As we delve into the state of Bitcoin adoption in April 2024, it's evident that Bitcoin continues to make significant strides across various metrics of adoption. From the number of Bitcoin addresses to institutional and government ownership, and from the Lightning Network's progress to global regulatory environments, Bitcoin's footprint in the financial landscape has only deepened over the past year. Last year’s Bitcoin adoption update is here if you’re interested:

A Look at Bitcoin Adoption

A quick reminder about why Bitcoin is such a remarkable financial innovation: Absolutely scarce (21M maximum coins) Transfers are peer to peer without an intermediary; you can send value to anyone, anywhere in the world with a computer and internet connection

Number of Bitcoin Addresses

As of March 2024, there are 460 million Bitcoin addresses, with 37% deemed "economically relevant." This segment mainly includes addresses belonging to crypto exchanges and other third-party entities. Among these, 67 million are funded addresses, indicating wallets with at least $1 worth of BTC tokens. This represents a substantial increase from the previous year, highlighting growing user engagement and wallet distribution.

Institutional and Government Bitcoin Ownership

The landscape of Bitcoin ownership has also evolved, with notable figures such as Satoshi Nakamoto, the Winklevoss twins, Michael J. Saylor, and Tim Draper continuing to hold significant amounts of Bitcoin. Additionally, countries like El Salvador have embraced Bitcoin as legal tender, while others, including the US, hold large stashes of Bitcoin seized from criminal activities. This diverse ownership underscores Bitcoin's broad appeal across different sectors. Here’s a cool visual of institutional and government Bitcoin ownership from BitcoinTreasuries.net (check out their website for more details on each entity’s holdings):

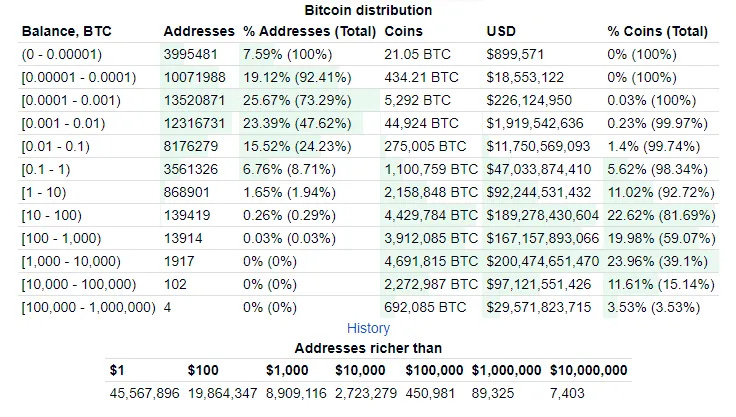

While the Microstrategy, GBTC, iShares Bitcoin Trust and US/China Government holdings are impressive, they individually represent only about 1% - 1.5% of the 21M total supply of Bitcoin. More than half of the total current value of Bitcoin (61%) still sits with smaller holders who have 1,000 Bitcoin or less, as you can see in the below distribution chart:

Bitcoin Lightning Network

The Lightning Network, Bitcoin's premier layer-two solution, has seen exponential growth, significantly enhancing Bitcoin's utility as a medium of exchange. This is reflected in the increasing number of nodes, channels and network capacity (i.e. the amount of Bitcoin committed to open channels). This growth improves the Lightning Network’s capacity for fast and low-cost transactions.

Global Regulatory Environment

Significant developments in the regulatory landscape, such as the FASB's decision to adopt fair-value accounting for Bitcoin, have made holding Bitcoin more attractive for US companies by allowing them to recognize unrealized gains. This change, along with expectations of pro-Bitcoin regulations in multiple US states, contributes to a more favorable environment for Bitcoin's growth.

Since March 2023, several US states have enacted or considered legislation generally supportive of Bitcoin, reflecting a broader trend towards integrating digital currencies into the regulatory and economic frameworks. Here’s a summary of key legislative actions:

Arkansas passed the Arkansas Data Centers Act of 2023, creating guidelines for Bitcoin mining and protecting miners from discriminatory regulations and taxes. This legislation aims to recognize the economic value data centers, including crypto miners, bring to local communities.

Texas considered Senate Bill 1751, which proposed limits on tax abatements for Bitcoin mining properties and restrictions on miners' participation in demand response programs. The bill faced criticism from the crypto community and industry leaders for potentially undermining Texas' position as a leader in the digital economy.

Florida and Georgia explored legislation related to the broader digital asset space. Florida examined bills regarding Decentralized Autonomous Organizations (DAOs), digital trust business, and the application of sales and use taxes to cryptocurrency transactions. Georgia proposed the Blockchain Basics Act, which offers protections for virtual currency mining activities and exempts them from money transmission licensure requirements.

Idaho introduced the Bitcoin Protection Act, aimed at establishing rights regarding the mining and use of Bitcoin. This act adds to a growing list of state-level initiatives to provide a legal framework for the adoption and use of cryptocurrencies.

Oregon and New York looked into regulations impacting the crypto mining industry, with Oregon proposing emissions reduction targets for high-energy-use facilities, including crypto mining. New York enacted a law pausing crypto mining operations that use proof-of-work methods and depend on carbon-based power. These states have been known to not support Bitcoin adoption, unlike other states like Texas, Florida, Wyoming, Idaho, etc.

In the category of adoption headwinds, European Central Bank officials have expressed skepticism about Bitcoin's efficacy as a global, decentralized digital currency, citing its failure to become a mainstream form of payment or a stable investment. They argue that Bitcoin's design does not produce any intrinsic value, making it unsuitable for payments or as an investment. Furthermore, the environmental impact of Bitcoin mining and its association with criminal activities raise significant concerns. The recent approval of a Bitcoin ETF has not changed these fundamental issues, and the officials warn of the potential for another speculative bubble, emphasizing the need for stringent regulation. Most of this is ancient FUD that has been debunked many times, but not surprising since Bitcoin was designed to usurp power and control from central banks.

In the U.S., the legislative landscape for cryptocurrencies, including Bitcoin, is in flux, with specific regulatory frameworks still pending. Given the divided Congress and the political complexities, particularly in an election year, it's unlikely that comprehensive crypto regulations will be established before 2025. Nonetheless, key court cases and agency policies will continue to shape the regulatory environment for digital assets. On the regulatory front in the US, the SEC’s approval of the Bitcoin ETFs was a significant development this year and will certainly have a significant impact on adoption moving forward.

Transaction Volume and Other Metrics

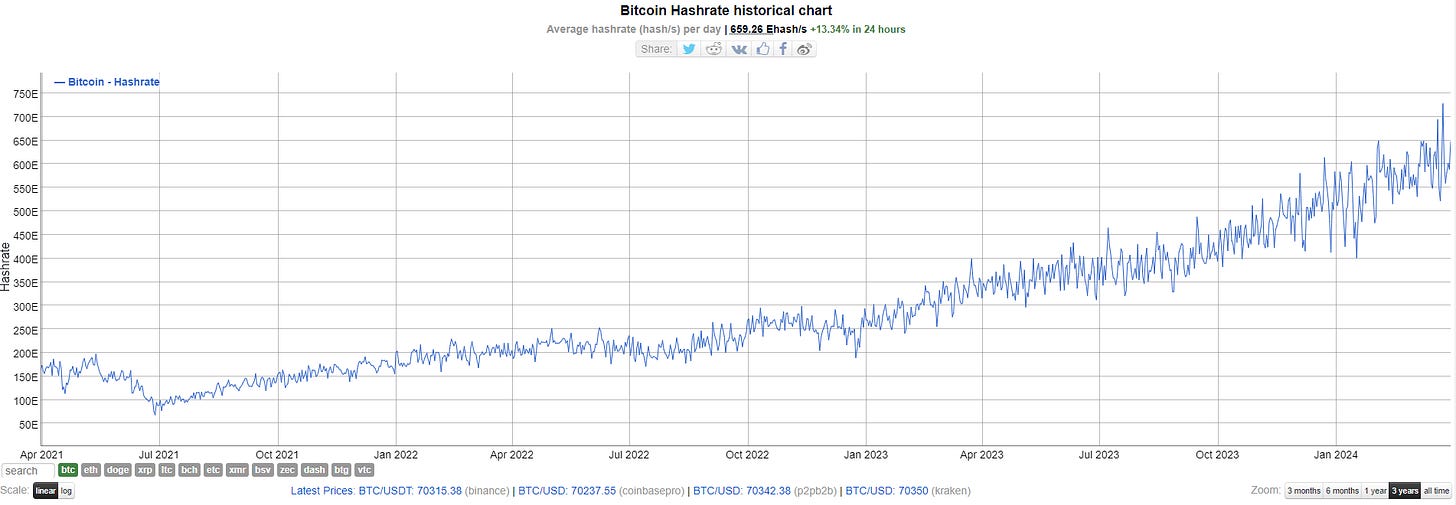

The total Bitcoin circulating as of March 2024 is approximately 19.67 million BTC, with a market capitalization nearing $1.38 trillion. The daily transaction volume ($10.6B over the last 24 hours as of this writing) reflects a vibrant and active network, further emphasized by Bitcoin's price stability and hash rate reaching new heights of 660 EH/s, underscoring the network's security and resilience.

Bitcoin ATMs, Search Volume, and Merchant Adoption

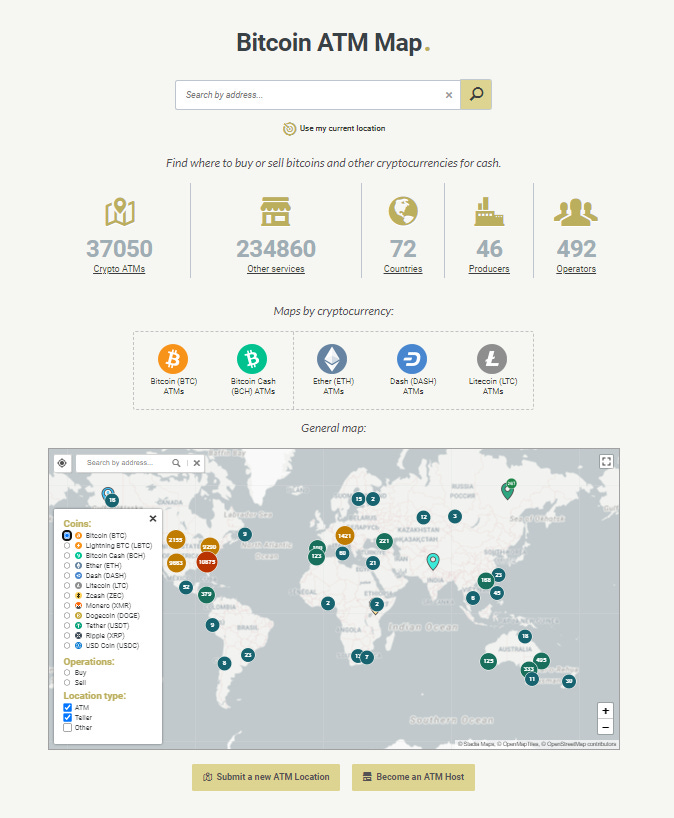

The number of global Bitcoin ATMs, Google search volume trends, and merchant adoption rates continue to rise, albeit at varied paces. These indicators collectively demonstrate an increasing public interest and acceptance of Bitcoin for both investment and everyday transactions.

Bitcoin ATM’s (33,990 last year vs 37,050 this year, a 9% increase):

Google search results over the past year for Bitcoin:

Conclusion

Looking at Bitcoin adoption in March 2024, it's clear that the network continues to expand and mature. With an increasing number of addresses, significant institutional and individual holdings, advancements in the Lightning Network, supportive regulatory changes, and robust network fundamentals, Bitcoin is solidifying its position as a crucial player in the global financial system. The ongoing growth in adoption, security, and regulatory acceptance positions Bitcoin favorably for further integration into mainstream finance and everyday use.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.