Bitcoin, often hailed as digital gold, is a decentralized cryptocurrency that has fundamentally transformed the landscape of finance and monetary systems. Born out of the 2008 financial crisis, Bitcoin was introduced by an anonymous entity known as Satoshi Nakamoto in 2009. Its core principle revolves around a decentralized, peer-to-peer network that allows for secure, transparent, and immutable transactions without the need for intermediaries like banks.

Why Own Bitcoin?

Decentralization and Security: Bitcoin operates on a decentralized network of computers (nodes) that validate and record transactions on a public ledger called the blockchain. This decentralization ensures that no single entity can control or manipulate the network, providing unparalleled security and trust.

Scarcity: Bitcoin has a fixed supply cap of 21 million coins. This scarcity contrasts sharply with fiat currencies, which can be printed at will by central banks, leading to inflation and loss of purchasing power over time. Bitcoin's finite supply makes it an attractive store of value.

Global Acceptance and Liquidity: Bitcoin is increasingly being accepted by merchants, financial institutions, and even governments. Its liquidity and ease of transfer across borders make it a valuable asset in the global economy.

Hedge Against Inflation: In times of economic uncertainty and rising inflation, Bitcoin acts as a hedge. Its deflationary nature, driven by its fixed supply, makes it a reliable store of value. Here’s what Larry Fink had to say recently (he’s really quite the Bitcoin fanboy now):

The Importance of Accumulating Bitcoin Over Time

Investing in Bitcoin can be daunting due to its price volatility. However, it's crucial to focus on long-term accumulation rather than short-term gains. Here's why:

Market Volatility: Bitcoin's price can experience significant fluctuations in the short term due to various factors like market sentiment, regulatory news, and macroeconomic events. These fluctuations can deter new investors who might panic during price drops.

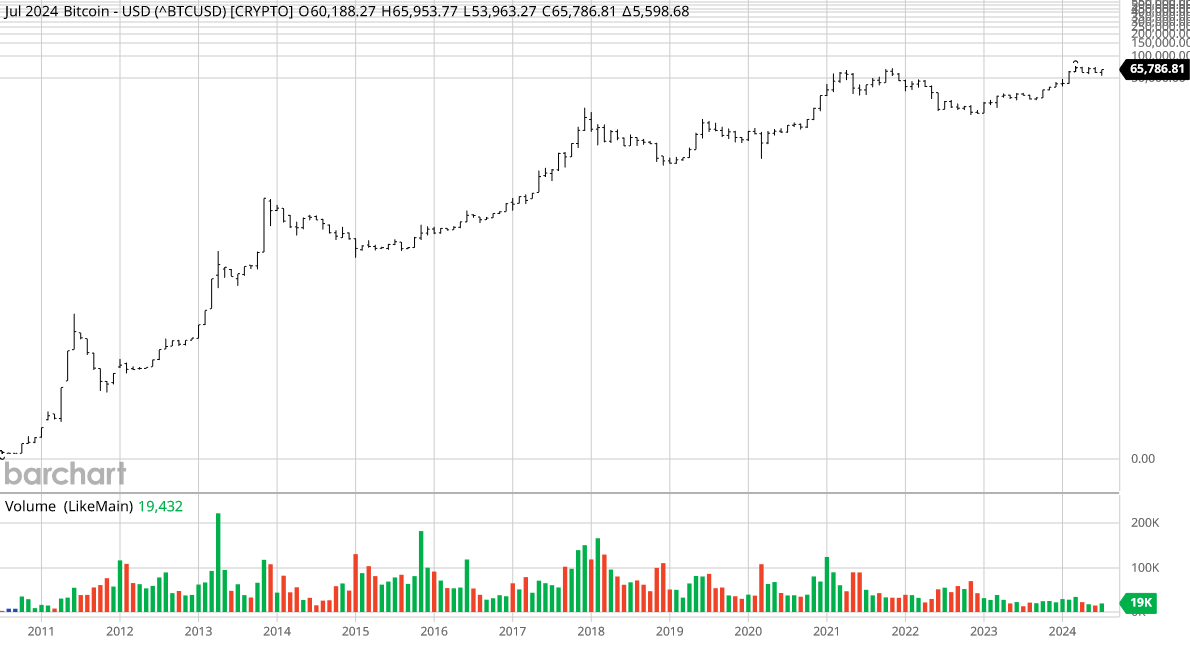

Long-Term Growth Potential: Despite short-term volatility, Bitcoin has shown remarkable long-term growth. Those who have held onto their Bitcoin for several years have often seen substantial returns.

Psychological Benefits: By slowly accumulating Bitcoin, investors can avoid the stress and emotional rollercoaster associated with trying to time the market. This methodical approach fosters a healthier investment mindset.

Dollar Cost Averaging (DCA) as a Strategy

Dollar Cost Averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset's price. This approach helps smooth out the effects of market volatility and reduces the risk of making poor investment decisions based on short-term price movements.

Example Calculation

To illustrate the effectiveness of DCA, let's consider an example where you invest $100 in Bitcoin every week for the past five years.

Total Investment Over Five Years: $100/week * 52 weeks/year * 5 years = $26,200

Total Bitcoin Accumulated: Using historical Bitcoin price data, the total Bitcoin accumulated would be approximately 1.542 BTC.

Current Value: As of July 2024, with Bitcoin's price around $57,000, the total value of your holdings would be about $87,915.

Rate of Return:

Total Investment: $26,200

Current Value: $87,915

Rate of Return: ($87,915 - $26,200) / $26,200 * 100 = ~235.55%

This example demonstrates how DCA can result in significant returns over the long term, despite the inherent volatility in Bitcoin's price. Remember, when in doubt, zoom out:

Conclusion

Owning Bitcoin is not just about potential financial gain; it's about participating in a revolutionary financial system that offers security, decentralization, and a hedge against traditional economic uncertainties. By adopting a long-term perspective and employing strategies like Dollar Cost Averaging, investors can navigate the volatility and steadily build wealth in Bitcoin. As the world continues to recognize Bitcoin's value proposition, those who patiently accumulate this digital asset are likely to reap the benefits of its transformative potential.

Bitcoin embodies the principles of financial sovereignty and sound money, making it an essential component of a diversified investment portfolio. Remember, the key to successful Bitcoin investment lies in understanding its fundamentals, embracing its long-term potential, and maintaining a disciplined accumulation strategy amidst market fluctuations.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Bitcoin Fortress Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Bitcoin Fortress Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.