Model Investment Portfolios

I have recently been researching "model portfolios" and wanted to share a few I have identified that would be good for long term investors.

Some of the key themes I have discovered in my research that are important to maximizing long-term returns include the following:

Simplicity

Diversification across asset classes

Low cost (almost everyone agrees that keeping the cost low is critical to supporting strong long term returns - Jack Bogle, founder of Vanguard, calls it the "relentless rules of humble arithmetic")

What I have learned in my research, is that a small number of Exchange Traded Funds (ETF's) can deliver on all of these requirements and don't require a lot of maintenance. ETF's have very low costs because they are not actively managed and instead track underlying indices. I suppose this could also be called a "lazy portfolio," but there's nothing wrong with that way of investing, since it can expose you to less risk, better returns and all for less effort.

Since the time horizon I was looking at was long, these portfolios skew more toward "aggressive" but you can easily adjust the percentage allocations back to levels that you are more comfortable with, depending on risk tolerance and timeline.

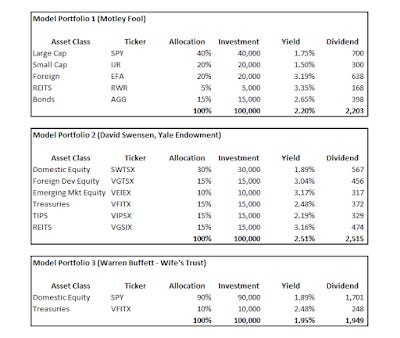

I looked at several model portfolios, but the ones I liked best were inspired by Motley Fool, David Swensen (he successfully managed the Yale Endowment to an average annual return of 13.9% over the past 20 years) and Warren Buffett (the allocation supposedly called out in the trust for his wife).

For the illustration below, I assumed an investment of $100,000 and I also show the dividend yield provided by each of the funds, since that is also important (whether you take the cash or reinvest). Reinvesting the dividends would greatly improve the overall long-term return, of course, but you may have a situation where you want or need the regular passive income. The funds selected are among some of the lowest cost ETF's available on the market for the specific asset class. There may be better ones out there, but these pretty consistently popped up in the research.

Here are the model portfolio examples:

I think out of the three, my favorite is Portfolio 2 since it provides a lot of diversification across various asset classes and is designed to do well in pretty much any market environment. I do like Portfolio 3 for its simplicity, but really all three are pretty simple and easy to manage. As you can see, you can accomplish a lot with between 2 and 6 ETF's. This is certainly a lot easier than having to manage a large portfolio of stocks and a lot cheaper than having a portfolio of actively managed funds, even if returns might be slightly better in some years. You would just need to rebalance once or twice a year and otherwise these would be very low maintenance once setup.

Here are links to the funds included above if you are interested in researching them further:

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020.

To see all my books on investing and leadership, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.