This week, the Supreme Court struck down the Chevron deference, a landmark decision that has significant implications for the balance of power between federal agencies and the judiciary. The Chevron doctrine, stemming from the 1984 case Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc., allowed federal agencies considerable leeway in interpreting ambiguous laws. The Supreme Court's recent decision to overturn this doctrine represents a pivotal shift in administrative law, curbing the power of federal agencies to unilaterally expand their regulatory reach.

The End of Chevron Deference: A Win for Liberty

From a Libertarian perspective, this ruling is a substantial victory. For decades, the Chevron deference has enabled federal agencies to stretch the interpretation of vaguely written laws, often leading to increased governmental control and overreach. By empowering agencies to act with minimal judicial oversight, the Chevron doctrine has allowed for a significant expansion of the administrative state, often at the expense of individual liberties and free-market principles. Doomberg illustrates this in a great chart showing the growth of final rules in the Federal Registry:

The Supreme Court's decision to dismantle Chevron signals a return to a more constrained and accountable administrative state. Without the broad interpretative authority granted by Chevron, agencies will now face greater judicial scrutiny, ensuring that their actions are more closely aligned with the intent of Congress. This change is expected to lead to more precise and limited regulations, reducing the scope of bureaucratic intervention in the lives of individuals and businesses. One estimate is that there are over 2,000 federal agencies in the United States. Regulatory agency staffing has grown substantially over the years as shown in this chart:

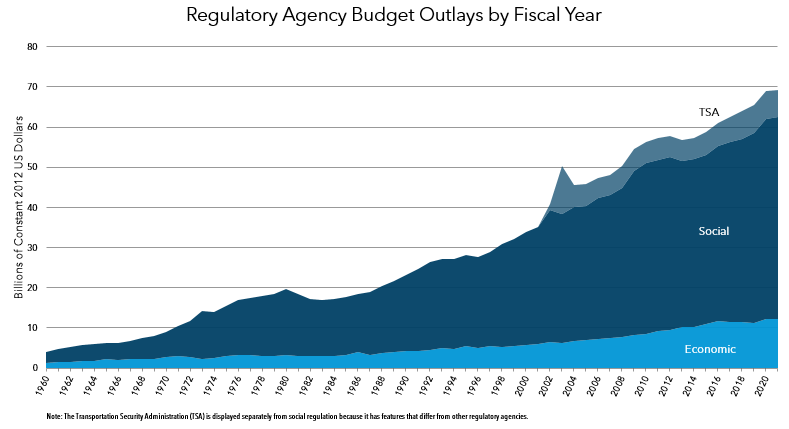

Clearly, none of this is helping reduce the national budget deficit:

Maybe we need a little of this in the US:

Potential Positives and Negatives

The decision to curtail Chevron deference has several potential positive impacts:

Increased Accountability: Federal agencies will be more accountable to the courts and, by extension, the public. This can lead to more transparent and deliberate rulemaking processes.

Limited Government Overreach: By narrowing the scope of agency power, the decision can prevent regulatory overreach, thereby protecting individual freedoms and encouraging economic innovation.

Judicial Oversight: Enhanced judicial oversight ensures that regulations are firmly grounded in the legislative framework set by Congress, rather than the expansive interpretations of unelected bureaucrats.

However, there are potential downsides to consider:

Regulatory Uncertainty: The shift away from Chevron may lead to increased litigation as courts and agencies navigate the new landscape, potentially creating regulatory uncertainty.

Legislative Gridlock: Without Chevron, the onus is on Congress to draft more precise and unambiguous legislation. Given the current political climate, this could result in legislative gridlock, delaying necessary regulatory updates.

Variable Court Interpretations: The increased role of the judiciary in interpreting laws could lead to inconsistent regulatory environments, depending on differing judicial philosophies across jurisdictions.

Implications for Bitcoin and Financial Regulation

The Supreme Court's decision could also have positive ramifications for Bitcoin. Over recent years, various government agencies, including the Securities and Exchange Commission (SEC) and the Financial Crimes Enforcement Network (FinCEN), have taken aggressive stances against Bitcoin, often using broad and ambiguous interpretations of existing laws to justify their actions. As outlined in my article on the government crackdown on Bitcoin, these agencies have targeted Bitcoin in ways that stifle innovation and infringe on financial privacy:

The Government Crackdown on Bitcoin Privacy Tools

Over the past few months, the Bitcoin community has witnessed an alarming increase in government actions aimed at curbing privacy tools associated with the cryptocurrency. These measures have sparked significant concern among advocates for financial privacy and decentralization. This post will detail the key events in this crackdown, underscore the impo…

With the curtailment of Chevron deference, these agencies will now face greater judicial scrutiny when interpreting the scope of their regulatory authority over Bitcoin. This can limit their ability to impose restrictive regulations unilaterally and ensure that any regulatory actions are more closely aligned with the intent of Congress. For the Bitcoin community, this could mean a more favorable regulatory environment that promotes innovation and protects individual financial freedoms.

Conclusion

The Supreme Court's decision to strike down Chevron deference marks a significant shift in administrative law, restoring a more balanced distribution of power between federal agencies and the judiciary. From a Libertarian perspective, this is a clear win for individual liberty and limited government. While there are potential challenges and uncertainties ahead, the move towards greater judicial oversight and accountability is a step in the right direction.

For the Bitcoin community, this ruling offers hope for a regulatory landscape that is more predictable and less prone to overreach. As agencies face increased scrutiny, there is an opportunity for the cryptocurrency industry to thrive under a framework that respects innovation and financial autonomy. In the ongoing battle between freedom and control, the end of Chevron deference is a victory worth celebrating.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Bitcoin Fortress Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.

Loper & the other decisions trimming the power of the administrative state this term were victories for freedom. They will help restore the rule of law & proper balance to American government. We discuss this at length in the July issue of The Credit Strategist where we always focus on the connections among finance, law, politics & culture. This is a key moment in the history of American liberty.

Great insight