NFT's - I'm Cautiously Optimistic

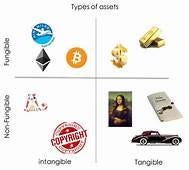

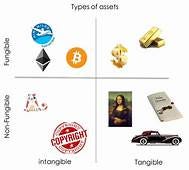

Non Fungible Tokens (NFT's) are original digital collectibles or works of art that are stored on a blockchain. Already, there have been many famous NFT's, including the recent sale at auction of the digital artist Beeple's "5000 Days" for over $69 Million. Because the artwork was transferred to an NFT, it is a digitally secure "original" and while it can be copied online and printed out or reused many times over, there is only one original, it's authenticity and ownership secured by the blockchain.

What's more interesting about NFT's is that all sorts of digital artwork creators can take advantage of this not only as another way to create and distribute their work directly to fans, but also to more efficiently monetize their work and ensure they receive royalties both at the point of original sale and in the future. Because smart contracts are used, they can be programmed to share a percentage of each resale of the original work of art with the creator as the piece changes hands in the future (presumably for more money) - this is revolutionary and cannot be replicated in the real world. For this reason, I think most NFT's will probably benefit the artist more than the buyer and can also allow more artists to reach a global audience than ever before with their work. From the buyer's perspective, but there could be some limited edition pieces that go up significantly in value - either due to viral popularity of a previously unknown artist and / or after the passing of the artist. It's possible, however, for the owner of the NFT to find ways to monetize the value of their digital art piece other than selling it in the future - possibly charging a fee for showing the piece in a digital museum or using it as collateral for a loan. Clearly, not everything being offered for sale today will have value in the future, so if you are interested in investing in NFT's it will pay to be cautious.

Many artists and creators are getting into the game. A couple of weeks ago, Time Magazine auctioned off some of its most iconic covers as NFT's, including "Is God Dead?" and "Is Truth Dead?" and a new cover based on the other two "Is Fiat Dead?" These covers sold for between 70 and 80 ETH ($140K to $160K based on recent price). More recently, musical artists Snoop Dogg and Boy George have created and are offering limited edition NFT's for sale on Crypto.com's new NFT site. Crypto.com's approach is to offer "drops" for a limited time and then limited quantities of each NFT. Purchasing an NFT requires you to buy cryptocurrency to complete the transaction. Typically this has been Etherium, but with Crypto.com they leverage their own CRO coin on their site. The rise of NFT's will obviously increase the demand for the cryptocurrencies used to purchase the items, which should help increase the value of the cryptocurrencies used over time, especially if supply is limited similar to Bitcoin. I still prefer Bitcoin as an investment and store of value vs the other cryptocurrencies, although it's not easy to be a long term holder - see my post from last week on dealing with fear, uncertainty and doubt.

Collectibles, including rare works of art can be a lucrative investment but you have to really understand the market for the items you buy. Some collectible items that are only represented physically like coins, stamps, baseball cards and the like could some day have digital counterparts but that's one I have a hard time getting my head around. It's one thing to have a song, video clip or piece of digital art (or all three combined in some cases) natively created in a digital format and put on an NFT. Indeed, this is what all the current generation of NFT's are. It's a whole other thing to create a digital representation of a physical thing for a peer to peer transaction, without involving a third party such as an escrow agent. However, in terms of documenting change of ownership of a physical thing without an intermediary including setting and enforcing contractual requirements, the blockchain does have huge potential. The applications for this are truly immense (think about buying and selling homes or cars, for example).

In terms of the Financial Fortress, collectibles do have a place in a portfolio, although I would recommend a small percentage at least to start with. Maybe 1-2%. As you gain confidence in the process and the assets you are interested in accumulating, a higher allocation may be warranted. With Bitcoin, I started with a small 1-2% allocation and have raised it steadily as my confidence in the asset has grown while still making sure I'm maintaining my overall portfolio diversity. The same could be true of NFT's, although I have yet to invest in any.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.