In case you missed it, the $212B Silicon Valley Bank was taken over by regulators last week Friday. This was the second largest bank failure since the Great Financial Crisis (second only to Washington Mutual a $307B institution), with potential knock-on effects to its tech / biotech industry customers (companies, founders and venture capitalists) and the larger banking system. I have been following this pretty closely and have curated a series of twitter posts here that I think provide some valuable background and insight into what is happening and where this might be headed.

Is this the crisis we have been expecting from the Fed raising interest rates so fast (i.e., something “broke”)? Or is this just an isolated incident? When you look at how almost all banks operate, they depend to a great extent on confidence in their ability to pay people their funds when requested. If everyone with an account shows up the next day wanting to withdraw their money, there is literally no bank that can handle that, even the big ones. So how the FDIC, Treasury and Fed handle this crisis next week will be very important to maintain that confidence and avoid more damage. If they do nothing, they risk sparking a cascading series of bank runs and more banks collapsing. If they backstop / bail out the banks, then they basically kick the can down the road once again at taxpayer expense (exactly like the 2008 GFC) and potentially make inflation worse through more currency debasement / money printing.

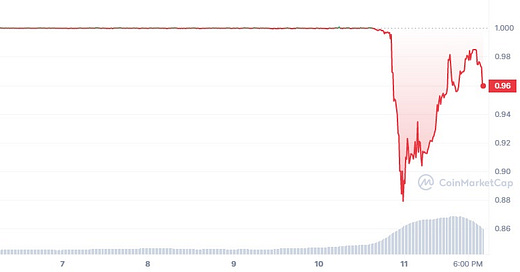

In a weird twist, about 25% of the collateral of USDC (a stablecoin pegged to the dollar) was held at Silicon Valley Bank. Since this is clearly above the $250K FDIC insurance limit, a portion of USDC is technically no longer “backed” and the price of USDC “depegged” from $1, which needless to say is not good if you own any of it:

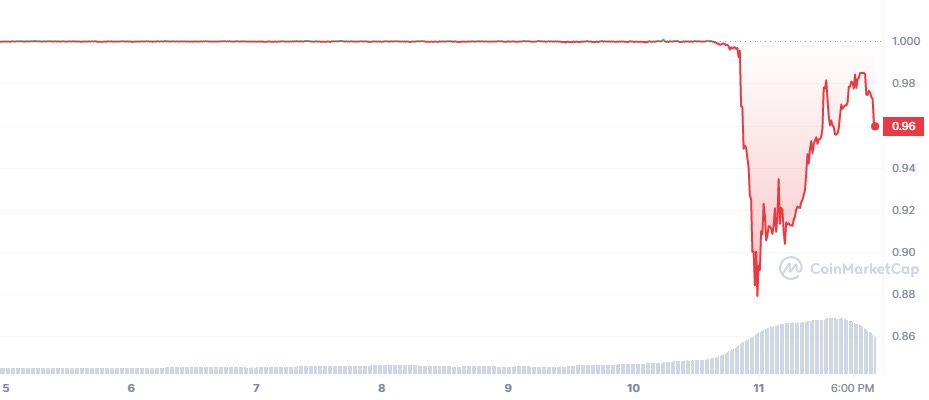

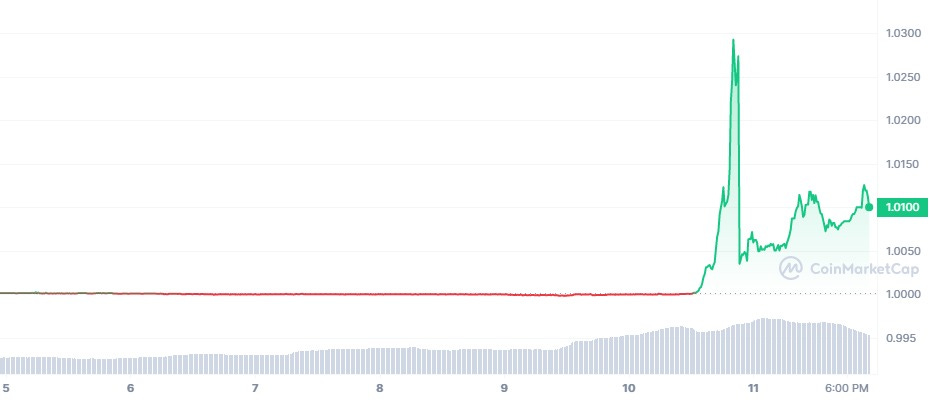

Other stablecoins that are linked to USDC also dropped below a dollar, including DAI, Pax Dollar and USDD. Ironically, Tether is actually trading at above a dollar in a weird sort of flight to safety:

Personally, I’d rather be holding Bitcoin than anything else right now, including stable coins. I’d be checking on your bank’s stock price next week and if you are in a regional bank, think about moving your money to one of the biggies until this thing cools down. I do most of my fiat banking with Wells Fargo (I moved my accounts there in 2008 when Washington Mutual failed - guess I could have waited until JPM bought them for pennies but wasn’t really in the mood to mess around at that point). Also have accounts with JPM. I have some money at Charles Schwab and found this piece by Morningstar which didn’t really make me feel that great - “should have enough equity and liquidity to ride out current storm.” Famous last words. Going to move that money, I think. Funny, the only thing I don’t have to worry about today is my Bitcoin.

How it started:

A history lesson from Rudy (retweeted by LL):

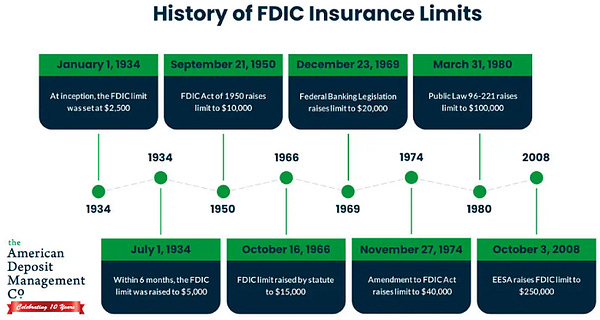

FDIC “insurance”

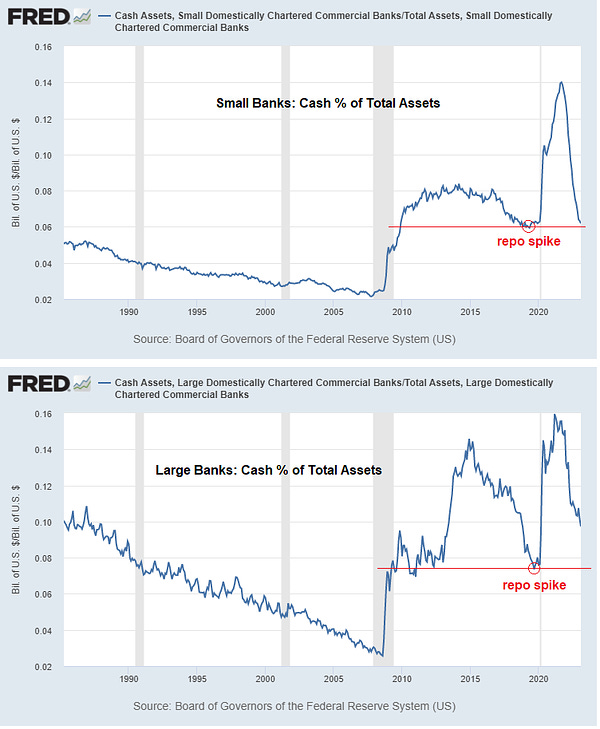

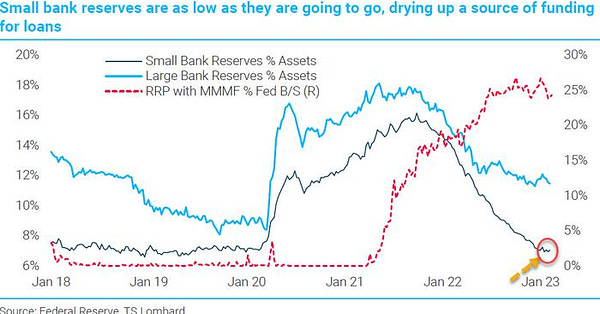

A great Lyn Alden explainer about how Fed’s withdrawal of liquidity (rising rates / QT) had a disproportionate effect on smaller banks:

Great podcast where Uncle Marty and Odell give their perspective on what’s happening with the bank run and why Bitcoin fixes this:

A Zerohedge article on why SVB is not isolated and could trigger broader issues in the banking system:

Bill Ackman has been all over Twitter today with his warnings about impending doom if the government doesn’t step in and do something (maybe he will cry on CNBC next week):

As of Saturday night they are talking “backstop” (don’t call it a bail out):

Lyn Alden shares an interesting history of FDIC deposit limits (apparently a vast majority of Silicon Valley Bank’s depositors are well above the current insurance limit of $250K):

Final thoughts:

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Bitcoin Fortress in 2023. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms. I do a weekly Bitcoin news update every week on current items of interest to the Bitcoin community, usually 30 to 60 minutes depending on the number of topics to cover. Please check it out if you haven’t already. Also now on Fountain, where you can earn sats just for listening to your favorite podcasts.