The Recovery Is Here - Now What?

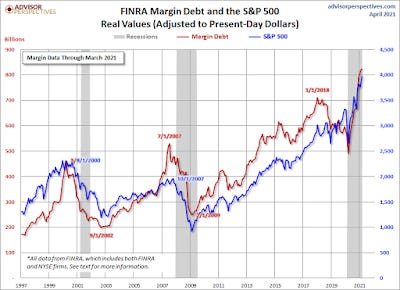

Last week showed just how great corporate earnings were, with a vast majority of the S&P 500 beating estimates significantly so far this earnings season. The "low base effect" of being for the most part completely shut down last year for most companies contributed greatly to year over year growth, but analysts still got it wrong. The stock market reaction in many cases was muted and many companies who otherwise reported excellent results and outlook sold off. This will no doubt create some near term buying opportunities for great companies including Microsoft and Apple. At the same time, the bond market sell off abated somewhat and rates stabilized (for example 10 year most recently at around 1.625%). Could the markets be telling us that while we will see stellar near term growth and higher than normal inflation, the outlook for future growth - 2023 and beyond is anemic, possibly deflationary? Will we see continued strong growth for years to come with higher than normal inflation? Or will we see weak or no growth and inflation (stagflation)? The first scenario seems like the market signal, versus the other two. With the stock market continuing to make all time highs, one concern weighing on investors' minds is the large amount of margin debt that has been taken on (an all time high), as shown in the chart below:

Growing margin debt is a significant area of concern because a sharp stock market sell-off could quickly cascade into a major downturn as a result of all this leverage, as brokerages issue margin calls, curtail margin lending and investors are forced to sell their stocks. Ultra-low interest rates, strong stock market performance and very few other options for investors have all fed this borrowing binge. Indeed, we have seen that recently in the Bitcoin options markets, with leveraged traders both long and short getting crushed at various times as the Bitcoin price rallied and fell, and as long term unlevered investors sat calmly on the sidelines HODLing. Typically, the stock market peak has lagged the peak in margin debt by a few months. The real question is when will we see the peak in margin debt and how long after that before the market peaks and goes into the next correction cycle? A second and more important question is how bad will the correction be? I have seen some investors such as Jim Rickards project as much as an 80% correction. I sure hope he's wrong about that!

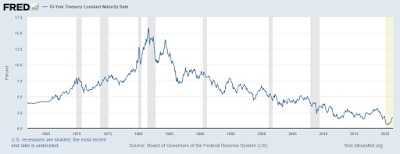

The 10 year treasury yield is sending its own signal about rising inflation expectations, after having bottomed at 0.55% last year in July, then rising to 1.65% at the end of April:

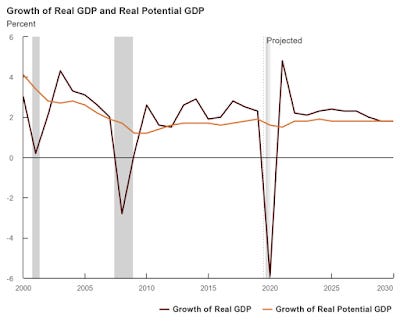

While this is a significant short term increase of 110 bps in a period of 9 months, it's not particularly rapid in historical context and we are still very close to all time lows for this important benchmark rate. For example, in July 1979 the rate was 9.01% and by April 1980 it had risen to 10.76%, a 175 bps increase in 9 months. We know in hindsight that period coincided with serious and pervasive inflation, which is why the rates were so much higher and now we are starting from a much lower level, having been through a period of very modest inflation. If the bond market is processing all available information correctly, it is not seeing economic growth (the main driver of long term inflation) continuing at the current pace for very long and indeed, falling to perhaps lower than pre-pandemic levels. Indeed, the CBO projection shows GDP trending back to about 2% over the next several years, as shown in the chart below. The Conference Board projects 6% GDP growth in 2021 and 3.5% GDP growth in 2022 after posting -3.5% in 2020. The huge amount of fiscal and monetary stimulus that was deployed last year and earlier this year (and more to come) is clearly driving the economic recovery. All of this designed to "prime the pump." But what happens when the stimulus effects burn off? Will the pump run on its own? Will we return to 2% growth or will it be even lower?

After thinking this through, while there is definitely a short term threat of inflation, longer term it's not totally clear to me that we don't face an equivalent risk of deflation as stimulus wears off, supply chains normalize and technological innovation continues to increase efficiency and puts pressure on the labor market (both in terms of overall demand and also labor rates). One of the long term consequences of the COVID-19 pandemic is the acceleration of corporate investments in technology to streamline process and leverage artificial intelligence and automation, which ultimately results in substitution of technology for labor. As such, many jobs cut during the pandemic recession just won't be coming back. If high unemployment is persistent, that will be a significant drag on economic growth. At the same time, new jobs are forming rapidly as technology innovates, but there will be fewer of those and they will require different education and skills. Either way, the Fed will have no choice but to keep short term rates low until labor markets recover and this could take quite some time. This means cash will continue to offer no return and thus forcing investors into stocks, commodities, bonds and other assets.

How does all this uncertainty translate into an investing strategy? As Ray Dalio has said, probably the best way for an individual investor to approach this environment is to be broadly diversified across many asset categories. For the average investor, it's very difficult to trade in and out of positions and try to "front run" the market, which can shift daily if not by the hour. This philosophy fits well with my concept of a Financial Fortress, which builds on a solid foundation of liquidity and focuses on broad asset class diversification.

Over the past year or so, my view of the liquidity foundation of the Financial Fortress has changed in that cash no longer provides any return and is unlikely to for the foreseeable future. I used to have a lot of my cash in US Treasury Bills, which I shifted to other assets recently. This turned out to be a good move since last week the US Treasury sold 4 week bills for zero yield for the first time ever. As such, after keeping enough cash on hand for short term needs, the rest of the cash is now invested in short term Treasury Inflation Protected Securities (31%), gold (15%) silver (16%), Bitcoin (32%) and a mix of large cap cryptocurrencies (6%). In the long run, it's my belief that these investments represent "sound money" and will outperform cash held in a bank account significantly. Whether inflation is a modest 2% or much higher, these investments should perform well over the longer term. In particular, I think gold and silver are relatively undervalued right now based on everything going on with fiscal and monetary stimulus. Bitcoin while extremely volatile still has a long way to go on its adoption path, is immutably sound money and has already demonstrated an incredibly asymmetrical investment opportunity over the past 10 years. I think other cryptocurrencies such as Etherium and some of the other "alt coins" also warrant consideration as well due to their utility in the rapidly growing NFT and Decentralized Finance spaces. Indeed, Coinbase will soon offer staking of Etherium with a 6% yield, which doesn't require you to hand over your coins to a third party and you can still achieve an attractive alternative to bank yields (of course you still have the risk of holding the cryptocurrency but if you are not leveraged, have a long term hold strategy and can stomach short term price fluctuations it shouldn't be an issue). DeFi could seriously challenge traditional banking in the coming years.

I have also reconsidered my "zero bonds" thesis and now think it makes sense to at least have some allocation to actively managed bond funds as a hedge against longer term deflation risks. I'll have a complete update on my portfolio allocation in the next week or two that will reflect that change as well as other fine-tuning to broaden and improve overall portfolio diversification.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.