Defining Sound Money

Sound money is a term that refers to a stable and reliable form of currency that maintains its purchasing power over time. Historically, sound money has been associated with commodities such as gold and silver, which have intrinsic value and are not easily manipulated by governments or central banks. The core attributes of sound money include durability, divisibility, portability, uniformity, limited supply, and acceptability. These characteristics ensure that sound money preserves wealth, facilitates trade, and promotes economic stability and prosperity.

Historical Examples of Sound Money

Throughout history, periods in which societies used sound money have often been marked by significant economic growth and prosperity. For instance, the Gold Standard era (approximately from the 19th century to the early 20th century) is often cited as a period of remarkable economic stability and growth. During this time, currencies were directly convertible to a fixed quantity of gold, limiting the ability of governments to inflate the money supply. As a result, prices remained relatively stable, savings retained their value, and investments were more predictable and secure.

Similarly, ancient civilizations such as the Roman Empire and various Chinese dynasties thrived economically when they relied on sound money like gold and silver. These metals provided a reliable store of value and medium of exchange, supporting robust trade networks and stable economic systems.

The Drawbacks of Fiat Currency

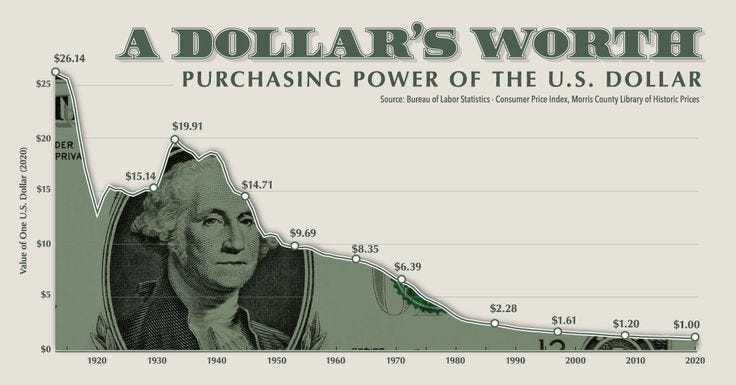

In contrast, fiat currencies, which are not backed by physical commodities, are prone to debasement and inflation. Modern fiat currencies, such as the US dollar, are issued by central banks and are not convertible to a fixed amount of any commodity. This system allows for greater flexibility in monetary policy but also opens the door to inflation and currency devaluation.

The Federal Reserve, for instance, targets an inflation rate of 2% per year, which ostensibly promotes economic growth by encouraging spending and investment. However, even a modest 2% inflation rate erodes purchasing power over time. Currently, the inflation rate in the US is around 3%, exacerbating the loss of purchasing power.

To illustrate the impact of inflation, consider saving $100 a week over a 40-year working career, from 1984 to 2024. If you saved in fiat currency with an average annual inflation rate of 3%, your savings would significantly lose value over time.

Let's calculate the purchasing power of these savings in fiat currency versus sound money like gold.

Calculating the Impact of Inflation on Savings

Fiat Currency Savings:

Weekly savings: $100

Annual savings: $5,200

Total savings over 40 years: $208,000

The purchasing power of $208,000 saved in fiat currency would be approximately $63,801.23 in today's dollars.

Gold Savings:

Historical average annual return on gold (1984-2024): ~5.5% (adjusted for inflation)

The purchasing power of $208,000 saved in gold, considering its historical performance, would be significantly higher, around $2,283,840.

Bitcoin: The Sound Money for the Digital Age

Bitcoin represents a modern form of sound money, designed for the digital age. Introduced in 2009 by the pseudonymous Satoshi Nakamoto, Bitcoin possesses many characteristics of sound money and offers several advantages over traditional forms such as gold.

Advantages of Bitcoin:

Portability: Bitcoin can be transferred instantly to anyone, anywhere in the world, without the need for physical transportation.

Divisibility: Bitcoin is highly divisible, with each Bitcoin being divisible into 100 million smaller units called satoshis.

Durability: As a digital asset, Bitcoin is not subject to physical degradation.

Limited Supply: Bitcoin has a fixed supply of 21 million coins, ensuring scarcity and resistance to inflation.

Security: Bitcoin transactions are secured by a decentralized network of nodes and miners, making it virtually impossible to counterfeit.

Low Storage Costs: Bitcoin can be stored securely at virtually no cost, compared to the significant costs associated with storing and insuring physical gold.

These attributes make Bitcoin a superior form of sound money in many respects, offering the benefits of traditional sound money while leveraging the advantages of digital technology.

Conclusion

Sound money has historically been the bedrock of prosperous societies, providing stability and preserving wealth. In contrast, fiat currencies are engineered to debase over time, eroding purchasing power and undermining savings. Bitcoin, as a form of digital sound money, combines the best attributes of traditional sound money with the advantages of modern technology. Its fixed supply, portability, and security make it an attractive alternative to both fiat currency and traditional commodities like gold. As we navigate the digital age, Bitcoin stands as a beacon of financial stability and a promising foundation for future economic prosperity.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2024.

Thanks for following my work. Always remember: freedom, health and positivity!

Please also check out my Bitcoin Fortress Podcast on all your favorite streaming platforms. I do a weekly Top Bitcoin News update every week on Sunday, focused on current items of interest to the Bitcoin community. Please check it out if you haven’t already. Also now on Fountain, where you can earn Bitcoin just for listening to your favorite podcasts.

Follow me on Nostr:

npub122fpu8lwu2eu2zfmrymcfed9tfgeray5quj78jm6zavj78phnqdsu3v4h5

If you’re looking for more great Bitcoin signal, check out friend of the show Pleb Underground here.

Lightning tips appreciated here.