Masterworks.io Review

As an investor that favors hard or tangible investments, I'm always looking for new alternative assets for portfolio diversification. Quite a while ago, I was introduced to Masterworks.io, but only recently did a bit more research and finally made my first investment in artwork. This post is a general overview of the site, pros and cons and my overall take on the product.

Overview

Masterworks.io is a site that allows you to make fractional investments in fine art. They research the art market, have developed relationships with major auction houses and have built a database tracking a massive amount of historical sales data. Using this data, they have developed a selection process whereby they are able to vet through art offered for sale to them and select the pieces that are expected to have the best long term investor returns through the use of algorithms. Each piece of art they acquire is held by an entity that is registered with the US Securities and Exchange Commission and shares are sold to investors representing fractional interests in the work. They also maintain a secondary exchange where you can sell your shares to other investors if for some reason you need the cash. Otherwise, you would just hold your investment for 3-10 years until it is ultimately sold. They only end up buying about 2% of the art they are offered in about 1% of the artist markets they have analyzed (the ones they believe have the best returns based on their data analysis). The amount of historical price data they have is impressive - they have a proprietary data set that spans 70+ years of data and 60,000 datasets. They boast a 16% average annual rate of return on all their artwork, after deducting fees, which is pretty impressive. Fees are 1.5% annually (collected in additional shares issued to Masterworks vs cash) and a 20% fee upon sale.

Benefits

There are several benefits to investing in fine art through Masterworks:

Each piece is carefully vetted and unique and therefore scarce, which improves chances for strong returns

Additionally, over time the works of popular (deceased) artists find their way into museums and off the market, thereby increasing scarcity of the artist's work over time

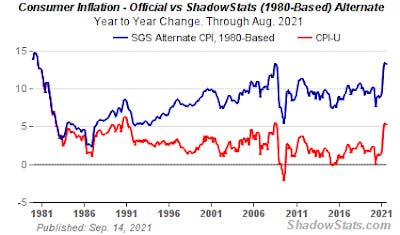

Can potentially be a hedge against inflation

Diversification of portfolio

Low correlation to other asset classes (see chart below - top performing artists as represented by the Artprice 100 have far outpaced S&P 500 historically)

Anyone can invest (no need to be an accredited investor) and low initial offering price of $20 per share for each work of art

Works of art valued in the millions or tens of millions that would not ordinarily be available to small individual investors can be invested in

Art is protected and insured

Disadvantages

There are also some disadvantages to this investment:

Counterparty risk (i.e., Masterworks.io continues to stay in business, adequately safeguards the works of art, has appropriate due diligence prior to purchase of works of art including careful authentication and also knows when to sell)

Secondary market may be illiquid and pricing in the event of the need to sell may not be very favorable

Requires "patient money" since this is a very long term investment and ideally shouldn't be "traded"

Fees are pretty substantial, however the 20% back-end fee does align Masterworks' interests with the shareholders

Overall Take

Sales process is very smooth; you make an appointment to talk to an agent who walks you through the investment process and answers any questions you might have

Website is intuitive and very easy to navigate

Investment thesis and investment deal sheet are well written and very straightforward

Funding investment and closing were easy (link bank account using Plaid)

I plan to continue to build my Masterworks portfolio over time by adding some other artists and works. Eventually I plan to target about 2%-5% or so of my portfolio in this asset class. It should perform well in the coming years, especially if we experience above average levels of inflation, which may be a lot higher than the official numbers as I have discussed before (see chart below).

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.