I thought this week I would dive into what the current global reserve currency situation looks like and how Bitcoin could fit into that in the future, understanding that as George Gammon likes to say, there are no certainties, only probabilities.

Below is a table showing the relative dominance of world reserve currencies since 1900. As you can see, the Pound Sterling was dominant in 1900 (indeed, more dominant than the Dollar is today) and has slowly declined over time, while the Dollar has become the world reserve currency today, with the only real competition being the Euro (see chart below courtesy of Visual Capitalist).

The infrastructure underneath the current global reserve currency (dollar based) system includes many forms of dollar-based instruments including cash in bank accounts, money market funds, US Treasury bills, US Treasury notes, US Treasury bonds, US real estate and also stocks of US companies. Because of its massive network effect, the dollar demand for settling international payments is very large / global and therefore the demand for dollars and dollar based investments is deep. In past posts, I have talked about the massive and growing amount of global sovereign debt and how that is a ticking time bomb for fiat currencies, since there is no way out besides inflating the currency or defaulting on the debt.

This is why Brent Johnson (Santiago Capital) developed the Dollar Milkshake Theory - see tweet below - which says that in the long run, all other currencies will collapse into the dollar as the dollar continues to strengthen and the dollar will be the last currency to collapse before being replaced by one (or more) new global reserve(s). Brent has been very clear that the ultimate result is a collapse of the dollar but the timeline could be very long and of course, he favors holding gold as a hedge against that ultimate outcome. While I agree gold is good, I also think Bitcoin is an important hedge and better in many ways than gold.

The dollar strengthening will not be a straight line and there will be lots of volatility along the way. Here’s a chart of the DXY to get an idea of that:

As you can see over the past five years, although there have been periods of weakness, the dollar (as expressed by the DXY index) has strengthened relative to other currencies significantly. The strong dollar has been a problem for investors, since with higher interest rates (which have helped drive the dollar higher) there is less of an incentive to invest in risky assets. Why would you earn 4% in real estate or stocks paying 2% or 3% dividends with further bear market downside risk when you can earn the same amount on a 3-month Treasury Bill with no risk of getting your principal back? Also, the strong dollar has suppressed the price of gold, silver and I think to some extent Bitcoin (although Bitcoin has suffered mostly from events occurring in the crypto industry as exchanges and lenders collapse and leverage unwinds as I have discussed extensively in my podcast recently). As the Fed has hinted they will slow down the rate at which they are hiking interest rates starting in December, the dollar weakened and this has caused a rally in risk assets, gold, silver and even Bitcoin. This up and down and sideways volatility seems likely to continue for some time until there is a meaningful change in Fed policy, which won’t likely happen until late next year, presumably in reaction to real data about a recession (which means elevated unemployment).

Looking ahead to the future, what are some possibilities for how Bitcoin fits into the future global financial system as the Dollar Milkshake Theory continues to play out?

Store Of Value

For most of the folks in the Bitcoin community, this is a done deal and they are able to look past the short-term volatility of Bitcoin price action and see that over time Bitcoin demand, driven by network effect, and its absolute scarcity of supply (helped by global monetary debasement aka money printing trend) has driven the price of Bitcoin higher in fiat currency terms. For many people, however, Bitcoin is not viewed as a store of value, but more of a speculation akin to a technology stock and indeed the price action over time has tended to mirror the Nasdaq index performance. This will have to change in order for Bitcoin to be widely accepted as a store of value, similar to gold. In my opinion, Bitcoin should be able to clear this hurdle in the next few years.

Unit of Account

The next level is unit of account, or pricing in terms of Bitcoin. We are further off from this in my opinion since everything we buy today is denominated in fiat currency terms. As fiat currencies collapse, however, more things will be denominated in the remaining currencies (eventually only the dollar) but I do think also there will be more goods priced in Bitcoin (sats) but that will move much more slowly until / if Global Reserve Currency status is achieved.

Medium of Exchange

The final level of evolution as a money is medium of exchange. We are actually further along in this area than unit of account, mostly due to the development of the Lightning Network. The Lightning Network allows you to pay in fiat currency terms (dollar to dollar, dollar to euro, or your choice) using the Bitcoin network and final settlement as the payment rail. This has tremendous potential for accelerating Bitcoin adoption as the Lightning Network technology matures and gets built out further, since payments on Lightning are very low cost, fast and have enhanced privacy versus on chain transactions.

Global Reserve Currency

One scenario espoused by Bitcoin Maximalists is that Bitcoin will become the global reserve currency. In order for this to happen, Bitcoin will have to have more of its second and probably third layer of the network built out for that to happen. This is to basically ensure that we have a robust system equal to or better than the dollar-based system to handle the volume, trading/payment, borrowing/lending and investment needs of the entire global community. Most importantly, network adoption has to continue strongly and this is critical. One of the challenges that Bitcoin will face is that governments really like to be in control of their own currency, so they will do everything to keep that privilege. Even if their currency collapses totally, they will just come up with a “new” version and will start over until that one collapses again and this cycle continues. Capital controls will keep citizens’ money from fleeing to other stronger currencies. Gold / silver or even Bitcoin ownership could be outlawed (good luck in enforcing physical holders though). This is what history teaches us. Most people will go along with that unless they understand that they can protect themselves by owning Bitcoin (store of value) and they an also use it as a medium of exchange if they need to buy things and their currency is worthless. This is a bit harder for people holding physical gold or silver, unless you are transacting in person with coins of the correct denomination for goods and services.

One other criticism of Bitcoin is that with a fixed supply there isn’t the ability to add liquidity (monetary units) to expand credit and lending over time to generate economic growth. One argument is that because Bitcoin is so valuable, individuals or companies will only lend it out to carefully vetted opportunities and will demand an appropriate return on that capital which would in theory reduce the amount of malinvestment we see in the fiat boom cycle that ultimately washes out when the bust comes. The other side of that argument is it will stymie growth, which is a reasonable assertion and economic growth is essential for human prosperity.

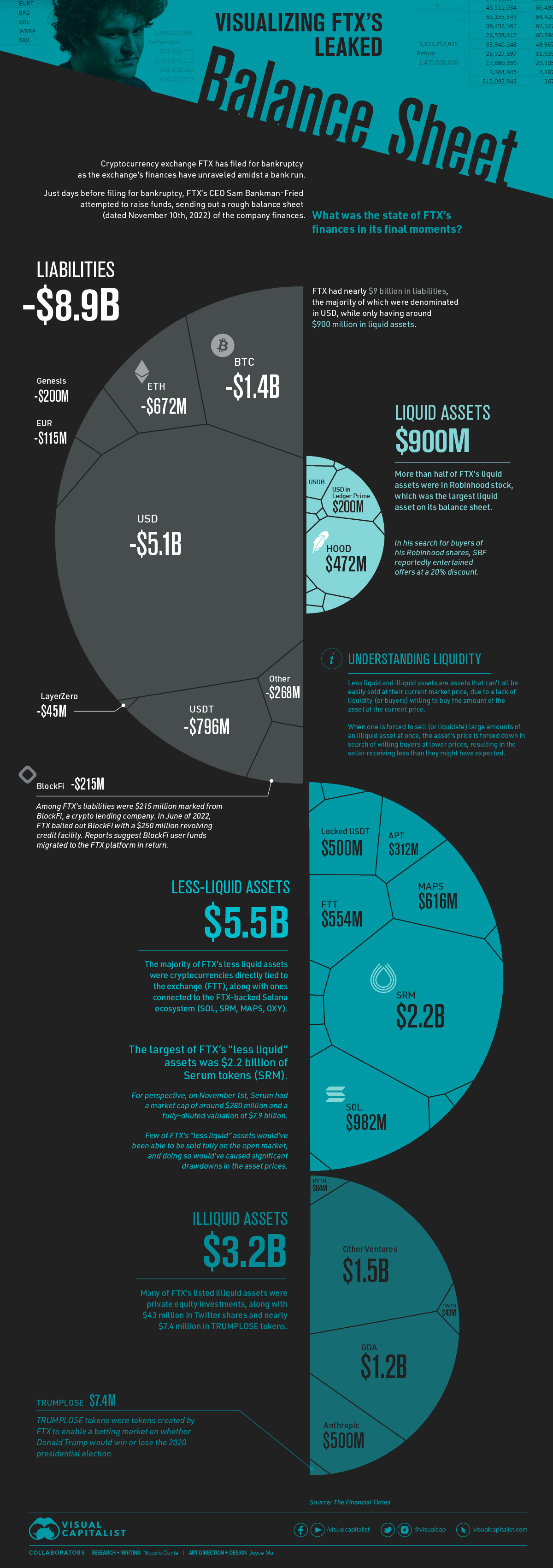

The other problem is more of one of human nature, which I have struggled to wrap my head around lately especially looking at how things actually are in the world. On the one hand, when you interact with Bitcoin you do tend to change how you view things in the world and many of the early adopters are like minded individuals that prefer to align themselves with hard work, truth, transparency, sound money and generally libertarian ideals. The question is, can Bitcoin change human behavior such that the human desires such as greed, control and corruption melt away? I want to believe that’s possible, but unfortunately millenia of human history point to the same outcome. Paper Bitcoin can and will be created (even if it is the base of the monetary system) and that will allow for borrowing / rehypothecation for speculation or investing in bad deals. All you have to do is look at the balance sheet for Alameda Research on which they had $1.9 Billion of Bitcoin liabilities and no actual Bitcoin (courtesy of Visual Capitalist):

The scale of the FTX debacle, which has eclipsed Enron is stunning and yet, human nature being what it is, seems likely to happen again in the future (of course on a bigger more unprecedented scale). This will be regardless of whatever laws are passed and regulatory changes are made in the wake of the FTX collapse. When the dust settles on this, it’s my unfortunate conclusion that you can’t change human nature and you will continue to see money drawn into the “crypto” space. The main reasons are speculation (casino like returns) for individuals and hedge funds, yield and perhaps most importantly, payment alternatives. Even if Bitcoin was mandatory for payment settlement, ultimately the market decides what is or will be used. If the market prefers Tether (despite the risks that it may not be fully backed), or other stable coins or even Etherium / other alt coins as a means of payment, nothing is going to stop that unless Bitcoin Lighting is a lot better, probably 10x better. I think it could be, but only time will tell.

As such, I think the most likely scenario unfolding over the next few years is as follows:

Bitcoin’s store of value use case will continue to expand as it’s likely to become more apparent to more people (digital gold thesis) as network effects grow and the average investor is able to tolerate the volatility, volatility declines with adoption and investors can develop buy and hold (hodl) discipline; Bitcoin’s portability and the ability to have money stored “outside the system” is a huge feature

Bitcoin’s medium of exchange use case will expand rapidly as Lightning Network is developed and this will facilitate commerce independent of unit of account, securely, at a low cost and while preserving privacy; there will be competition in the form of stablecoins, altcoins and even central bank currencies, but ultimately the market will decide what works best for moving payments around - I think this is the most exciting area right now and will be watching this carefully

Bitcoin’s unit of account use case will be slow but will gain adoption initially in the Bitcoin community as an ecosystem of goods and services is built around pricing in sats; obviously it will happen quickly if Global Reserve Currency status is achieved

Global Reserve Currency seems low probability where we sit here today, but Bitcoin certainly has as good a chance as gold in a post-fiat collapse, sound money environment as a monetary base; there’s certainly the potential to have multiple reserve currencies in the future and also multiple ways to back those currencies with “hard assets” such as commodities including Bitcoin, gold, silver, oil etc.

The harder governments try to regulate money in the digital age (like with central bank digital currencies, which are a horrible idea), the more exits will be created and Bitcoin is by far the best in terms of the alternatives, but there will be alternatives; thousands of years of human history says so

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.