Stock Market Outlook - Short Term/Long Term

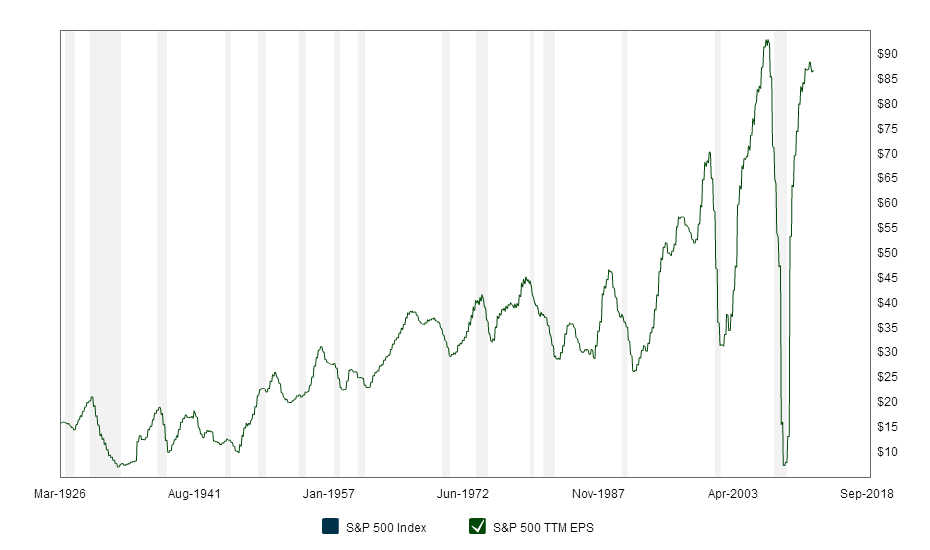

S&P 500 Earnings History - Have We Seen a Peak?

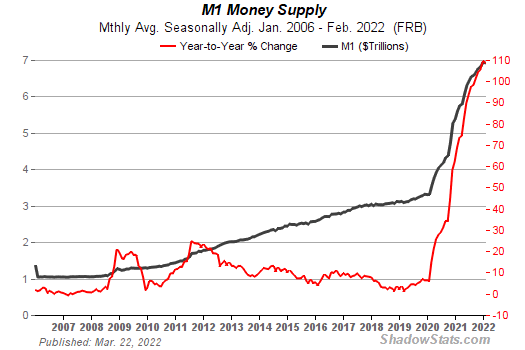

The US stock market outlook for the short term appears to be bullish, thanks to the money printing operations of the Federal Reserve (see chart below). This despite a slowing economy and many challenges to the strong growth of corporate earnings since the Financial Crisis (see chart above).

Fed Money Printing Expands the Supply of Dollars - M-1 at $2.4 Trillion (almost doubled since 2007)

While the short term outlook for stocks looks good, the longer term outlook is less clear. With all the monetary stimulus currently being applied, the possibility of a rapid and significant rise in inflation seems more likely. Long term the dollar continues to decline in value, pushing up the value of hard assets such as gold and silver. Stocks could also benefit from inflation if companies are able to push prices faster than the increase in cost of labor and materials, which may be possible for some time after inflation becomes apparent.

Long Term Trend of the Dollar is a Significant Decline in ValueA high inflation environment will be catastrophic for bonds and will result in plummeting values as yields soar. Only those who have very short term holdings will be safe from this. Hard assets should do well in this environment, including gold and silver, real estate and oil/gas.

Time will tell, but a further decline in the value of the dollar seems unavoidable.

Related articles

"The Fed, Having Used Its Bazookas, Is Now Down To Firecrackers"

GOOD NEWS: Some Stocks Won't Be Horrible Investments Over The Next 7 Years -- Just Don't Buy Bonds