“History doesn’t repeat itself, but it often rhymes.” – Mark Twain

In 2025, we find ourselves staring into a mirror that reflects not just the future, but also the past. Massive tariffs, extreme debt levels, monetary policy chaos, rising geopolitical tensions, and failing trust in institutions are making headlines around the globe. But have we seen this before?

Yes. The last time the United States had comparably high tariffs was the 1930s, and while the 1970s brought different economic challenges, both periods offer critical lessons for our time. If we understand the rhythms of history—especially through the lens of Ray Dalio’s work on cycles—we can begin to decode the present and potentially navigate what lies ahead.

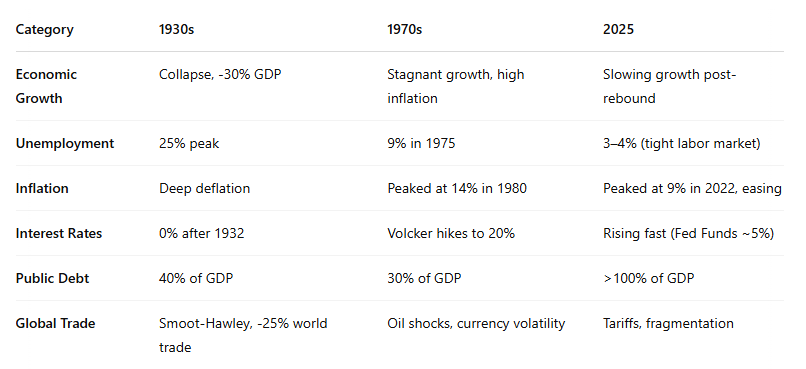

Macroeconomic Patterns: Depression, Stagflation, and the Debt Supercycle

The 1930s were defined by economic collapse—real GDP in the U.S. fell by over 30%, unemployment reached 25%, and a deflationary spiral deepened the misery.

The 1970s were the opposite: inflation soared as a result of oil shocks and monetary expansion. But growth stagnated and public trust eroded amid crises like Watergate and the end of Bretton Woods.

Today in 2025, we’ve experienced a combination of both: pandemic-driven shocks, record-high stimulus, inflation spikes, and rising interest rates—all while public and private debt are at historic highs.

Dalio calls this the endgame of a long-term debt cycle.

A Comparison Table: Then and Now

Cultural and Institutional Shifts

1930s: Radical political movements. Fascism in Europe. Class conflict. Breakdown of trust in capitalism.

1970s: Disillusionment with government. Watergate. Strikes. High union power.

2025: Low trust in institutions. Record-low confidence in media and government. Rise of populism.

Dalio warns that we now have the biggest wealth and values gap since the 1930s, which is driving social unrest and polarization.

Geopolitics: From Great Depression to Great Power Conflict

The 1930s saw the breakdown of the global order—the League of Nations failed, and protectionism plus nationalist expansion led to war.

The 1970s managed to avoid global collapse but ushered in the Cold War and energy conflicts.

Today? The U.S.-China rivalry mirrors the 1930s U.S.-Japan tensions, especially around trade and technology. We’re seeing economic decoupling, rising military posturing, and fractured alliances. Dalio refers to this as the “greatest international conflict since the 1930–45 period.”

Monetary Systems in Flux

1933: U.S. exits the gold standard.

1971: Nixon unlinks the dollar from gold, ending Bretton Woods.

2025: The fiat dollar system persists, but cracks are showing. Central banks are hoarding gold. BRICS and China are promoting alternatives. Bitcoin and CBDCs are pushing the Overton window of monetary reform.

Dalio’s conclusion? We’re at the end of a “Big Cycle.” That means major monetary, political, and global shifts are due.

Are We Repeating the 1930s or the 1970s?

We may be living through a fusion of both:

Inflation and monetary disorder (1970s),

Political polarization and declining trust (1930s),

Plus: unprecedented debt levels and geopolitical fragmentation (unique to today).

We could be in the late 1930s of the current cycle—a perilous time that demands wise policy, global cooperation, and serious reforms. If mishandled, the 2020s could spiral into disorder or conflict. But with foresight, it can become a period of peaceful transition.

Conclusion: History Is a Guide, Not a Blueprint

We’re not destined to repeat the Great Depression or the 1970s. But we are rhyming with both.

As Dalio says, we must study the past to better understand today’s volatile present—and to prepare for tomorrow’s opportunities and risks.

What happens next depends on how leaders, citizens, and markets respond to this historical echo.

Bitcoiners take note: this is a time to focus on self-sovereignty, sound money, and antifragile systems. As history shifts again, be ready to opt out of the broken system—just as some did with gold in the 1930s, and others did with equities in the inflationary 1970s. Today, the answer might be Bitcoin.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2025.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.