Recession Preparation

A summary of some of my past articles on the topic for your consideration.

Despite the apparently strong economy according to Fed Chair Jay Powell (high inflation, low unemployment), there are increasing signs that a recession may well be in the cards in the next 12 to 18 months - the steep sell-off in the stock market recently and the more recent rally in the 10-year treasury bond market could be leading indicators, but there are others including abysmal earnings reports from major retailers like Target and WalMart (rising inventories, cost pressures and consumers shifting from discretionary items to necessities). The high cost of food and gas will no doubt continue to weigh on consumers and will make them less likely to spring for big ticket items. Same goes for housing, with higher prices and interest rates, the average mortgage rate has risen 36% since last year which has significantly impacted affordability.

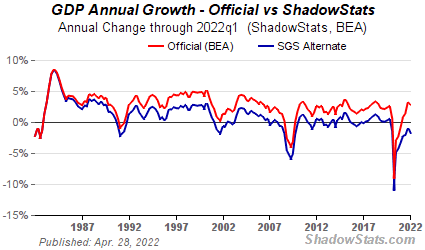

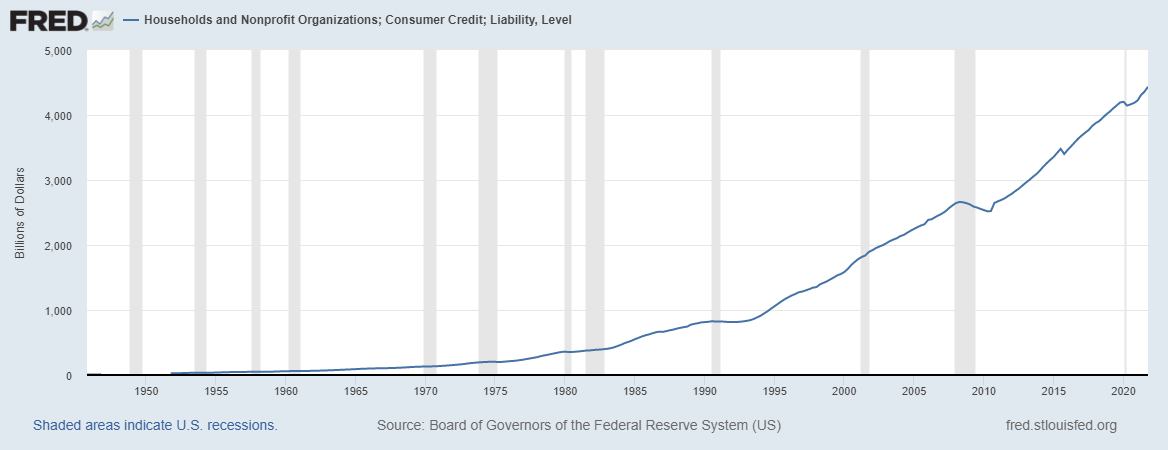

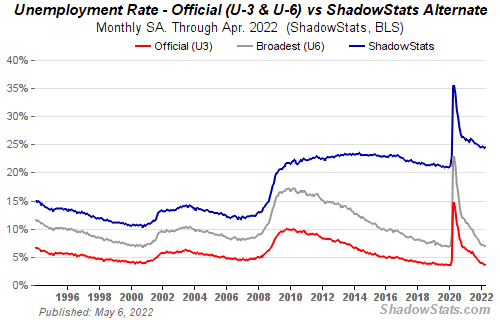

A few charts:

GDP growth is weak and declining. If reported in a consistent and unbiased manner as Shadowstats shows, it is likely negative and declining.

Second, consumer debt is monumental and growing. Highlights from the most recent CPI report included food at home +10.8%, energy +30.3%, used cars and trucks +22.7% and new vehicles +13.2%; oddly, shelter is only +5.1% (see my recent post for a fully summary of my take on the recent CPI report and monthly portfolio update here). Rising food, energy and housing prices will likely force more consumers to tap credit for necessary items, versus discretionary items:

Third, the official unemployment rate is low and starting to flatten out around pre-pandemic levels, but the official data excludes “long term discouraged workers” and so may significantly understate the actual unemployment rate. If you never felt like things were going well when we were having an economic recovery, this could help explain why things aren’t what they seem:

In late 2019, I wrote a series of posts covering various aspects of preparing for a recession, so I thought it might be a good idea to provide a summary here in case you find this helpful in being mentally and physically prepared for the next downturn. Don’t laugh, but making coffee at home (actually cutting back on trips to Starbucks) was one of my recommendations and depending on how tight things are for you personally, that may not be a bad idea after all.

Not financial advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.