Solid Dividend Plays for Inflation or Deflation

There is currently much speculation about whether we will witness a deflationary period followed by inflation as the post-COVID-19 recession / depression unfolds. With all the monetary and fiscal stimulus being put forth by the Federal Reserve and the US government, we could very well see tremendous inflation down the road. Either way, investing in solid dividend yielding stocks can be a great way to ensure a steady source of income and provide superior returns in either environment.

The simple math is that the more dollars there are in circulation, the less each one is worth. Global demand for dollars, the safest currency in the world, has continued to be very strong in this downturn which has resulted in the dollar appreciating recently, oddly enough. Still, the dollar is worth between 30% and 40% less (depending on who you believe) than it was back in 1985 due to inflation. So the long term effects of inflation on the value of cash are still very much in play. See chart below:

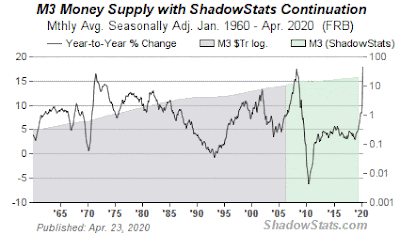

Here's a longer term view of the growth of the money supply since 1960. The money supply growth has spiked significantly recently due to the Federal Reserve's historically unprecedented actions:

I have written about dividend stocks as a passive income strategy a few times and have screened some great names previously. If you're interested, here are links to my previous posts:

I recently updated the screener to focus on those stocks that have a 50-year or longer history of increasing dividends, with a payout ratio of 80% or less (for safety of dividend) and without regard to industry or market capitalization.

Here are the top 6 stocks that screened and also seem poised to continue to do well in the current economic environment:

3M (MMM) / 4.07% yield / 70.5% payout ratio

Coca Cola (KO) / 3.64% yield / 80% payout ratio

Procter & Gamble (PG) / 2.65% yield / 63.7% payout ratio

Target (TGT) / 2.54% yield / 39.8% payout ratio

Colgate-Palmolive (CL) / 2.47% yield / 60.7% payout ratio

Johnson & Johnson (JNJ) / 2.44% yield / 51.8% payout ratio

In addition to collecting the dividend, if you own enough shares, another strategy to increase cash flow is to sell covered call options. Best case is the options expire out of the money and you get to keep the premium. Worst case, is you have to sell your shares at the contract price and then use the money to either repurchase the same shares or move funds to a different stock on your target list. If you sell calls that are sufficiently out of the money, your chances of profit can be very high (80% - 90%). You should make sure you are comfortable holding the stock you buy for the long term, since price decreases may occur which will enhance your chances of a profitable option trade, but will result in losses in the underlying stock.

Stay safe, healthy and positive.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.