Time to Refinance?

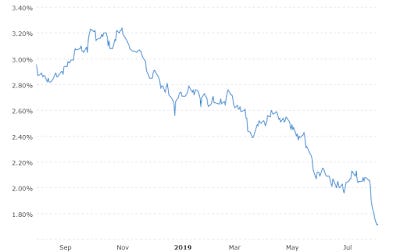

You may have noticed that interest rates on the 10-year Treasury bond, which are what most mortgage loans are tied to, have been plummeting recently to lows we have not seen in a few years and are now well below 2%. This could be a great opportunity if you own a home or have investment property that has not been refinanced for a few years. See chart below.

10 Year Treasury Rate (One Year) Courtesy of www.macrotrends.net

Now might be a good time to consider refinancing your mortgage, depending on the rate you currently have. A quick review of interest rates online at Bankrate.com shows rates on conventional loans averaging 3.88%. Chase is offering rates as low as 3.5%, while Bank of America is offering 3.625% and Wells Fargo is offering 3.75%. If you have a jumbo loan (over $484,350 conventional loan limit), rates are a little higher but still lower than they were just a few years ago.

The good news is if you refinance and don't take any cash out, even if your loan is above the new IRS deduction limits (loans over $750,000), you can still deduct interest on the full amount of the refinanced loan.

One idea is you can take the monthly savings from refinancing and rather than spending it, put that into an investing strategy. See my post on some investing ideas here.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress this year.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.