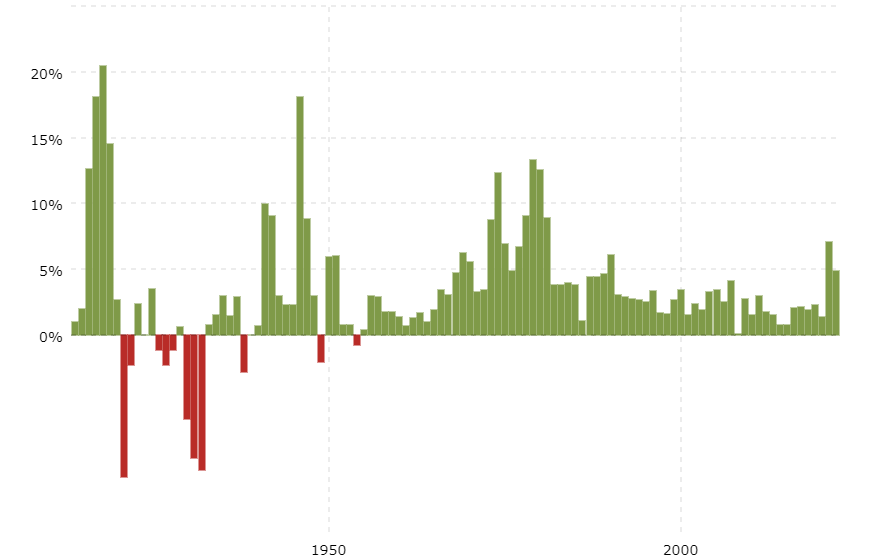

Most investors today are too young to remember what it was like investing during the late 1970’s and early 1980’s, the last time the US experienced a significant amount of inflation. Here’s a Macrotrends chart of the historical inflation rate by year. Prior peaks were in 1979 (13.29%), 1946 (18.13%) and 1918 (20.44%). The only significant deflationary time period was the post-1929 stock market crash Great Depression (lasted for three years). The Federal Reserve has been very focused on avoiding a repeat of the deflationary depression and so their default approach continues to be to keep interest rates low and expand credit to ensure growth and only tightening for as long as necessary to tame inflation. These tightening cycles seem to be getting shorter and shorter as time goes on, probably because the amount of debt outstanding keeps growing bigger and bigger.

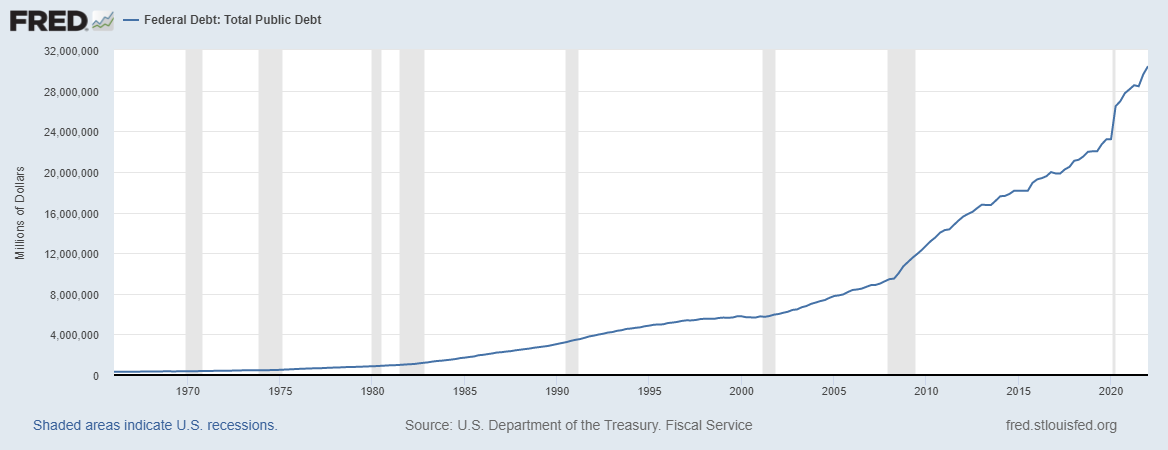

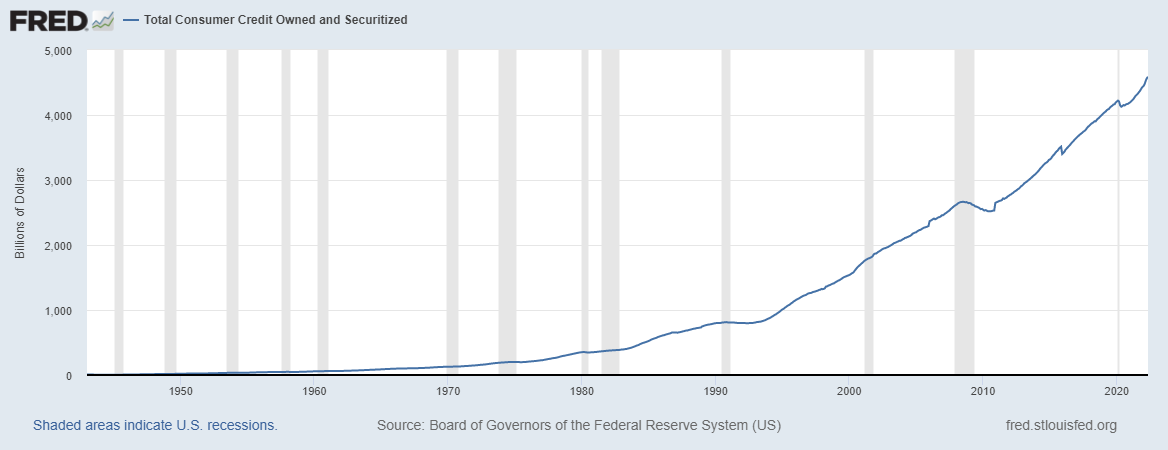

The main thing that is different this time versus the last time we had significant inflation is that the amount of public (and private) debt outstanding is much higher now than before and so increases in interest rates (especially from very low recent levels) will cause a bigger drag on the government’s ability to spend by eating up more of the budget paying interest, not to mention on businesses’ ability to grow or consumers’ ability to finance their lifestyles. Just look at mortgage rates, which have doubled over the past 18 months while real estate prices also rose, causing a double whammy to affordability for homebuyers. Now the real estate market feels like it has completely stalled out as buyers are more wary and sellers who have to sell are forced to cut prices to get offers. Here’s a look at public and private debt levels over time:

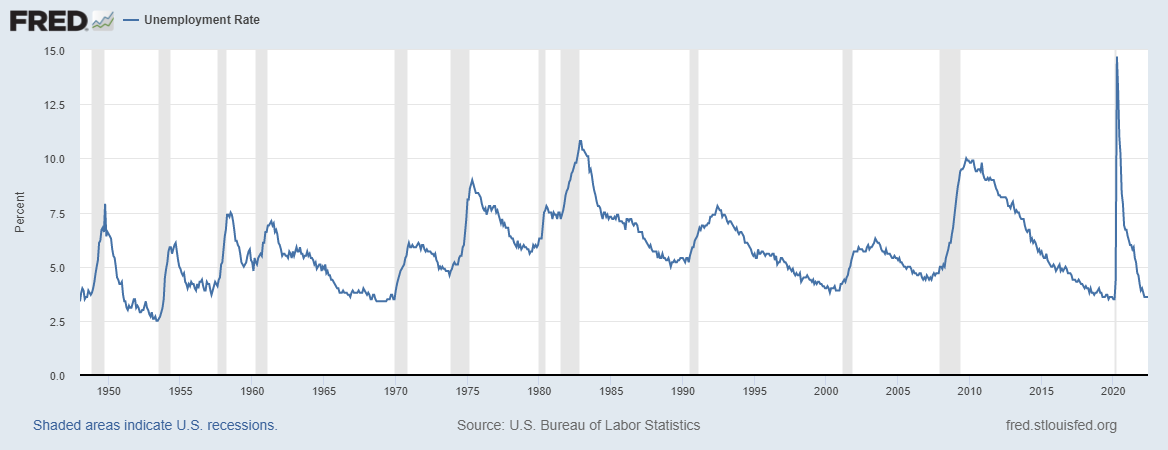

In a highly leveraged system, even small increases in interest rates have an outsized effect on the ability for governments, companies and consumers to spend and that’s a big reason why many are warning of an impending recession due to current Fed interest rate hiking policy. Lagging indicators like jobs still look pretty strong as the recent jobs report showed (+372,000 jobs in June and unemployment rate steady at 3.6%).

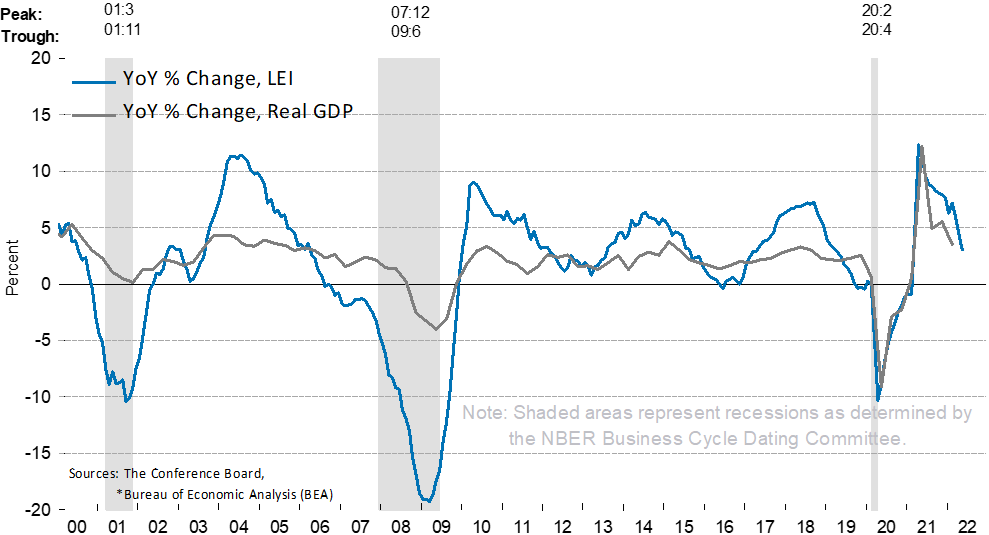

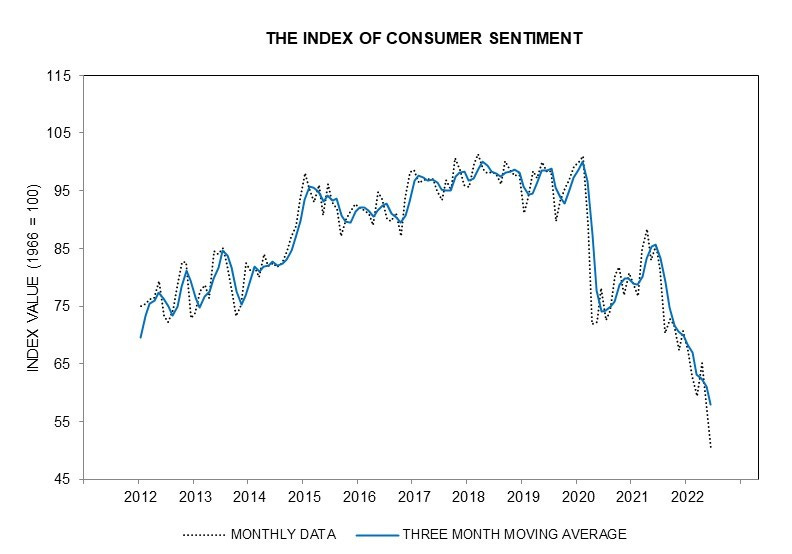

At the same time, leading indicators are showing pretty significant slowing in the economy. A few of my favorite charts include index of leading indicators and consumer sentiment:

As always, it’s not if we get a recession it’s when and how bad will it be. Everyone can probably rest assured that the Fed won’t let it get too bad (certainly no repeat of 1930’s) before they start the easy money again and at that point it will be game on for all risk assets. It will be painful, though, until then. Meantime, inflation looks like it will stick around for a while (especially when the Fed eventually has to loosen monetary policy before inflation is back to 2%) and so what makes sense to own in this type of environment? Well basically real things are better than paper things. What do I mean by that? These tend to work better in inflationary times:

Commodities

Precious Metals

Real Estate

Bitcoin (first time going through inflationary cycle, but I’m sure it will hold up well due to absolute scarcity, ongoing adoption and other features similar to gold, only better)

Things to avoid would include all bonds and stocks of companies who are losing money, have negative cash flow, have unsustainable dividends or who lack pricing power with their customers. Stocks of commodity producers, real estate companies or miners would be okay to own in this environment and some might be at more attractive prices due to the recent recession scare sell-off. Real estate stocks have sold off quite a bit (VNQ is down about 21% from its peak). Gold miners have gotten clobbered (GDX is down almost 51% from recent highs). Then there are major mining stocks like Rio Tinto (RIO) down 27% in the last three months currently sporting a 13.4% dividend yield or Freeport McMoran (FCX) down almost 43% in the last three months and yielding 1.61%. As far as oil is concerned, look no further than Warren Buffet buying more shares of Occidental Petroleum for a bullish longer term sign that oil prices will remain elevated in the coming months and possibly years, with or without a recession. For diversity, you can buy shares in the oil producer ETF Energy Select SPDR (XLE) that currently yields almost 4%.

As far as Bitcoin is concerned, it’s down about 70% from it’s all time high in November 2021. Seems like a buy at these levels and I’m definitely not a seller. As I wrote last week, Bitcoin should have a place in everyone’s portfolio at some nonzero amount because Bitcoin:

Is absolutely scarce (21M)

Peer to peer and can be transferred without a bank or other intermediary

Can be self-custodied outside the banking system and has no counter party risk if held without leverage

Is a hedge against fiat currency debasement / collapse

Some market bears say that stocks will fall another 50% from here. If you are unsure about that and have extra cash to invest, then dollar cost averaging into some of the hard assets may make sense on the way down, but trying to time the market is really hard to do (no pun intended). Better to look at whether valuation of real companies that make stuff people need are trading at low levels (price / earnings or price / cash flow) relative to history or other companies. The drawdowns of the commodity stocks can be tough to take in the short term and as described above, but the long term holder who buys at the right price will be rewarded. As George Gammon says, buy when things are cheap (fear) and sell when they are expensive (hysteria). There’s a lot of fear out there right now.

Not financial or legal advice, for entertainment only, do your own homework. I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2022. To see all my books on investing and leadership, click here.

Always remember: freedom, health and positivity!

Please also check out my Building a Financial Fortress Podcast on YouTube here and on all your favorite streaming platforms.