Market Volatility? Not to Worry!

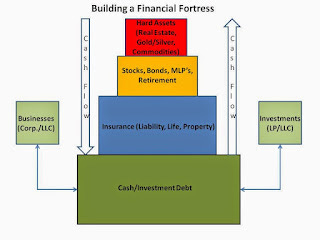

Quite some time ago, I made a decision to once and for all go to a very defensive investment posture, including lots of cash and short term investments, some gold and silver as a true "safe haven" investment and reducing my exposure to equities and bonds. While I do keep a portion of my non-401(k) investments in stocks, I like investing small amounts over time in a highly diversified way and recommend Acorns for this. This is based on my experience over the last two major investment cycles of having seen my portfolio lose half it's value each time - first in 2001 (Dot Com) and then again in 2007 (Great Recession). No one knows for sure when the next cyclical downturn is coming but it will certainly arrive and you must be prepared when it does!

As I have generated new money from selling investments and other income, I decided to keep it all in cash for a relatively small interest return (I was able to find some higher yield alternatives paying close to 1%), rather than risk putting it in the market at the current lofty valuations.

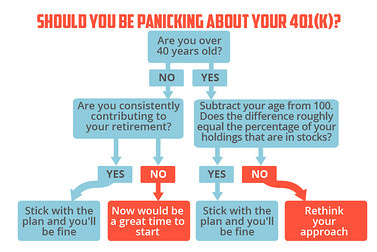

Marketwatch posted this infographic today:

For my 401(k), I wanted to be in a position where if my equity portfolio lost half its value, I would lose no more than 25% of my investment so I made sure that no more than half of my portfolio was equities and I split that 50/50 between US and International stocks for diversification.

The last few days in the market have confirmed in my mind the wisdom of this approach. I believe volatility in markets will only get more extreme as time goes on, with low interest rates which continue to encourage borrowing and speculation in all investments.

As I discussed in a previous post, almost three years ago, a broadly diversified approach is really the best way for a non-professional investor to protect him or herself from market volatility.

For more investing ideas, please see my website at Building a Financial Fortress.