Introduction

As Bitcoin continues to gain popularity as an alternative form of investment and payment, understanding its taxation becomes increasingly important. In the United States, the Internal Revenue Service (IRS) has established specific guidelines for the taxation of Bitcoin. This post will provide a detailed examination of the current tax treatment of Bitcoin in the United States, including tax reporting requirements and implications of using Bitcoin for transactions. We will also explore the contrasting tax treatment in jurisdictions such as El Salvador and provide a global perspective on Bitcoin taxation, along with ideas for potential tax savings.

Taxation of Bitcoin in the United States

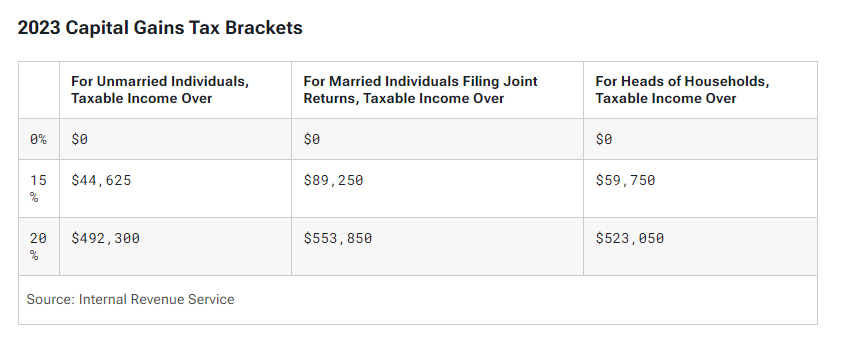

Classification as Property: In the United States, the IRS classifies Bitcoin as property rather than currency. This means that Bitcoin is subject to capital gains tax when disposed of, rather than ordinary income tax when used for transactions. Long term capital gains (held for over one year) are taxed at lower rates than short term capital gains (held for less than a year). Short term capital gains are taxed at ordinary income tax rates - the maximum ordinary income tax rate is 37% in 2023. Below is a table showing the 2023 capital gain tax rates, which vary depending on your filing status and your taxable income - the maximum capital gains tax rate is 20%.

Tax Reporting Requirements: Taxpayers who engage in cryptocurrency transactions must report these activities to the IRS. The key reporting requirement is "checking the box" on Form 1040's Schedule 1, which explicitly asks if you have received, sold, sent, exchanged, or otherwise acquired any financial interest in virtual currency during the tax year.

Tax Implications of Transactions: When Bitcoin is used to purchase goods or services, it triggers a taxable event. The taxpayer must calculate and report capital gains or losses based on the difference between the purchase price of the Bitcoin and its fair market value at the time of the transaction.

Recordkeeping: Maintaining accurate records of Bitcoin transactions is crucial for tax compliance. Best practices for recordkeeping include keeping an Excel spreadsheet detailing each transaction's date, amount, market price, and total purchase price. There are also cryptocurrency tax software tools available that can automate this process.

Tax-Saving Strategies: To minimize taxable gains, some individuals choose to buy and hold Bitcoin, only selling when necessary. Another strategy involves borrowing against Bitcoin holdings rather than selling, which avoids triggering capital gains tax.

Contrasting US Tax Treatment with El Salvador

In El Salvador, Bitcoin is considered legal tender, and tax treatment differs significantly from the United States. Here, Bitcoin transactions are not subject to capital gains tax, providing a unique advantage for citizens and businesses. While the tax implications for businesses accepting Bitcoin are still evolving, El Salvador's approach represents a stark contrast to the US stance.

Global Perspective on Bitcoin Taxation

The tax treatment of Bitcoin varies worldwide. Many countries, like the United States, tax it as property, subject to capital gains tax upon sale. Others, such as Germany, classify it as private money, subject to income tax. Some nations have more favorable tax policies, while others have taken a punitive approach, imposing high taxes on Bitcoin transactions. However, tax haven jurisdictions have no income or capital gains taxes (this would include Bitcoin). At present, there are 14 tax-free countries around the world. These include Antigua and Barbuda, St. Kitts and Nevis, the United Arab Emirates, Vanuatu, Brunei, Bahrain, the Bahamas, Bermuda, the Cayman Islands, Monaco, Kuwait, Qatar, Somalia, and Western Sahara. For more on the best and worst tax jurisdictions, this is a pretty good recent article. Also, you might be interested in this post on international diversification:

Plan "B" With Bitcoin

Last year I put together an offshore plan and was rather shocked at not only the upfront cost, but also the ongoing costs to maintain. For example, the traditional approach of setting up offshore trusts, companies and bank accounts, while providing privacy and geographic diversification, can cost thousands of dollars to maintain annually and even more …

Ideas for Tax Savings

To potentially save on taxes, individuals can explore the following strategies:

Holding Bitcoin Long-Term: Holding Bitcoin for over a year may qualify for lower long-term capital gains rates, if/when you decide to sell.

Borrowing Against Bitcoin: Using services that allow you to borrow against your Bitcoin holdings can provide liquidity without triggering taxable events.

Donating Bitcoin: Donating appreciated Bitcoin to charitable organizations can result in a deduction for the fair market value without paying capital gains tax.

Tax-Loss Harvesting: Offset gains by selling other investments at a loss to reduce overall tax liability, to the extent allowed in your jurisdiction.

Conclusion

The taxation of Bitcoin in the United States and around the world is a complex and evolving landscape. While tax treatment varies significantly from one jurisdiction to another, staying informed about changes and exploring tax-saving strategies can help individuals navigate the world of Bitcoin taxation. The best tax saving strategy is to buy and hold for the long term. Stay humble and stack sats!

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023.

Thanks for supporting my work. Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here: