Silver Short Rumors

Last week, the short-busting activity of the subreddit WallStreetBets crowd dominated the financial news, with stocks like Gamestop, AMC and other companies with high short interest (in some cases much more than the total float of shares outstanding, which added more fuel to the short squeeze). This activity appears to have had some ripple effects throughout the broader stock market, with some observers thinking that the short squeeze forced hedge funds holding the short positions to liquidate their long positions to cover, driving down prices of some of the more popular stocks and driving down the overall stock market averages in the process. This has also become a social movement for equality, not unlike other populist movements of the recent past (Occupy Wall Street), except this movement packs a punch because it involves the loss of real money by those institutions on the other side of the crowd. This movement has garnered a lot of attention, from lawmakers, regulators, media and celebrities and seems likely to have far-reaching consequences. At a minimum, institutions will need to be careful about taking short positions in companies and broadcasting their rationale to the media. Individual investors will have to be careful about their entry point into shorted stocks when the rally "fades" and they could be stuck waiting a long time for the stock values to return to their parabolic peaks.

The next target appears to be the silver market, a market that has been historically notorious for institutional manipulation / shorting activity and which is rumored to have much more short positions than physical silver in existence, which would definitely be an enormous speculation opportunity. Many think if that's successful, gold will be next.

The silver market is about $1.4 Trillion and the gold market is about $11.7 Trillion. Bitcoin has a market cap of about $600B by comparison (and is also rumored to now be heavily shorted after the recent parabolic move to $40K, from which is has sold off down to about $30K). Last week I wrote about how I now recommend a higher allocation of your portfolio to Bitcoin (see my post here) and if anything, the events of last week have only confirmed the thesis of holding Bitcoin for the long haul due to its decentralized nature. The market caps of Gamestop, AMC and the companies that have been shorted recently are much smaller and therefore technically "easier" targets for crowdsourced short-busting activity and that's the argument for why the WSB crowd will not be able to impact these large commodity markets. However, if indeed the amount of "paper" silver far exceeds the amount of physical silver backing it up, as some have suggested, then a large group of individual investors buying physical silver and ETF shares in concert could conceivably cause a short squeeze and a parabolic move in the price of silver. Indeed, there are already signs this is happening with physical dealers running out of inventory over the weekend and unusual volume and price action in the ETF's.

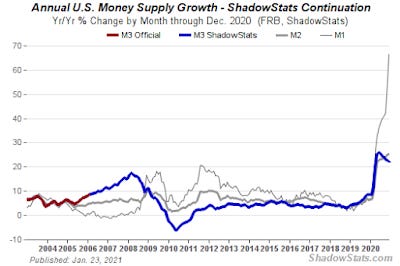

Silver has done well over the past 12 months (from a low of $14 in March 2020 to $27 recently), but some would say it should now be much higher given all the global financial turmoil caused by the pandemic and the resulting huge increase in the money supply, not to mention the industrial demand that is coming from the technology and electric vehicle markets as the economy recovers and unprecedented product demand continues.

Silver is currently nowhere near recent peak despite the macro trends mentioned above. Here's the long-term silver chart (note where the prices peaked at over $100 and $50 only to fall precipitously thereafter):

100 Year Silver Price

Again, it's easy to understand how massive shorting following parabolic upward price moves has been standard operating procedure for institutions for years. It's a fairly straightforward strategy and seems to "work." If you are an individual long term investor, you just need to be careful at what level you buy at and hold your position for the long term. If you have been waiting to open a position in silver, now might be a good time to do that ahead of what could be another parabolic move to the upside. Even if the crowd is only able to make the short players more cautious, the price of silver should "normalize" at a higher level commensurate with the macro environment, which would still be a positive for long term investors. I recently learned about the Sprott Physical Silver Trust (PSLV), which might be a good alternative to the iShares Silver Trust (SLV) since it has a lower share price and so is a little more affordable for individual investors. Also, the shares are more easily redeemable for physical silver (if desired) by individual investors than SLV.

If you're interested in learning more about investing in gold and silver, check out my book here.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.