Stock Market and Dollar Rally? What's Wrong With This Picture?

Stock Market Fortune Cookie (Photo credit: bransorem)

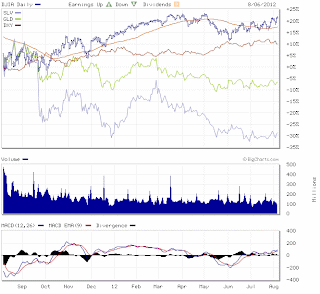

As you can see in the chart to the right, silver (SLV) is down 30% over the past year and gold (GLD) is down 5% while the dollar (DXY) is up 10% and the stock market (DJIA) is up over 20%.

This looks like an opportunity to buy silver and gold and/or sell or short the stock market and the dollar. The stock market increase over the past year certainly isn't because the US economy is doing great (8.3% official rate of unemployment, 1.5% growth in GDP, etc.). Also, with the Federal Reserve's "easy money" policy, the dollar's recent appreciation is sure to be short-lived, and the dollar seems almost certain to continue declining in value - possibly at an accelerated pace, just as it has for years (see chart below):

Speculators seem to have moved from gold and silver into the dollar and the stock market, fueled by cheap credit. Also driving the dollar (and Treasuries, which continue to have very low yields) is the periodic fear/panic that accompanies the Europe story, when investors rush into Treasuries for "safety."

Funds have continued to flow into bond mutual funds and out of stock mutual funds as individual investors continue to prefer safety and yield over capital gains (or losses), which means that the stock market rally is being led by Wall Street "smart money." But even the "smart money" makes dumb moves, like JP Morgan's $5.8 billion trading loss or more recently, the "Knightmare" on Wall Street. Treasury yields have dropped almost 1% over the past year due to continued strong demand. Recently, there is more investor interest in municipal bonds as well as corporate bonds in addition to Treasuries.

Here are some interesting ways to short the dollar:

UDN - The investment seeks to track the price and yield performance, before fees and expenses, of the Deutsche Bank Short US Dollar Futures Index. The index is comprised solely of short futures contracts. The futures contract is designed to replicate the performance of being short the US Dollar against the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc.

CYB - The investment seeks to achieve total returns reflective of both money market rates in China available to foreign investors and changes in value of the Chinese yuan relative to the U.S. dollar. The fund normally invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in investments whose combined performance is economically tied to China. It is an actively managed exchange traded fund that seeks to achieve its investment objective by investing in short-term securities and instruments designed to provide exposure to Chinese currency and money market rates. The fund is non-diversified.

I have written previously about the strategy of going long on the Chinese currency as a short play against the dollar.

Here are some interesting ways to short the stock market:

HDGE The investment seeks capital appreciation through short sales of domestically traded equity securities. The fund seeks to achieve the fund's investment objective by short selling a portfolio of liquid mid- and large-cap U.S. exchange-traded equity securities, ETFs registered pursuant to the Investment Company Act of 1940, ETNs and other ETPs. On a day-to-day basis, it may hold U.S. government securities, short-term high quality fixed income securities, money market instruments, overnight and fixed-term repurchase agreements, cash and cash equivalents with maturities of one year or less for investment purposes and to cover its short positions.

If you want to invest in silver or gold, I recommend physical coins (store in a safe or bank safe deposit box for security) - preferably US Silver Eagle or Gold Buffalo bullion coins. These are available from reputable coin dealers - you can easily check the prices on EBay.

Related articles