The Fall of the Roman Empire: Lessons for the Decline of the United States and the Role of Bitcoin

Introduction

The fall of the Roman Empire stands as one of the most significant and debated events in human history. Edward Gibbon's magnum opus, "The History of the Decline and Fall of the Roman Empire," offers a profound analysis of the causes and effects of Rome's decline. The Roman Empire, which once stood as a symbol of power, civilization, and grandeur, eventually crumbled under its own weight. This post explores the final years of the Roman Empire, the time it took to collapse, the lingering belief in its existence, and the primary factors leading to its demise. Drawing parallels with the current political and economic situation of the United States, we will examine how Bitcoin may offer an escape from the government's currency devaluation during a period of decline.

The Final Years of the Roman Empire

The decline of the Roman Empire was a gradual process that unfolded over several centuries. Historians often cite the year 476 CE, when the Germanic chieftain Odoacer deposed the last Roman emperor, Romulus Augustulus, as the symbolic end of the Western Roman Empire. However, this was merely the culmination of a prolonged period of decay that began with the Crisis of the Third Century in the mid-3rd century CE.

Edward Gibbon's work emphasizes the erosion of Roman military power, economic instability, and the rise of corrupt leadership as key elements in the decline of the Roman Empire. Gibbon notes, "The decline of Rome was the natural and inevitable effect of immoderate greatness" — a sentiment that reflects the overextension of resources and territories that eventually weakened Rome.

The Length of Time it Took to Collapse

The fall of the Roman Empire was not a sudden event but rather a protracted process that spanned several centuries. Gibbon's extensive work covers over 1,000 years of Roman history. He observed that "the decline of Rome was the decline of a city," signifying a slow and gradual deterioration. The Roman Empire's disintegration occurred over approximately four centuries, from the Crisis of the Third Century to the final fall of the Western Roman Empire in 476 CE.

Lingering Belief in the Empire

One fascinating aspect of the Roman Empire's decline is that many people continued to believe in its existence long after its final collapse. The Eastern Roman Empire, or Byzantine Empire, persisted until the fall of Constantinople in 1453 CE, and even then, it carried on in the form of cultural and political influence.

Gibbon's writing highlights how the memory and cultural legacy of Rome continued to impact the world long after its political structure had disintegrated. He stated, "The legacy of the Roman Empire persisted in the form of law, language, and culture."

Main Causes of the Roman Empire's Collapse

Several key factors contributed to the fall of the Roman Empire, as analyzed by Gibbon and other historians:

Economic Decline: The constant devaluation of the Roman currency through "clipping coins" led to rampant inflation. Gibbon notes, "The decline of the empire was accelerated by the increasing devaluation of Roman currency."

Military Weakness: The Roman Empire's vast borders became increasingly difficult to defend, leading to military and territorial losses. Gibbon observed that "the Romans learned to hire barbarian mercenaries to defend against other barbarians."

Political Corruption: Corruption and ineffective leadership within the Roman government weakened its ability to manage the empire effectively. Gibbon pointed out, "The luxury of one generation became the patrimony of the next."

Comparing Rome to the United States

Drawing parallels between the fall of Rome and the current situation of the United States is a complex and contentious endeavor. However, some similarities exist.

While we see “good news” that the economy is “strong” (i.e., except for recessions real gross domestic product is positive), the poor and middle class increasingly participate less and less in this prosperity. This was outlined in a 2019 report by the OECD:

A strong and prosperous middle class is crucial for any successful economy and cohesive society. The middle class sustains consumption, it drives much of the investment in education, health and housing and it plays a key role in supporting social protection systems through its tax contributions. Societies with a strong middle class have lower crime rates, they enjoy higher levels of trust and life satisfaction, as well as greater political stability and good governance.

However, current findings reveal that the top 10% in the income distribution holds almost half of the total wealth, while the bottom 40% accounts for only 3%. The OECD has also documented that economic insecurity concerns a large group of the population: more than one in three people are economically vulnerable, meaning they lack the liquid financial assets needed to maintain a living standard at the poverty level for at least three months.

We have also found that children born to parents who did not complete secondary school have only a 15% chance of making it to university, compared to a 63% chance for children whose parents attended university. Health outcomes, and even life expectancy, are also heavily influenced by socio-economic background.

We have seen plenty of political corruption recently and this is well documented in a 2021 report by Transparency International as noted below:

Corruption in the United States is apparently at its worst in almost a decade, according to a new global report released Thursday by Transparency International. Advocates attribute the drop to declining trust in democratic institutions and poor oversight of pandemic-related financial aid.

In the annual Corruption Perceptions Index (CPI), the United States fell to a low of 67 out of a maximum possible score of 100, down from a high of 76 in 2015. By its nature, corruption is difficult to document, so the index relies on a variety of different sources to measure the level of perceived public sector corruption. The lower the score, the worse the corruption. Two-thirds of the 180 countries and territories included in the 2020 index scored below 50, with an average of 43.

The United States, like Rome, faces the challenge of managing an ever-growing national debt. The US monetary system is supported by a fiat currency that is steadily losing purchasing power over time and this will accelerate as more money will need to be printed to fund deficits and the growing interest burden of the public debt.

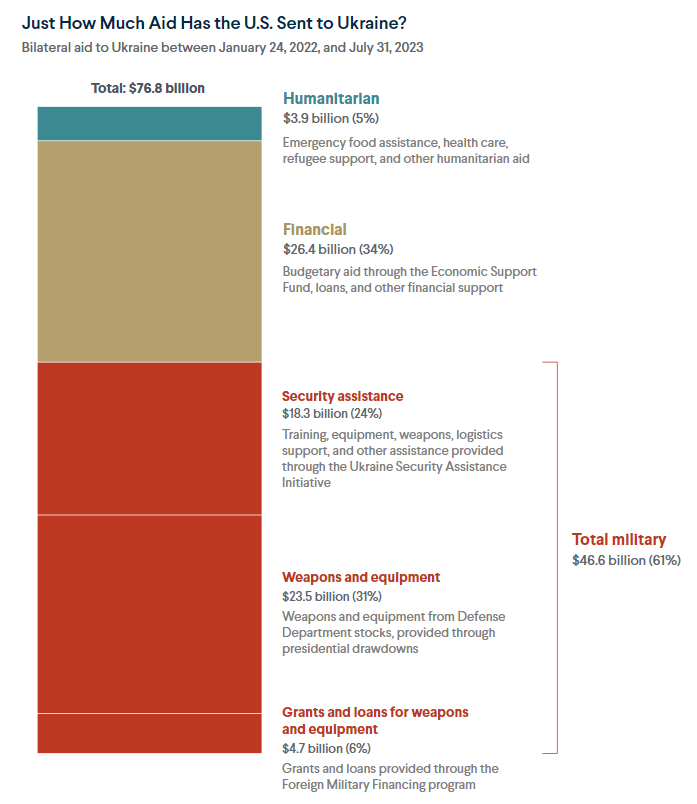

Also, while the United States military is still quite strong relative to all other countries in the world, it finds itself increasingly challenged, with multiple conflicts around the world. Rather than direct military engagement, the current approach is for the United States to provide funding and equipment to Ukraine and it intends to increase support to Israel for their respective war efforts, which will result in accelerated growth of public debt and ultimately further accelerate the debasement of the dollar. The possibility of more conflicts in other parts of the world (i.e., Taiwan) will only add to this military and financial burden.

Bitcoin as a Hedge

Bitcoin, a decentralized digital currency, has gained prominence as a potential safeguard against government currency devaluation. By relying on a blockchain and cryptographic principles, Bitcoin is immune to traditional forms of currency manipulation. It offers the possibility for individuals to retain their wealth and purchasing power during times of economic uncertainty. Converting dollars to Bitcoin is a peaceful protest against the fiat war machine. Bitcoin may indeed be a path to world peace as I wrote recently here:

Bitcoin: A Path to World Peace and Financial Freedom

Introduction In an increasingly chaotic and violent world, the pursuit of peace and personal freedom has become more critical than ever. For many, Bitcoin has emerged as a symbol of hope and a potential catalyst for global change. This post explores how Bitcoin can contribute to world peace by empowering individuals, offering financial protection, and ch…

Conclusion

The fall of the Roman Empire serves as a cautionary tale for any empire, emphasizing the perils of economic instability, military overextension, and political corruption. While drawing direct parallels between the Roman Empire and the United States is challenging due to differing historical and geopolitical contexts, there are valuable lessons to be learned.

The enduring cultural legacy of Rome shows that empires can leave a lasting impact even after their political structures collapse. Bitcoin, a new and innovative financial technology, provides hope for individuals seeking to protect their wealth during uncertain times, whether in the context of the United States or any other nation. While the path to the future remains uncertain, the lessons of history and the potential of emerging technologies offer hope that humanity can navigate its challenges and avoid truly dark times.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated:

It’s all and only about corrupted politicians and greed.

But fortunately today we have the only alternative to tyranny and financial slavery that Romans didn’t have 2000 years ago.

BITCOIN