VS

As some of my readers may know, I wrote a book in 2014 titled Building a Financial Fortress: Getting Started in Real Estate Investing that chronicled my leap into investing in small condos in the aftermath of the Great Financial Crisis with what was left of my Individual Retirement Account. I learned a lot in that process about how difficult being a real estate investor can be, but I also learned a few years later when I sold most of my properties that buying when everyone else is panicking and being patient can pay off.

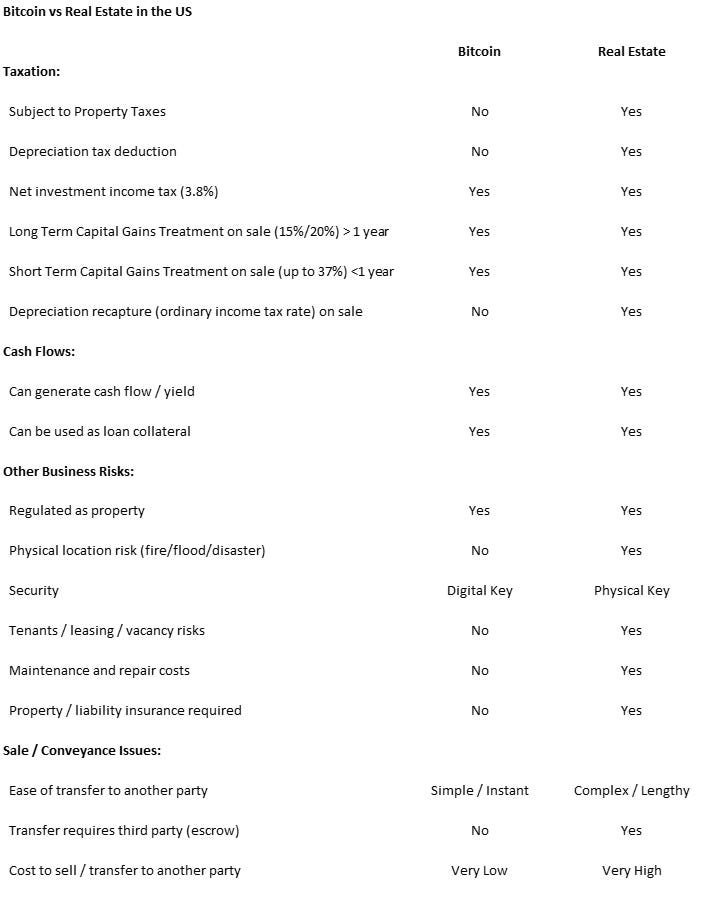

After many years as a real estate investor and also working in the real estate industry for most of my 30+ year career, and after a relatively short period of time as a Bitcoin investor, I have started to give a lot of thought to comparing Bitcoin to Real Estate as an investment. I wanted to look at taxation, cash flows, other business risks and sale/conveyance issues side by side, so I created the graphic below as a starting point for this week’s topic. Note that this is written from a US-centric view and Bitcoin may have even more favorable tax treatment in other countries that either recognize Bitcoin as legal tender or have zero or very low taxes on the sale of Bitcoin. This only increases the appeal from my base case analysis below, especially as more countries adopt favorable Bitcoin tax treatment as an incentive to attract new investment. Also, I am learning that highly leveraged real estate investing is more common in the US than in many other countries in the world (where cash transactions are common) and I believe this tends to magnify the “boom / bust” cycles in the US.

The remainder of this post is to analyze each factor. Spoiler alert: I found that overall, Bitcoin is a compelling alternative to real estate as an investment and long term store of value.

Taxation

One of the biggest factors in favor of Bitcoin over Real Estate is that although both are regulated as property, only Real Estate is subject to a property tax. Property taxes vary across the US. In California, we have a state law that limits the amount property value can increase for purposes of the tax to 2% annually (there are exceptions if properties have been revalued lower due to an economic shock such as GFC in 2008). The actual tax rate varies by city / county, but can be anywhere from 1% to up to 2% of the value of the property or even higher depending on the “add-ons” in a particular jurisdiction in California. In other states, while the tax rates may be lower they can increase over time and also there is no “cap” on valuation, so the property taxes just keep going up as values increase. I think this is a pretty significant advantage for Bitcoin.

Real Estate allows you to depreciate the portion of your purchase price related to the building which gives you a noncash expense to offset your other net income (rent minus cash expenses) and this often results in no taxable income or even a loss that some may be able to take on their tax return to offset other income (depends on your adjusted gross income or whether or not you are considered a “real estate professional”). While this sounds great, there is a catch if you sell the property called “depreciation recapture.” This is simply a higher tax rate applied to a portion of your gain than the long term capital gains tax rate when you sell. For many people, this is a very unpleasant surprise when they sell a property. There is no similar concept in Bitcoin, but with the concept of recapture, I’m not sure that the depreciation deduction is really that big of an advantage unless you hold your property forever.

All investment income is subject to the 3.8% net investment income tax (courtesy of Obamacare legislation - something I was never in favor of). As such, any net income generated from yield and any capital gains from sales would be subject to the tax, so there is no differentiation here.

As far as capital gains treatment when you sell, you have to pay a rate of 15% or 20% (depending on your income level) for assets held more than a year and you have to pay a short term rate on assets held less than a year that approximates your ordinary income tax rate (up to 37%). These tax rules are the same for both Bitcoin and Real Estate, so there is really no differentiation. Of course, hodling your Bitcoin or Real Estate generates no capital gain taxes.

One benefit of Real Estate is that it’s possible if you properly structure the transaction to qualify as a 1031 Exchange (see my recent post where I discuss in more detail here). You can defer the taxes you would otherwise have to pay if you take the proceeds from a property sale and buy another property (or properties) with them using a qualified intermediary through escrow. There is no such way to do this with Bitcoin. Having said that, it’s not easy to do a 1031 Exchange as there are many rules that have to be followed and ultimately you will have to pay the tax when the last property in the chain of exchanges is sold.

Estate taxation is the same for both Bitcoin and Real Estate in that upon your death, all of your assets are revalued at fair market value as of the date of your passing. To the extent the value of your estate exceeds the current Federal estate tax exemption limit ($12,060,000 in 2022), your estate will owe taxes. Whether your estate owes taxes or not, your assets will pass to your heirs at the stepped-up fair market value basis, which is a big deal since a significant amount of taxes on unrealized appreciation can potentially be avoided. Again, both Bitcoin and Real Estate have the same tax treatment for estate purposes. By the way, if you haven’t already setup an estate plan including revocable living trust(s), durable power of attorney and advanced healthcare directive, it’s definitely a good idea and well worth the attorneys’ fees.

Cash Flows

Real Estate generates positive cash flows from the rent less cash expenses in most cases, assuming the property is being managed properly. Bitcoin can also generate yield by loaning your Bitcoin to an institution who will pay you interest in the form of additional Bitcoin at some rate (I have seen 1% - 2% and sometimes higher rates). Most hardcore Bitcoiners say this is a bad idea because “not your keys, not your coins” and if the third party you have entrusted your coins to is hacked or otherwise fails to perform their end of the bargain, you lose your coins for a relatively paltry sum of yield. Still, there is the potential to earn positive cash flow from Bitcoin same as Real Estate so there is no clear advantage to either asset class except that the Real Estate yield can potentially be a bit higher than Bitcoin (for example, the current yield on the Vanguard Real Estate ETF is 2.9%).

Another common way to generate cash flow is through financing and refinancing real estate. Bitcoin can also be used as collateral for a loan and so there is no real differentiation here. The amount a lender might be able to loan you may vary - for example an investment residential property might qualify with a loan at 75% or 80% of the value of the property which would allow you to put 20% to 25% down to purchase the property and then later when the property value appreciates would allow you to refinance and tap additional cash as long as there is enough positive cash flow to handle the new loan payment. Bitcoin is normally purchased for cash, but you can also borrow against it - in fact most recently Goldman Sachs announced they would be doing Bitcoin loans, but there are many other companies who provide this service today (i.e., Unchained Capital, Ledn, etc.). One difference is that Bitcoin loans typically max out at 50% loan to value, which is lower than a real estate loan. However, because the loan is only backed by the asset, the loan process is typically very fast, doesn’t require a credit check or for you to provide a lot of information about your income since the loan is entirely based on the Bitcoin collateral. In the case of a real estate loan where you are an individual investor, the real estate is collateral (security) and the lender is really looking at your ability to repay the loan. As such, they will look at not only the net income from the property (which will be heavily discounted) but also how much you make personally, your credit profile, etc. in deciding whether or not to make the loan to you. Also higher leverage, while it can enhance future returns, cuts both ways and can also result in being “underwater” where you owe more than the property is worth. While that doesn’t result in the lender calling the loan, it’s not a great situation to be in as an investor and will certainly make getting additional properties / loans more difficult. If cash flow turns negative for any reason, being “underwater” makes holding the investment that much harder. For Bitcoin, I would probably not want to risk a 50% draw-down resulting in a margin call or losing my coins so I would probably do a lower LTV if ever borrowing against Bitcoin. Again, while the terms and conditions can vary and there are advantages / disadvantages in each case you can still get a loan on either asset class.

Other Business Risks

This is an area where I think Bitcoin clearly outshines Real Estate. Both assets are regulated as property so there is really no fundamental difference in how they are treated, except as I have noted above under taxation.

Unlike Bitcoin which lives in cyberspace, Real Estate is subject to physical location risk, including earthquake, fire, flood, riots and other disasters. While you can buy insurance for most of these perils, it’s expensive and reduces your cash flow. In some cases (like earthquake insurance in California) it’s prohibitively expensive for a small landlord to obtain.

Security is provided by a digital key to your hardware wallet for Bitcoin which only you hold (or if you setup a multi-signature wallet a third key can be maintained by a trusted third party if one of your two keys is lost). Real Estate is secured by a physical key to the property but that doesn’t stop criminals from breaking in or worse, from your tenants destroying your property while not paying rent. Security in the digital realm is absolute where in the physical realm it’s somewhat limited (i.e, you can put up fences, walls, gates and security cameras at added cost).

With Real Estate, you have to deal with the “Three T’s” Tenants, Taxes and Toilets. First you have to find good tenants and then they need to take care of your place and pay their rent on time. The last couple years with Covid-19 have proven to be a nightmare for small landlords who were stuck with nonpaying tenants that could not be evicted due to federal, state and local regulations, while having to continue to pay the mortgage, maintenance costs, property taxes and insurance. Also, even if you are lucky enough to have good tenants who pay on time, they will eventually move out and you will have to face a period of time of no rent (vacancy) until you can find another tenant. For a small investor with a one two or three unit property vacancy can really hurt the cash flow. Bitcoin has none of these concerns and so is clearly a winner here. Some may say these risks are worth the reward of long term, highly leveraged capital appreciation provided by owning the property. That’s great as long as the real estate market doesn’t go through a significant downturn as it did during the GFC. Not only were homeowners evicted from their homes but investors also chose to dump their underwater properties at that time which helped fuel the crash. For individuals with cash ready to move, however, that was a great buying opportunity and with currently elevated real estate values and rising interest rates that cycle will no doubt come again.

Sale / Conveyance Issues

As far as transferring the asset to another entity, Bitcoin is the clear winner as the process is simple, fast and low cost. All you have to do is put in the address to which you are sending the coins, validate it’s correct and send. Ten minutes later it’s finalized / final settled at a very low transaction cost. Real Estate on the other hand requires many steps and multiple third parties to complete a transfer:

Buyer and seller hire real estate agents who can charge up to 6% of the sale price - finding a buyer can be quick or take much longer depending on how property is priced and how “hot” the market is

Seller hires Escrow agent

Buyer applies for loan and chooses Lender

Lender hires Appraiser to determine the property value to support the loan

Lender hires Termite Inspector (required where I live) and Seller is required to treat / repair for any issues identified - this was a significant expense on one of the properties I sold in the past, literally thousands of dollars

Lender asks for lots of information from Buyer and ultimately has to approve the loan; if not approved, buyer has to find another lender or bail out of the deal

Buyer hires home inspector to look for any maintenance / repair issues

Escrow gathers all required documents and processes escrow close

Escrow pays transfer taxes to county and any withholding taxes due to government

Escrow disburses proceeds to seller after taking out all expenses - all of these third parties take their share of the money! On one of the properties I sold in the past, these costs added up to 10% of the sales price!

Entire process can take up to 30 - 60 days after getting under contract

So in summary, I would have to say that there is a strong case for investing in Bitcoin over Real Estate as a long term investment, wealth builder and store of value. I can honestly say I would never have thought this, but after doing the side by side comparison and also taking into account how relatively overvalued the real estate market is today (along with stock and bond markets notwithstanding the recent pull-back) and how relatively undervalued Bitcoin is today in terms of its future utility, if I had to choose where to deploy new money today and was faced with choosing between Bitcoin or Real Estate, I would be leaning toward Bitcoin.

Not financial advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.