The Fragility of Bitcoin: Potential Challenges and Resilience

There are no certainties, only probabilities...

Introduction

Bitcoin has gained widespread attention and adoption since its inception in 2009. However, its success and longevity are not immune to potential pitfalls and Bitcoin’s success is not inevitable. This post explores a few ways in which Bitcoin could face challenges in the future. Despite these challenges, there is reason to believe Bitcoin’s resilience shown to date will allow it to continue to push ahead into the future.

Regulatory Threats: One significant risk to Bitcoin is the ever-evolving landscape of global regulation. Governments may choose to clamp down on cryptocurrency exchanges or implement stringent regulations, hindering the ease of use and adoption of Bitcoin.

Counterpoint: Bitcoin's decentralized nature is a tremendous strength, because there is no centralized point of control that can be attacked. However, the protocol’s design opens it up to state attack as a competitor to fiat currency. Operating without a central authority, Bitcoin is resistant to censorship and in many ways it’s unstoppable. However, governments see this and are working hard to find ways to regulate or otherwise co-opt Bitcoin and bring it under their control, which is extremely difficult to do. Just look at Bitcoin adoption and use despite being banned many times in China, arguably the most authoritarian state in the world. Indeed, Bitcoin’s use thrives under authoritarian regimes, which often also feature high rates of inflation / fiat currency debasement - the exact use case for Bitcoin. And yet public figures like Elizabeth Warren and Jamie Dimon, continue to attack Bitcoin - clearly because they see the threat it poses. The government believes it can control Bitcoin through regulation and the highly anticipated Bitcoin ETF’s. Ironically, this should attract institutional investors, which should also drive the price higher, fostering mainstream awareness / adoption. The challenge will be to ensure people are properly educated about Bitcoin and have the tools and desire to self-custody their coins the way the protocol was designed. This will be an ongoing battle.

Technological Vulnerabilities: The cryptographic algorithms underpinning Bitcoin may face threats from technological advancements or unforeseen vulnerabilities. Quantum computing, for instance, could potentially compromise the security of Bitcoin's encryption.

Counterpoint: The Bitcoin community is known for its adaptability. In the face of emerging threats, developers can implement upgrades and improvements. Research into quantum-resistant cryptography is ongoing, suggesting that the protocol can evolve over time to withstand future technological challenges as it has in the past.

Market Volatility: Bitcoin's notorious price volatility has led some to question its viability as a stable store of value or means of exchange. Sharp price fluctuations can undermine confidence and discourage widespread adoption.

Counterpoint: Volatility has diminished over time as Bitcoin's market capitalization has increased and it clearly continues to outperform every other asset class.

Institutional involvement and the maturation of the market may lead to greater stability. Furthermore, as Bitcoin's adoption grows, its price may become less susceptible to market manipulations. Another way to look at volatility is that this is normal price discovery for a new and revolutionary digital sound money.

Scalability Issues: Bitcoin's scalability has been a subject of debate, with concerns about its ability to handle a growing user base. Network congestion and high transaction fees could hinder Bitcoin's functionality as a peer-to-peer electronic cash system.

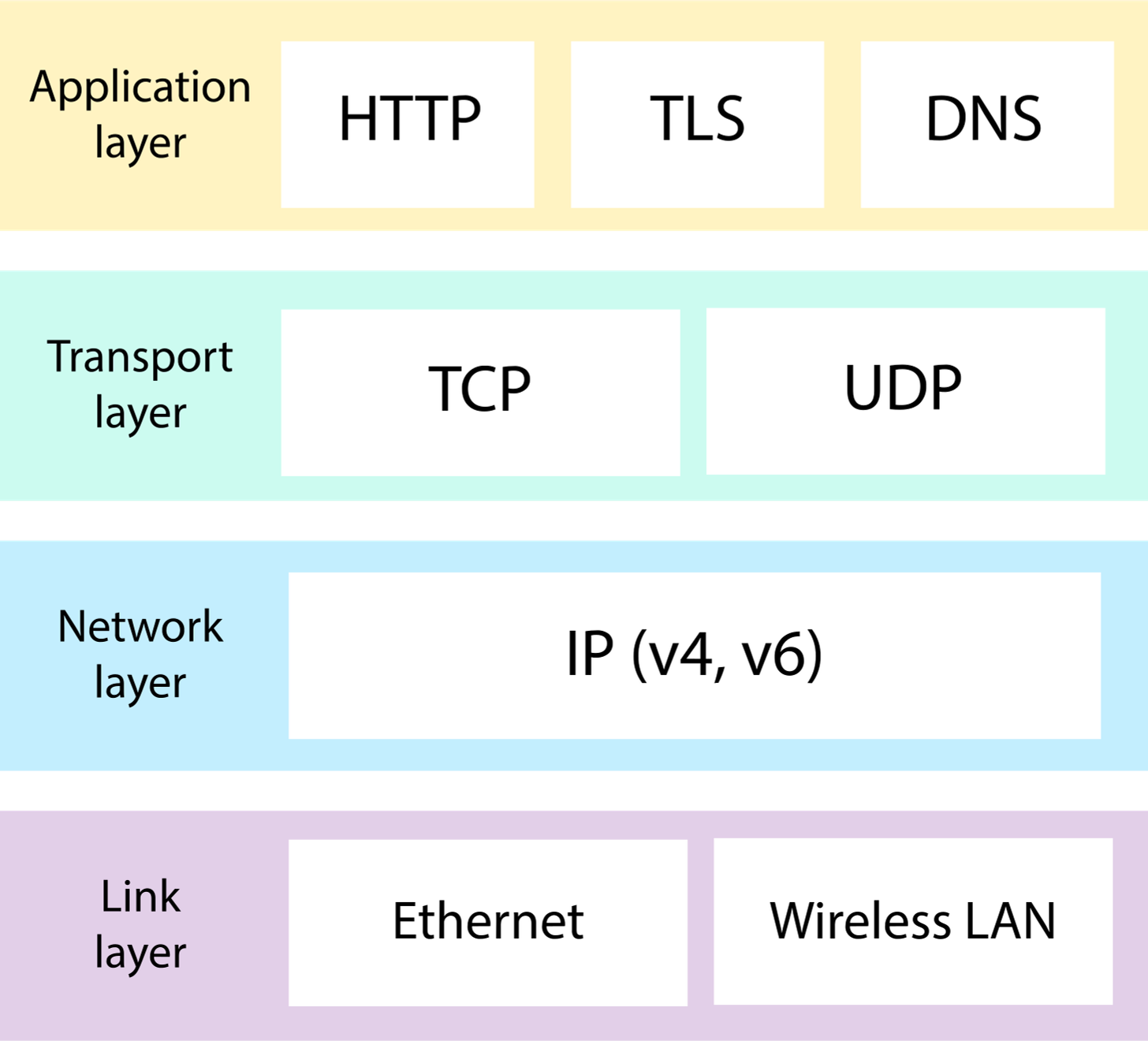

Counterpoint: Ongoing development efforts, such as the implementation of the Lightning Network, aim to address scalability issues by enabling faster, cheaper and more private off-chain transactions. The decentralized nature of Bitcoin development allows for continuous improvement and adaptation, building layers on top of the base Bitcoin layer, much like the internet was developed over time:

Conclusion

While Bitcoin faces potential challenges, it is essential to recognize its adaptability and the resilient nature of its underlying technology, which has proven itself so far over the past 14 years. The decentralized ethos of Bitcoin allows it to weather storms and evolve in response to emerging threats. It is crucial to challenge convictions, explore potential pitfalls, and consider the resilience of Bitcoin in navigating and overcoming these challenges. By doing so, one can develop a more nuanced and informed perspective on the future of this groundbreaking digital currency.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

No matter how fragile or strong Bitcoin can be the force is only with WeThePeople.

Govts are trying to fight it as much as they can to continue with the fiat currency scam and with CBDCs tyranny but there are a number of ways to fight back and resist, like:

MERCHANTS DO NOT ACCEPT THEM

CONSUMERS DO NOT ADOPT THEM