Trading Volatility

Stock market volatility is measured by the VIX index, sometimes called the "fear gauge."

The Cboe Volatility Index (VIX) is a real-time index that represents the market's expectations for the relative strength of near-term price changes of the S&P 500 index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants.

The index is more commonly known by its ticker symbol and is often referred to simply as "the VIX." It was created by the Chicago Board Options Exchange (CBOE) and is maintained by Cboe Global Markets. It is an important index in the world of trading and investment because it provides a quantifiable measure of market risk and investors' sentiments.

The VIX has looked like an interesting trade recently for several reasons:

Although still elevated relative to the period prior to COVID, VIX has declined significantly since March of last year when it spiked above 65, while the stock market has continued to rally (currently at about 15) - see first chart below

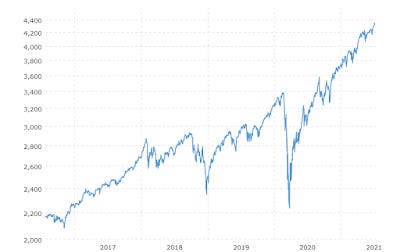

Stocks continue to reach all time highs - S&P 500 has recently started going parabolic, which is not sustainable from a technical standpoint (pullback to trendline will happen eventually - SPY closed at $433.72 on Friday; 50 day simple moving average is $420 (-3%), 100 day simple moving average is $408 (-6%) and 200 day simple moving average is $383 (-12%), which gives you some idea of the downside support levels) - see second chart below

Stock market margin exposure extremely elevated, something I have written about before as a concern if there is any sort of market sell-off, this can exacerbate the downward selling pressure - see third chart below

There are plenty of potential catalysts to derail the stock market rally, at least temporarily, including rising bond yields in response to inflation concerns as noted by Forbes

You can go long volatility by purchasing volatility ETF's - one thing is for sure, volatility will spike again, it's just a matter of time

VIX - 5 Years

S&P 500 - 5 Years

Broker Margin Accounts - 5 Years

There are several ways to invest in volatility. The largest and most popular ETF is VXX which tracks the VIX without leverage. One ETF I like is UVXY, which is designed to replicate 1.5x the performance of the VIX on a daily basis. Once you own UVXY, you can also choose to sell calls on it (as long as your strike price is at or above your cost basis so you don't lose money on your initial investment). This allows you to earn some additional cash flow and is a great way to capitalize on investor interest in gaining exposure to volatility, given the current market setup. The premiums tend to be high on this ETF due to the underlying volatility of UVXY, so a great cash flow opportunity.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.