Real Estate Crowdfunding

I was recently introduced to CrowdStreet, a real estate crowdfunding site and wanted to share a bit about them that I learned. This site offers an intriguing way to diversify your investment portfolio into commercial real estate. First of all, you have to be an accredited investor to invest in these deals. See my post on Angel Investing for more info, but basically your net worth needs to be over $1 Million, not including your home, or you need to make $200K/year ($300K/year if you are married).

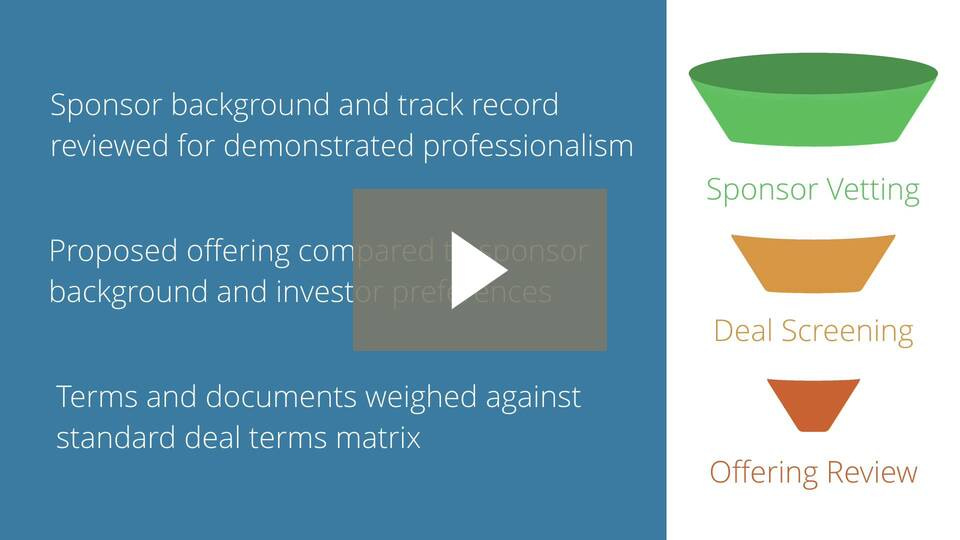

If you meet the requirements of an accredited investor, you can setup your account, submit an offer and if accepted, move to funding. The nice thing about this site is that it offers small investors access to institutional quality real estate investments that they don't normally have access to (other than investments in mutual funds or REITs). The site has a very rigorous, 26-step vetting process for deal sponsors (owners of real estate that are looking for funding) and less than 3% of the deals they review are accepted. The video clip link below describes this process, which I have to say is pretty thorough:

Expertly Reviewed Commercial Real Estate Offerings

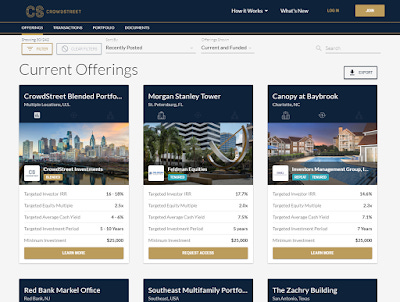

Investments include individual properties (you can sort by asset classification like office, retail, hotel, apartment, industrial, etc.) and they also have a few blended fund type investments with multiple properties included. Minimum investments are typically $25K or $50K and the holding periods vary depending on the asset. Most of the time they have managed to exceed the target rates of return in a shorter period of time, but the good economy of the past several years has no doubt helped.

Here's a look at the screen that lists available deals.

The listings will feature the investment targets for hold period, cash yield, internal rate of return and equity multiple. The equity multiple is your total return plus your investment divided by the investment. Both equity multiple and internal rate of return take into account the sale of the property at the end of the hold period in the calculation, while the cash yield is simply annual cash distributions to equity holders divided by the total equity investment while the property is being held and operated.

For more investing ideas, click here.

Disclaimer: I have not received any consideration from the company or affiliate income and I'm not currently an investor on their platform. This is not a recommendation to invest and you will need to do your own due diligence before investing.