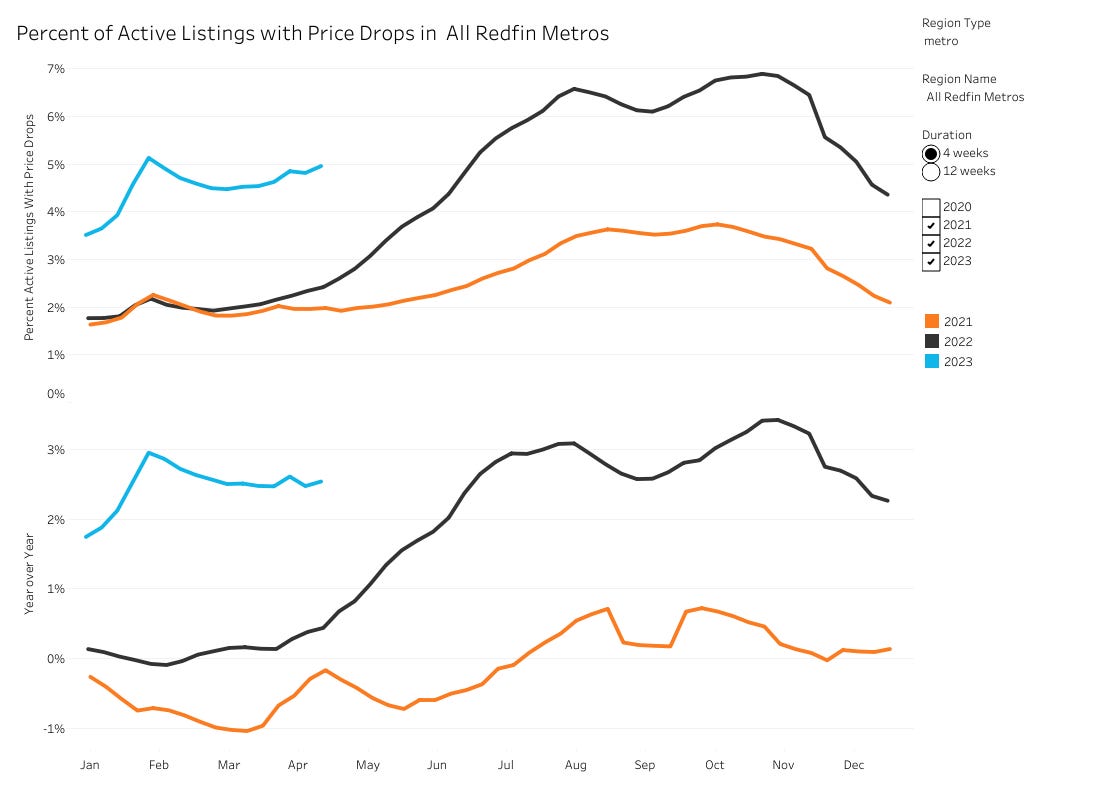

Price drops are trending much higher, compared to past two years:

Housing supply is off the lows but still relatively low by historical standards, which is no doubt helping to support the market, along with people reluctant to move and give up their low interest rate mortgage. To give you an idea of what this means, if you bought a home for $500,000 and paid 20% down, your mortgage would be about $1,900 / month at a 2.8% interest rate. Assuming that’s the payment you can afford, a 6.5% interest rate (and 20% down) would only buy you a $320,000 home.

Now time to take a look at the rental market with some data provided by Apartment List. After cooling for five months, rents are rising again seasonally as we enter the Spring:

The year over year change in national rent index shows a slowing rate of increase and is approaching pre-pandemic levels:

March’s 0.5 percent increase represents a slightly faster rate of growth than we saw last month, confirming the rents are firmly back on an upward trajectory. That said, year-over-year growth fell again to 2.6 percent – dipping below the pre-pandemic average from 2018 to 2019 – and will likely decelerate even further in the months ahead. And even if demand continues to rebound, a strong construction pipeline should temper rent growth for the remainder of the year. Prices may not fall further, but they are also unlikely to increase significantly.

If you are looking for investment property, I think it’s probably a good idea to wait until the housing market has clearly bottomed. This could take a couple of years, especially if there is a recession on the horizon, as seems more and more likely and as I discussed in last week’s post:

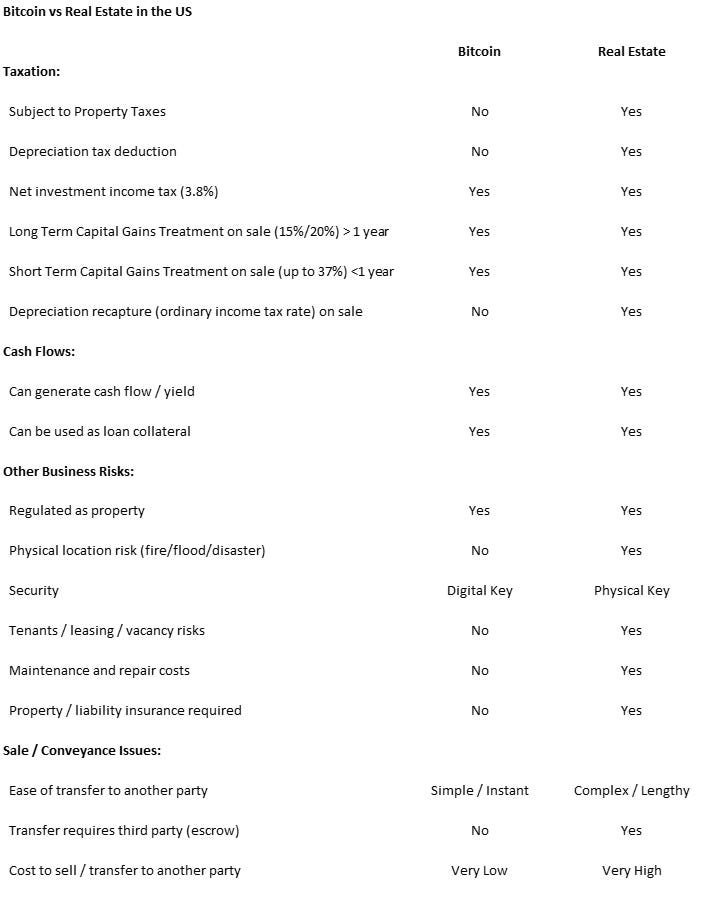

If I had the choice to invest in real estate or Bitcoin, I’d probably choose Bitcoin based on risk / reward and other factors (like Tenants, Taxes and Toilets). I did a side by side comparison a while back here if you’re interested, but this is the TLDR:

It’s worth noting that if you simply HODL Bitcoin, all the taxation responses would be “No.” In addition, while you can earn yield on your Bitcoin, it’s not advisable since you have to give up custody to a counterparty that you would have to trust with your coins. If you want to own investment property in places like California (especially cities like San Diego or Los Angeles), you’ll find the local government is hostile toward landlords and there are enough added regulations and related costs to discourage most small mom and pop real estate investors. This has definitely gotten worse since the plandemic and this was a major factor in my decision to sell my investment property last year.

If you are looking to buy a home and not in a hurry, it seems like it might make sense to wait a bit longer for prices to continue to correct and see at what level mortgage rates stabilize. Renting should continue to get more expensive, but at a much slower pace after the big run-up the last couple of years and in high cost of living areas, it’s probably still cheaper than buying a home for the time being. I look at owning a home as more of a way to lock-in my housing cost and less as an investment. If you can afford the payment, have a fixed mortgage and plan to stay there for a long time, you probably shouldn’t worry too much about the market. There’s no question owning a home is a great way to build wealth over time with a fixed rate mortgage and steady inflation thanks to the Fed. I have talked to people who recently sold their home for 4x to 10x what they paid for it many years ago and I always ask the same question “Is the house 4x / 10x better than when you bought it?” They just laugh. Of course it isn’t! That’s the inflation!

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.