Gold and Silver - Buy Now?

Gold and silver have both traded in a flat range for about the past year after rocketing to all time highs in mid-2011 (see charts below). My view is that gold is a better long term hold and silver is better for short term trading, as silver tends to be more volatile. The announcement last week that the European Central Bank cut interest rates and is also going to initiate it's version of "Quantitative Easing" surprisingly did not cause the metals to rally. Instead, the dollar rallied as investors shifted from Euro to dollar holdings which put pressure on gold and silver prices since they are denominated in dollars.

10 Year Gold Chart

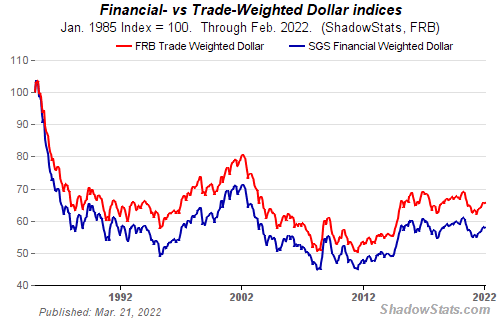

10 Year Silver ChartI think the temporary indirect support of the dollar provided by the ECB's move is just that and the longer term trend is toward the dollar continuing its downward movement, continuing to lose value as shown in the chart below. This is why I favor hard assets (gold, silver, real estate, etc.) at the top of the Financial Fortress. The value of gold and silver is absolute and will increase over time as the dollar continues to lose purchasing power. Not only will real estate increase in value over time, but the value of the fixed rate debt will decrease as you pay off the loan with devalued dollars. From an investor's standpoint, that's the beauty of today's low rates on 30 year fixed mortgages.

Dollar Index - Courtesy of Shadow Government StatisticsRelated Articles:

Gold and Silver Opportunity

Gold and Silver Making Moves

Hard Assets