The 2008 Global Financial Crisis (GFC) stands as one of the most significant economic downturns in modern history, characterized by a complex web of financial recklessness, regulatory failures, and the resulting public bailouts of private companies. This crisis not only devastated economies worldwide but also laid the groundwork for future challenges, particularly the looming threat of a sovereign debt crisis. Understanding the events leading up to and following the GFC provides crucial insight into the financial systems' vulnerabilities and the genesis of Bitcoin as a response to these shortcomings. Indeed, The GFC was my inspiration for starting this blog.

Origins of the Crisis

The seeds of the 2008 crisis were sown in the years leading up to the collapse. Financial institutions, driven by greed and a culture of risk-taking, engaged in a frenzy of subprime mortgage lending. These loans, extended to borrowers with poor credit histories, were bundled into complex financial products known as mortgage-backed securities (MBS). Fueling this risky behavior was the belief that housing prices would continue to rise indefinitely.

However, when the U.S. housing bubble burst in 2007, home prices plummeted, triggering a wave of mortgage defaults. This cascade of defaults reverberated throughout the global financial system, exposing the vulnerability of interconnected financial markets.

Government Bailouts and Debt Shift

As the crisis unfolded, governments around the world scrambled to prevent the collapse of major financial institutions deemed "too big to fail." Public bailouts became the norm, with governments injecting massive sums of taxpayer money into troubled banks and companies to prevent their demise.

In the United States, the Troubled Asset Relief Program (TARP) authorized a staggering $700 billion to purchase troubled assets and stabilize the financial system. Similarly, the Federal Reserve engaged in unprecedented measures, such as slashing interest rates and implementing quantitative easing, to inject liquidity into the markets.

These bailouts, while preventing immediate financial catastrophe, had significant long-term consequences. They shifted substantial amounts of debt from private companies to the government, laying the foundation for a future sovereign debt crisis. Governments now find themselves burdened with massive liabilities, leading to concerns about sustainability and the potential for default.

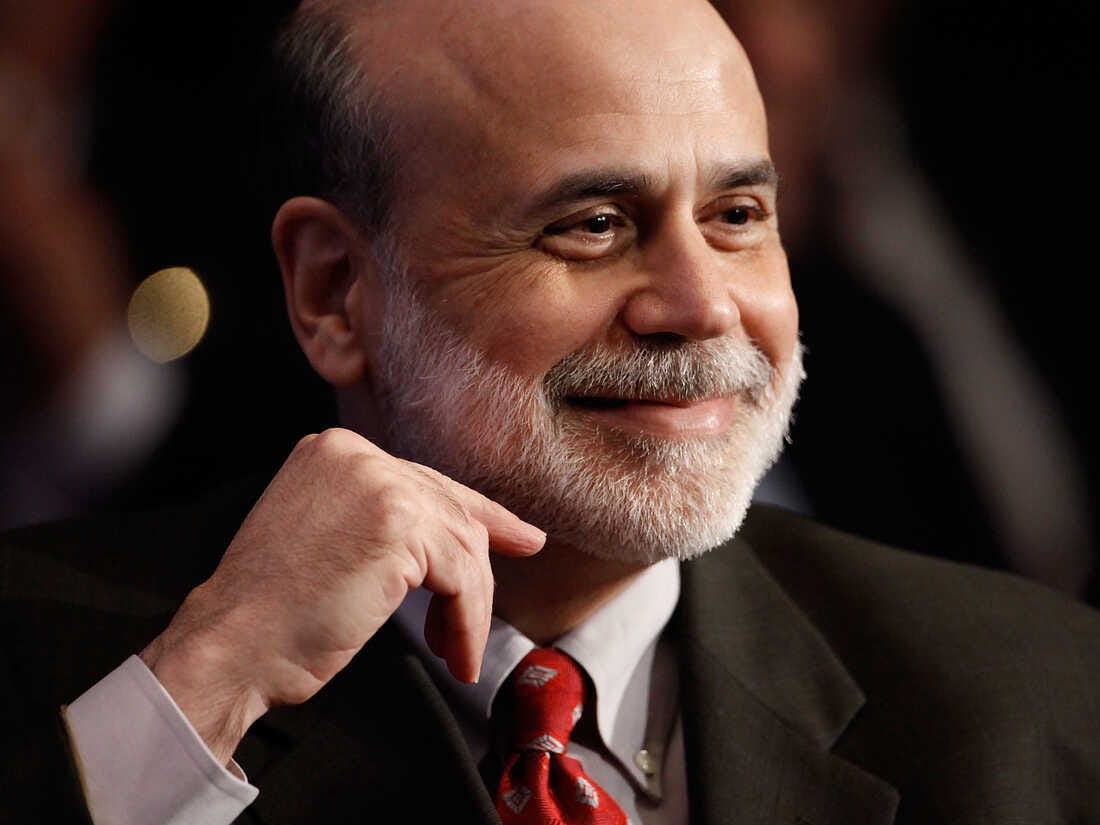

The architect of the money printing, Fed Chair “Helicopter” Ben Bernanke ended up winning a Nobel Prize for this colossal bail-out (just look at that smile):

ECONOMY

Ben Bernanke among 3 American winners of Nobel Prize in economics

OCTOBER 10, 20227:33 AM ET

Former Federal Reserve Bank Chairman Ben Bernanke.

Chip Somodevilla/Getty Images

Former Federal Reserve chairman Ben Bernanke was awarded the Nobel Prize in Economics Monday, along with economists Douglas Diamond and Philip Dybvig, for their research on bank runs and measures to prevent them.

The three will share the prize money of 10 million Swedish kronor, or $886,000.

Bernanke, who's now at the Brookings Institution, was recognized for his research on the role of bank failures in deepening and prolonging the Great Depression in the 1930s. He put many of those lessons to work as Fed chairman, pioneering the emergency lending programs that the central bank used to address the financial crisis of 2008-9.

Human Cost and Regulatory Responses

While governments moved swiftly to rescue financial institutions, the fallout for ordinary citizens was devastating. Millions lost their jobs as businesses shuttered (especially in the real estate industry where I spent my career), and families faced foreclosure as the housing market collapsed. The GFC underscored the stark reality of income inequality and the disproportionate burden borne by working-class individuals.

In the aftermath of the crisis, regulatory reforms were enacted to prevent a repeat of the debacle. The Dodd-Frank Wall Street Reform and Consumer Protection Act aimed to increase oversight and transparency in the financial sector, imposing stricter regulations on banks and enhancing consumer protections.

But the banksters didn’t go to jail for what they did. They only faced “intense scrutiny,” “lawsuits” and “reputation damage.” Here’s a sample of what happened to the worst of them:

Lehman Brothers:

Richard S. Fuld, Jr. was the Chairman and CEO of Lehman Brothers, one of the largest investment banks in the world. Lehman Brothers filed for bankruptcy on September 15, 2008, marking one of the most significant events of the financial crisis. Fuld faced substantial criticism for the bank's risky practices and failure to adapt to the changing market conditions.

After the collapse of Lehman Brothers, Fuld faced intense scrutiny from regulators, lawmakers, and the public. He testified before Congress and faced numerous lawsuits related to the bank's demise. Fuld largely withdrew from public life after the crisis, and his reputation as a Wall Street titan was tarnished by the events of 2008.

Bear Stearns:

Jimmy Cayne served as the CEO of Bear Stearns, another major investment bank heavily involved in mortgage-backed securities. Bear Stearns faced a liquidity crisis in March 2008 and was acquired by JPMorgan Chase in a government-assisted deal.

Cayne came under fire for his leadership during the crisis, with critics pointing to risky investments and poor risk management. After the sale of Bear Stearns, Cayne stepped down as CEO and largely faded from the public eye.

Citigroup:

Charles Prince was the CEO of Citigroup, one of the largest banks in the world. Citigroup suffered substantial losses related to subprime mortgages and required multiple rounds of government assistance to stay afloat.

In November 2007, amid mounting losses, Prince resigned from his position as CEO of Citigroup. He took responsibility for the bank's poor performance during his tenure, stating that "the buck stops with me." Prince largely retired from the financial industry after the crisis.

Bank of America:

Ken Lewis served as the CEO of Bank of America, which faced significant challenges during the crisis, including the acquisition of Merrill Lynch.

Lewis orchestrated the purchase of Merrill Lynch in September 2008, a move that drew scrutiny due to the losses and risks associated with the acquisition. Following the crisis, Lewis faced pressure from shareholders and regulators.

In 2009, Ken Lewis announced his retirement as CEO of Bank of America, stepping down from his position. His legacy was marred by controversy surrounding the Merrill Lynch acquisition and the bank's role in the financial crisis.

AIG (American International Group):

Maurice "Hank" Greenberg was the longtime CEO of AIG, a global insurance and financial services corporation. AIG faced massive losses due to its exposure to credit default swaps and other risky financial products.

Greenberg stepped down from his position as CEO of AIG in 2005, prior to the full extent of the crisis becoming apparent. However, his leadership decisions and the company's practices during his tenure came under scrutiny.

Greenberg continued to be involved in legal battles related to his time at AIG, facing allegations of accounting irregularities and misleading investors. While not directly implicated in the crisis, his legacy at AIG was forever tied to the events of 2008.

Bitcoin: A Response to Financial Crisis

The GFC served as a wake-up call for many to the flaws inherent in the traditional monetary system. It was against this backdrop of economic turmoil and distrust in centralized institutions that Bitcoin emerged.

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, published the cryptocurrency's whitepaper in October 2008, just weeks after the collapse of Lehman Brothers. The timing was not coincidental. Bitcoin was conceived as a decentralized digital currency, free from the control of governments and central banks.

At its core, Bitcoin addresses the very issues highlighted by the GFC. Its decentralized nature eliminates the need for intermediaries like banks, reducing the risk of another financial institution collapse. The fixed supply of 21 million bitcoins prevents the arbitrary printing of money, safeguarding against inflation and devaluation.

Bitcoin's blockchain technology ensures transparency and security, offering a viable alternative to traditional financial systems plagued by opacity and fraud. It empowers individuals to take control of their wealth and transactions, bypassing the need for trust in centralized authorities.

Conclusion

The 2008 Global Financial Crisis reverberated across the world, leaving a trail of economic devastation in its wake. The public bailouts of private companies, the shift of massive debt burdens to governments, and the human cost of job losses and foreclosures were stark reminders of the vulnerabilities inherent in the financial system.

Out of this turmoil emerged Bitcoin, a decentralized digital currency designed to provide financial sovereignty and security in the face of crisis. Satoshi Nakamoto's vision for a peer-to-peer electronic cash system was inspired by the failures of the GFC, offering a solution to the shortcomings of traditional monetary systems.

We must remember the lessons learned from the GFC and how Bitcoin can protect us from the next financial disaster.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

Thanks Franco. Always enjoy your commentary. It’s happening. For sure.

As usual excellent piece on the most tragic event in modern financial history.

But it didn’t come without guilts, extreme usage of financial derivatives such as MBS, ABS, CDS, CDO subprime loans to everyone and its dog most of which originated in South Beach Miami to finance a huge real estate development still half empty 15 years later.

But that’s not all the story.

Human greed and greed and money and greed was mainly behind it all.

Fiat money was turned over and over via those derivatives using leverage 100-120% over the collateral value.

A mess, a true financial mess that soon collapsed as a throne of cards.

Could it happen again?

Yes and it’s happening again right now and it’s called 34T US public debt and it’s much much worse than 2008 as there’s no collateral this time. No fancy condos , no luxury apartments and penthouses. Nothing, nothing at all but thin air.

Thank you Satoshi, you gave the world an alternative to greed and thin air.

Thank you for designing the BITCOIN!