The Real Value of Hard Assets

united states currency eye- IMG_7364_web (Photo credit: kevindean)

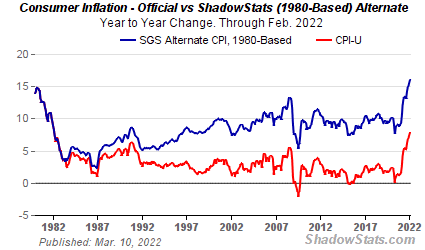

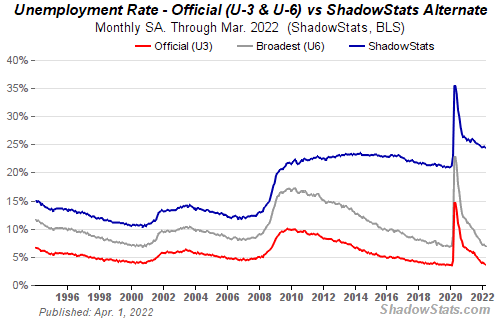

I advocate investing in hard assets (gold, silver, real estate, oil/gas, etc.). You only have to look at the grocery store or the gas station to see why. Inflation is clearly happening all around us, yet the official government statistics don't show it. Did you ever wonder why the Consumer Price Index or CPI doesn't track with your experience? For one thing, CPI excludes food and energy costs - officially because these items are volatile and can skew the index, but these are the very things that people buy every day. Beyond that, does the official measure of unemployment track with what you know is happening in your community to people you know, friends and family? The real rate of unemployment in this country is most likely north of 20% versus the official measure of just under 10%. The charts below depict intriguing alternative measures of annual consumer inflation and unemployment for your consideration. It's interesting to note the divergence in the alternative measure versus the official measure over time.

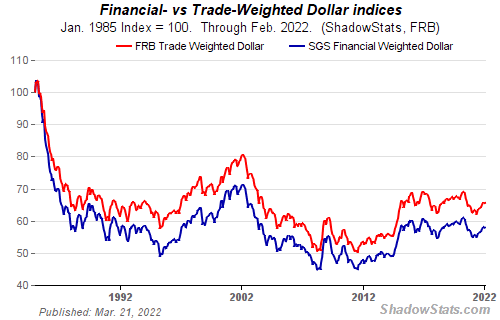

Another investment theme, which is linked to inflation concerns, is the continued deterioration in the value of the dollar. With the government printing more dollars every day (so-called quantitative easing), the decline in the value of the dollar has accelerated - this worsens inflation and diminishes the purchasing power of dollar denominated assets (like your savings account). The chart below shows the long-term decline in the value of the dollar and suggests that official reports understate the true decline in the dollar index. Indeed, some are concerned that we may experience hyperinflation in the United States before too long. If you are interested in this subject, I highly recommend two books I have read recently that help explain what is happening and how to protect yourself as an investor:

Ironically, in an inflationary environment with a declining dollar, the best position is to be a long-term borrower and investor in hard assets. Real estate works best, since you can still get a 30-year fixed loan for 4% to 5% (on investment property) today, which will be repaid in devalued dollars, while the value of the property appreciates due to inflation. Most people claim they do not want to be in debt at all, but that misses the point that there is both "good debt" and "bad debt." I define "bad debt" as loans to buy things you consume - even your primary residence, because these things do not earn a return on your investment. "Good debt" would include a mortgage on an investment property, assuming the property provides you with positive cash flow each month.