Omeros Looks Like a Buy

I don't normally write about individual stocks, but there are some Companies that are very interesting to me. One of them is Omeros Corp. (ticker OMER). Omeros operates as a biopharmaceutical company that specializes in discovery, development, and commercialization of both small-molecule and protein therapeutics for large -market as well as orphan indications targeting inflammation, coagulopathies and disorders of the central nervous system. The company was founded by Gregory A. Demopulos and Pamela Pierce Palmer on June 16, 1994 and is headquartered in Seattle, WA.

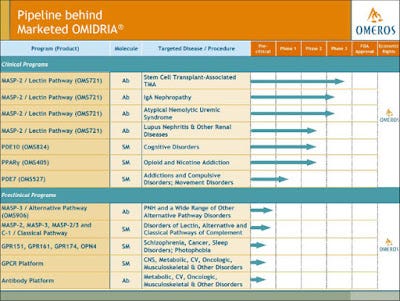

Omeros' drug product OMIDRIA ® is marketed in the United States for use during cataract surgery or intraocular lens replacement to maintain pupil size by preventing intraoperative miosis (pupil constriction) and to reduce postoperative pain. Omeros' pipeline features clinical-stage development programs focused on: complement-associated thrombotic microangiopathies; complement-mediated glomerulonephropathies; cognitive impairment; and addictive and compulsive disorders. In addition, they have a diverse group of preclinical programs and two platforms: one capable of unlocking new G protein-coupled receptor, or GPCR, drug targets and the other used to generate antibodies. For OMIDRIA and each of their product candidates and programs, they have retained control of all commercial rights, which is key for unlocking long term value should these drug candidates be approved and commercialized.

Below is a summary of the Company's drug pipeline:

Of particular interest are the drug candidates for relief of opioid and nicotine addiction as well as cognitive disorders, which are very attractive commercial markets.

Investing in development stage companies can be very risky since they have to continue to raise money in order to fund their operations until they can reach a high enough level of sales. Omeros is not unique in that respect. Based on their most recent quarterly report (September 2018) their "burn rate" of cash is about $9 million per month. With their current cash, investments and receivables that gives them about six months of operations before they will run out of cash. Their cash position was significantly impacted by an unexpected change last year in their OMIDRIA product's Medicare reimbursement coverage between January and October of 2018 (so called "pass through" status was restored in October). This resulted in a $43M drop in sales over the prior year to date period and cut into available cash flow. The Medicare reimbursement issue appears to have been addressed with a new ruling in 2019 and it looks like sales of this approved product should begin to grow again. They have a history of being able to continue to finance their operations without too much dilution to shareholders and while there are go guarantees, it seems like they will continue to do so.

The stock is currently trading at about $12 and has traded as high as $27 in the last year and so seems to be a relative bargain at the current price. The recent stock market volatility has really beaten this stock down and it was trading as low as $8. With the drug candidates in the pipeline, the stock certainly has the potential to go much higher than that if the Company can continue to successfully finance its operations and grow its commercialization effort. This one might be worth a look.

Disclosure: I have investments in OMER. This is not a recommendation to buy.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.