Market Outlook for Coming Week

For this week's post, I thought it would be good to give a market overview in light of the Federal Reserve Chairman's comments last week on starting to taper bond purchases later this year and continuing to hold interest rates low. This ignited a strong stock market rally on Friday after a volatile last couple of weeks, presumably lifting some of the uncertainty about the Fed's path forward. The question now is which way will the market go. A difficult question to answer, especially since September is typically not a great month for the stock market. On the flip side, the ongoing economic recovery, strong corporate earnings and favorable monetary / fiscal environment are positives. Perhaps the biggest positive is the continued "easy money" environment supported by the Fed. Some market watchers see economic weakness on the horizon based on some of the recent mixed economic data and a slowdown would obviously be bullish for bonds and not so bullish for the stock market. There is however, a big difference between a recession and moderating growth in 2022 and we could be seeing the latter, which would still bode well for the stock market for the remainder of the year and next.

Starting with the S&P 500, the linear trend continues to be up and there doesn't seem to be much in the way of keeping that going in the near term. Of course, there may be pull-backs and the market is due for a correction at some point, but predicting the exact timing is very difficult.

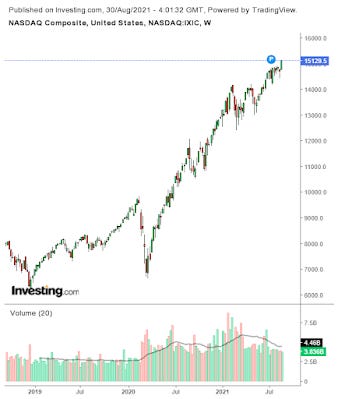

Much like the S&P 500, the NASDAQ linear trend is strong and upward. Again, not much in the way here.

Dow Jones Industrial Average momentum and linear trend continue to be strong as well, very much like the other two indices. Again, hard to see anything stopping this in the near term given the current environment.

The VIX continues to be at very low levels, suggesting that fear is low with investors. I think this is probably the best hedge against market uncertainty (better than bonds, which seem to be heading toward higher rates, not lower) in the current environment and it probably makes sense to own a small position at these levels just in case something happens to the broader market. I prefer UVXY a leveraged ETF, for that purpose.

Dollar is struggling now (was in an upward trend but Fed comments hit pretty hard last week). It will be interesting to see if the dollar moves higher or if it rolls over and heads back down into the 80's. The latter would be extremely bullish for commodities, including gold and silver.

Gold is trying to rally but has been stuck in a more or less sideways pattern since last summer. Many analysts believe that gold is poised to move up in light of the Fed's comments (presumably on dollar weakness) and the recent dramatic recovery from a deep sell-off. Gold is expected to move toward all time highs over the remainder of the year if it can overcome a few key technical levels. The long term outlook for gold is very good with global money printing, but patience may be required in the near term. Still worth at least a 5% or 10% portfolio allocation as a buy and hold, especially at these levels. I like the miners the best because they have sold off more, tend to outperform on the upside and also pay a dividend (GDX, GDXJ).

Bitcoin continues to mount an impressive rally from the recent 50% "crash" from all time highs. Some analysts believe that Bitcoin could hit $51K or $52K and then it will drop all the way down to the $15K - $20K range before consolidating and moving up again. If that's the case, I would definitely be a buyer at those levels. Others have said that it will continue to move up and once it breaks through the former all time high, $100K could be the next target level before the end of the year. Only time will tell, but the best approach is to buy on the dips and dollar cost average on a regular basis. See my post last week on Bitcoin investing rationale for more info.

In summary, perhaps your best protection over market uncertainty is keeping a broadly diversified portfolio since it's so difficult to beat the program traders and it's much easier for an individual investor to maintain a buy and hold portfolio. See my recent post here for my last portfolio allocation update. Beyond having a broadly diversified portfolio, it makes sense to stay fully invested in the stock market consistent with your portfolio allocation target and employ hedging where it makes sense just in case. For example in my trading portfolio I use two main hedging strategies: I sell call options on the stocks I own for cash flow and to hedge downside moves and I also own UVXY shares (roughly 9% of the total portfolio).

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.