The year 1971 stands as a monumental turning point in modern economic history. On August 15, 1971, President Richard Nixon announced the suspension of the U.S. dollar's convertibility into gold, effectively dismantling the Bretton Woods Agreement and severing the final link between major world currencies and tangible assets. This single decision ushered in the era of fiat currency, where money is backed solely by government decree rather than a finite commodity like gold.

The website "WTF Happened in 1971?" compiles a staggering array of data showing the economic, societal, and cultural shifts that have occurred since that pivotal moment. It paints a compelling picture of how detaching money from hard assets has had far-reaching consequences, many of which were unforeseen at the time. This post will explore these changes—ranging from wage stagnation and income inequality to dietary shifts, family dynamics, and the rise of populism—while highlighting how Bitcoin emerged as a direct response to the systemic failures that began in 1971.

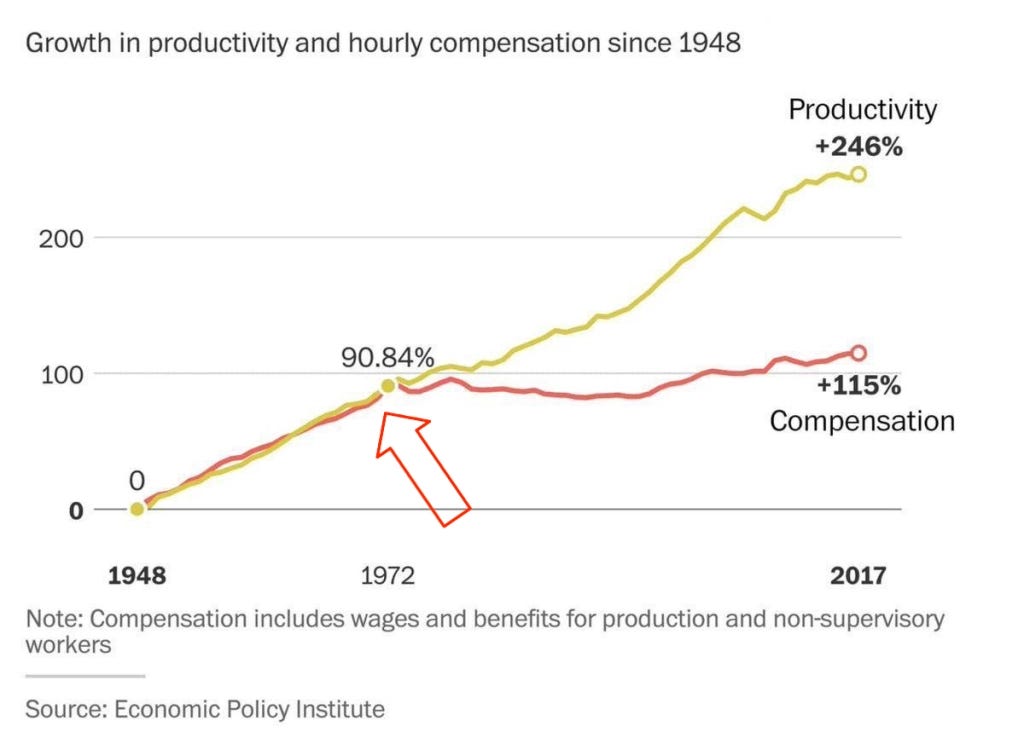

The Great Divergence: Productivity vs. Wages

One of the most striking charts from "WTF Happened in 1971?" shows the divergence between worker productivity and wages. From 1945 to 1971, productivity and hourly compensation rose in near lockstep, reflecting a period where workers directly benefited from economic growth. But after 1971, this relationship fractured. While productivity continued to climb—rising roughly 70% from 1979 to 2018—wages for the average worker barely budged, increasing only 12% during the same period.

This divergence has had profound implications. The middle class, once the bedrock of American society, began to shrink. In 1971, 61% of Americans lived in middle-income households, but by 2023, that figure had fallen to 51%. Simultaneously, the share of lower-income households increased from 27% to 30%, while upper-income households grew from 11% to 19%. The benefits of economic growth increasingly accrued to the wealthiest, while everyday workers struggled to keep pace with rising living costs.

The Inflationary Diet: From Red Meat to Seed Oils

The economic strain following the end of the gold standard extended beyond income and wages; it reached into our kitchens. As inflation eroded purchasing power, families began substituting more expensive, nutrient-dense foods like red meat with cheaper, calorie-dense options like cereals, processed foods, and products laden with seed oils.

This shift wasn’t purely about preference—it was a direct consequence of economic necessity. Seed oils, introduced as an affordable alternative to animal fats, became a staple in processed foods due to their low cost and long shelf life. Unfortunately, the increased consumption of these highly processed oils, coupled with refined carbohydrates, has been linked to a surge in chronic health issues, including obesity, heart disease, and type 2 diabetes.

Obesity rates in the U.S., for instance, have skyrocketed since the 1970s. In 1971, the adult obesity rate was about 15%. Today, it exceeds 40%. This health crisis reflects the deeper systemic issue of economic policies that have inadvertently pushed people toward cheaper but less nutritious food options. For more on this subject:

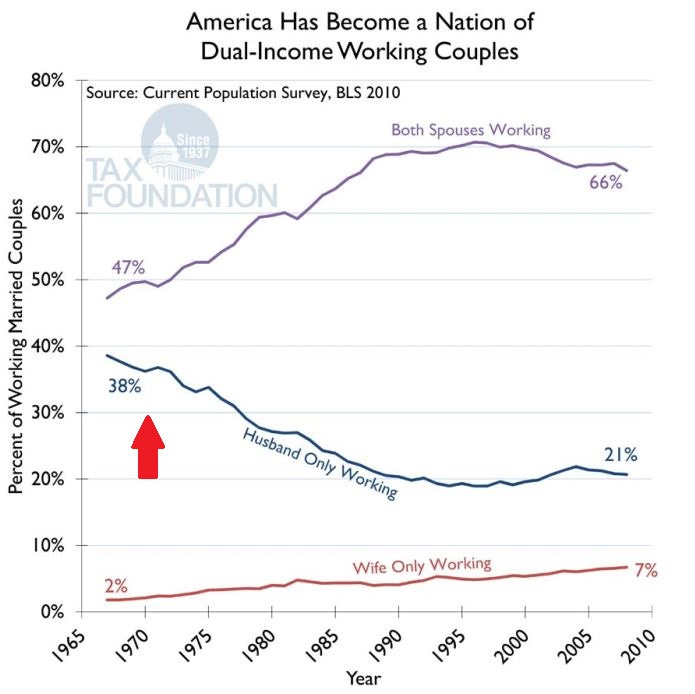

The Rise of Dual-Income Households and the Family Unit

Another significant societal shift since 1971 has been the rise of dual-income households. Before the fiat era, it was common for a single income to support an entire family, allowing one parent—typically the mother—to stay home and raise children. But as wages stagnated and the cost of living climbed, more families found it necessary for both parents to work.

This change had far-reaching consequences for family dynamics and child-rearing. With both parents in the workforce, there was an increased reliance on daycare and after-school programs, adding further financial strain. More importantly, it shifted the fabric of family life, leading to less parental involvement and increased stress as families juggled work and home responsibilities.

The impact on children has been the subject of much debate, but studies suggest that increased parental absence can affect emotional development, academic performance, and social behavior. While some families thrived in this new model, for many, the shift represented a loss of traditional family values and support structures.

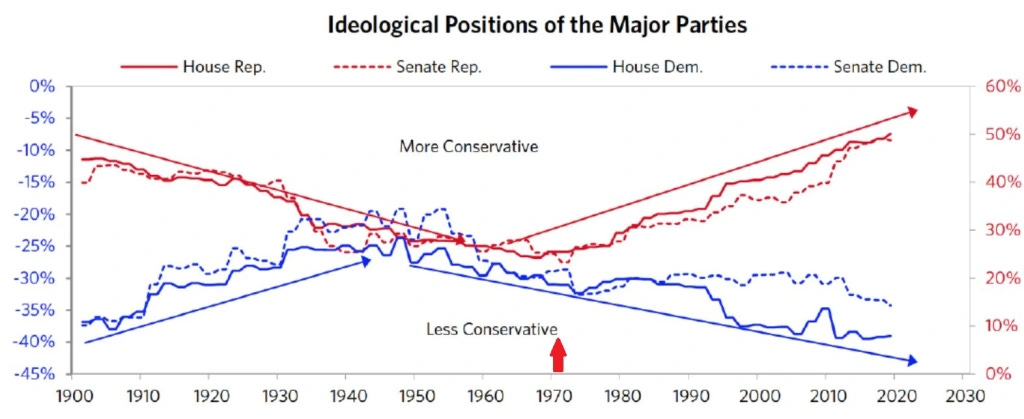

Economic Inequality, Money Printing, and the Rise of Populism

The era of fiat currency unleashed unprecedented monetary expansion. Without the discipline of a gold standard, governments and central banks could print money at will, leading to boom-bust cycles, asset bubbles, and a growing chasm between the rich and the poor.

This wealth disparity has fueled the rise of populism around the world. As the rich became richer—largely through asset appreciation and financial markets—many in the working and middle classes felt left behind. The 2008 financial crisis, and the government bailouts that followed, exacerbated these feelings of injustice, leading to a surge in populist movements on both the left and the right.

Populist leaders capitalized on the growing resentment, promising to address the economic and social grievances caused by decades of flawed monetary policies. Brexit, the election of Donald Trump, the Yellow Vest protests in France, and the rise of anti-establishment parties across Europe can all be traced, at least in part, to the economic distortions that began in 1971.

Bitcoin: A Response to Fiat’s Failures

In 2009, in the wake of the 2008 financial crisis, Bitcoin was born. Created by the pseudonymous Satoshi Nakamoto, Bitcoin was designed as a peer-to-peer electronic cash system that operates outside the control of governments and central banks. Its fixed supply cap of 21 million coins directly addresses the inflationary issues inherent in fiat systems.

Bitcoin represents a return to "hard money" principles—a modern-day digital gold. It offers a transparent, decentralized, and immutable ledger where no single entity can manipulate supply or control the network. For many Bitcoiners, it is the ultimate response to the systemic failures that began in 1971.

Where fiat currency rewards debt accumulation and short-term thinking, Bitcoin’s deflationary nature encourages saving and long-term planning. It also offers a potential escape from the wealth extraction mechanisms embedded in the current financial system, providing individuals with a form of money that cannot be devalued at the whim of policymakers.

Conclusion: Fix the Money, Fix the World?

The phrase "WTF Happened in 1971?" encapsulates a moment when the foundational rules of money changed—and with them, society followed. From wage stagnation and dietary decline to fractured family dynamics and the rise of populism, the downstream effects of abandoning hard money are evident in nearly every facet of modern life.

Bitcoin offers a radical alternative. It proposes a world where money is scarce, decentralized, and immune to political manipulation. While it's not a panacea for all the problems that began in 1971, it represents a hopeful path forward—one that prioritizes individual sovereignty, long-term stability, and economic fairness.

As the saying goes in Bitcoin circles: “Fix the money, fix the world.”

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2025.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

The world doesn’t need or want digital “gold” especially when they can actually digitize gold. 😂