Introduction

Bitcoin mining is a critical process in the operation and security of the Bitcoin network, serving as the backbone of its decentralized ledger, the blockchain. It is a complex and competitive industry that has evolved significantly since the inception of Bitcoin in 2009. This post will delve into the world of Bitcoin mining, exploring its purpose, hardware, software, geographic locations, history, profitability, and its unique relationship with energy sources. We will also focus on Bitcoin’s potential for abundant energy utilization and its role in enhancing grid stability and stranded energy monetization.

Purpose of Bitcoin Mining

At its core, Bitcoin mining is the process by which new bitcoins are created and transactions are confirmed on the blockchain. Miners validate transactions by solving complex mathematical puzzles using computational power. This process, known as Proof of Work (PoW), not only ensures the security and immutability of the Bitcoin blockchain but also incentivizes miners to participate by rewarding them with newly minted bitcoins and transaction fees. The amount of global mining power supporting the network is called “hashrate” and that number has been growing quickly:

Mining vs. Running a Bitcoin Node

It's essential to differentiate between mining and running a Bitcoin node. While miners validate transactions and secure the network, nodes play a vital role in distributing and verifying the timechain's entire history. Running a node helps users verify their own transactions and participate in the Bitcoin network's decentralized nature, but it doesn't involve the resource-intensive computational work of mining. It’s also pretty easy to do and every serious Bitcoiner should run their own node. If I can setup a node on an old computer at home, anyone can do it! Just download Bitcoin Core to an old computer - it will take a while even on a fast connection, so be patient!

Mining Hardware

Bitcoin mining hardware has evolved from CPUs and GPUs to specialized Application-Specific Integrated Circuits (ASICs). These ASICs are designed solely for mining purposes, offering vastly superior computational power and energy efficiency. The mining hardware arms race has resulted in highly efficient and powerful machines, driving miners to constantly upgrade their equipment to remain competitive.

Mining Software

Mining software manages the connection between mining hardware and the Bitcoin network. It includes components like the mining pool software, which allows miners to work together and share rewards, and the software that communicates with the Bitcoin protocol to solve PoW puzzles and validate transactions.

Geographic Locations of Miners

Bitcoin mining operations are dispersed worldwide, but certain regions have become prominent due to factors such as low energy costs, a favorable regulatory environment, and access to advanced technology. Historically, China was a significant player in the mining industry, but a crackdown on mining activities led to a mass migration of miners to other jurisdictions, further decentralizing the network, although China still has about 21% of the global hash power. The United States hosts a large number of miners (about 38% of global hash power), spread across many states as shown below:

Mining History and Recent Developments

Bitcoin mining has a rich history marked by significant technological advancements and regulatory changes. The mining ban in China highlighted the importance of geographic diversification in the mining industry. Additionally, the emergence of large public company miners has brought institutional interest and capital into the space, further legitimizing Bitcoin mining as a business.

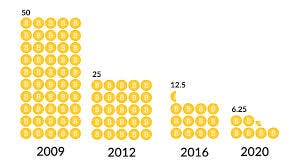

Block Rewards and Transaction Fees

Miners earn two main types of rewards: block rewards and transaction fees. Block rewards, which halve roughly every four years during the "halving" events, provide miners with newly minted bitcoins. See graphic below. The next “halving” is expected in early April 2024, at which time the block reward will decrease to 3.125 Bitcoins.

Transaction fees, on the other hand, are paid by users to prioritize their transactions on the blockchain and have become an increasingly important revenue source for miners as the block reward diminishes over time.

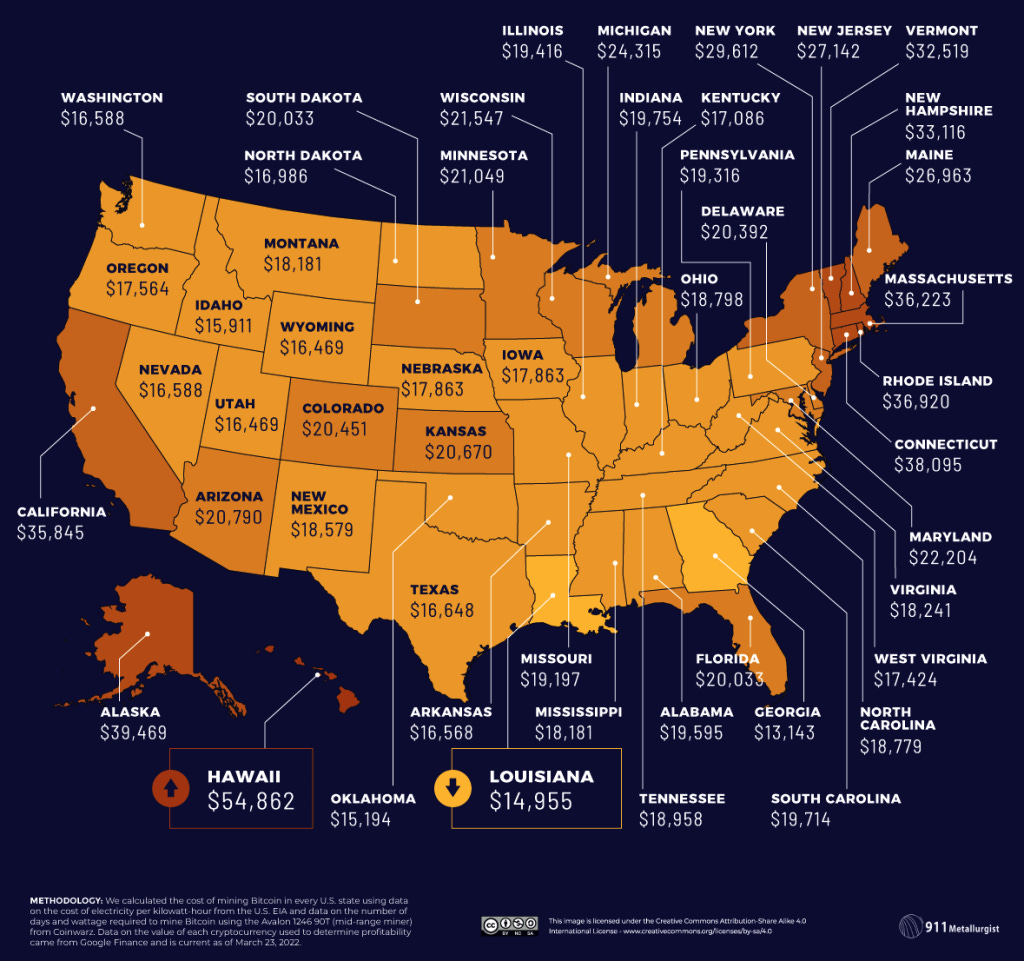

Mining Operating Costs and Profitability

Mining profitability depends on several factors, including energy costs, hardware efficiency, Bitcoin's price, and network difficulty. Mining can be highly profitable during bull markets when Bitcoin's price is surging, but it can also be challenging during bear markets or periods of high competition. Location is very important (where the cost of energy is lowest), as you can see in the chart below. The most expensive state to mine Bitcoin is Hawaii with a cost per coin of $54,862 while Louisiana is the cheapest with a cost per coin of $14,955. Currently, Bitcoin is trading at $26,576 per coin, so at the moment the best margin is 44% and, well, it just doesn’t make any sense to mine coins in Hawaii.

Using Low-Cost Energy Sources

Bitcoin mining's relationship with energy is multifaceted. While energy consumption is a common point of criticism, it’s mostly FUD (Fear, Uncertainty, Doubt) and Bitcoin mining should be thought of as an excellent and important use of energy.

Indeed, what’s more important than securing the best money we have ever known? Instead of complaining about energy usage, virtue signaling and focusing on unreliable and very expensive (government subsidized) renewable energy sources like solar and wind, we should be looking to expand all energy production used in Bitcoin mining across the spectrum. This can and should include reliable baseload sources of energy that don’t stop working when the wind doesn’t blow or when the sun sets, such as coal, gas, hydro and nuclear. Also using excess or stranded energy, such as flared natural gas as a source of power for Bitcoin mining, not only reduces environmental waste, but also enhances mining profitability and offers a great complement to oil and gas production as another way to solve a problem they have (flared gas) while developing a new revenue stream.

Bitcoin Mining and Grid Stability

Bitcoin mining can provide grid stability benefits by acting as a flexible demand customer for utility grids. Miners can ramp up operations during periods of excess energy production and shut down during peak demand, helping to balance the grid and prevent energy waste. This is a very important function that Bitcoin miners can provide to help sustain and grow grid systems and benefits households when there is high demand (so you can still do your laundry and cool / heat your home).

The Future of Bitcoin Mining

Looking ahead, the Bitcoin mining industry is poised for continued growth and innovation. The advent of small modular nuclear reactors (SMRs) holds promise for providing reliable, low-cost baseload energy to miners. Bitcoin's financial feasibility may expedite the development and adoption of SMRs. Additionally, the merging of energy production, utilities, and Bitcoin mining is a trend worth watching, as it can lead to more sustainable and efficient energy utilization. AI also promises to improve the efficiency of Bitcoin mining in the future as discussed here.

Conclusion

Bitcoin mining is a dynamic and essential component of the Bitcoin ecosystem. From its early days to the present, mining has evolved significantly, with miners continuously adapting to new technologies and changing regulatory landscapes. It's crucial to focus on the potential for abundant and sustainable energy use, the role of mining in enhancing grid stability, and the monetization of stranded energy sources. In the future, innovations like SMRs and the integration of energy production and mining may reshape the industry, further solidifying Bitcoin's position as digital gold.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated:

Really enjoyed reading your post!!