SWAN With the Financial Fortress

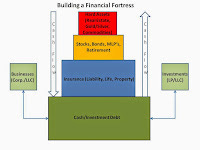

Stock market volatility has picked up the last couple of days and many are questioning whether the big crash is finally here or whether this is just a pullback / consolidation and we will continue to see further stock market gains as the economy continues its steady, but bumpy recovery. If you are worried about the stock market then you probably have too much of your money invested there and you might want to consider the Financial Fortress approach I have used for many years. This investing approach helps me SWAN (Sleep Well At Night). If the stock market does great, then a portion of my portfolio does too. If it doesn't, I'm not worried because other areas are continuing to hold their value or increase. Having been through two major stock market crashes in my life, including the dot.com bubble and the Great Recession prior to the COVID Crash, I have grown more cautious about the stock market and containing risk, but at the same time can't dismiss the fact that it's a great way to build wealth over the long term. Finding the balance between taking the risk of the stock market and playing it safe is a personal thing and is up to every investor to determine their own risk tolerance.

Here's a breakdown of how I allocate my Financial Fortress portfolio currently:

Retirement Accounts (conservative profile - mostly bonds) - 37%

Cash - 21%

Real Estate - 20%

Aggressive Stock - 14%

Alternatives (Gold/Silver/Bitcoin/Royalties/Private Equity/Life Insurance) - 8%

If the stock market does well, my overall portfolio grows, but I'm not dealing with huge fluctuations in the overall value because of the other asset classes and my aggressive stock investing is limited to 14% of the total portfolio.

While the retirement accounts do have some stock exposure, I'm even less concerned about those accounts since they are very long term hold in nature.

Even when investing aggressively in stocks, my primary focus is cash flow and I only own four stocks, all of which pay strong dividends:

Alliance Bernstein (AB) - 9.72% yield

Abbvie (ABBV) - 5.14% yield

Broadmark Realty Capital (BRMK) - 8.99% yield

Prospect Capital (PSEC) - 14.31% yield

The rest of the portfolio is invested in selling covered calls and selling put credit spreads on "household name" stocks with good stock price support and low volatility. This portion of the portfolio swings the most with the market and can be a little scary, so it's important to manage risk to ensure best possible outcome - keeping position sizes small and overall maximum risk in line with cash holdings (don't over-leverage). AT&T is a key holding in the option portfolio due to it's large market cap, very liquid market for stock / options and low volatility. It's also a great dividend stock to hold long-term in your portfolio, sporting a 7% dividend yield (see my recent post here for a deeper dive into AT&T).

Selling options plus the dividend stream from these four stocks really supercharges cash flow from this account. As the cash balance builds, it can be deployed into more dividend-paying stocks which I continue to screen on a regular basis. Here's a recent post on my latest dividend screen if you're interested.

Of course, you will need to do your own homework and invest where you feel comfortable. I'm not recommending any particular stock or strategy and full disclosure, I do own / manage positions in the stocks mentioned above. Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.