Macro View and Ideas for Coming Weeks

After reviewing the market action last week and watching some good market commentary on YouTube (see my twitter feed for some of the recommended videos I posted), my overall portfolio positioning as discussed last week here is still pretty solid and poised to weather the ups and downs as the markets cycle between risk on and risk off, inflation and deflation, etc. While Bitcoin and other crypto has been struggling lately, I am still bullish for the long term outlook on this asset class and feel better about reducing my allocation last week and shifting some money to gold, silver and TIPS. For my stock trading portfolio, I'm making a few moves next week to capture some areas of the market that I think look poised for growth and exit some positions that look less attractive, which I'll talk about later in this post.

In my opinion, the biggest macro theme in the coming weeks, other than inflation, is how over-extended the US stock market is starting to look. The S&P 500 continues to post all time highs and the chart is starting to look parabolic - a troubling development, as shown in the chart below:

S&P 500 - 10 Year Chart

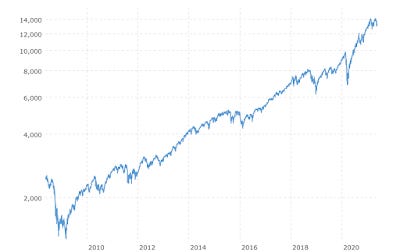

The market action last week (three days of sell offs followed by two strong days of rallies, but overall down for the week) indicates investors are nervous. The Nasdaq chart looks similar, although has faced a bit more weakness lately than the S&P 500 but still near all time highs and this chart is also looking parabolic:

Nasdaq - 10 Year Chart

It's pretty obvious to most investors that US markets are over-extended and are at risk of a near term correction, maybe as much as 20% or 30%. This is not because of any sort of economic slowdown (indeed, the economy is doing quite well and is expected to do so for the next year or two - but that's already priced-in). Instead, it could be driven by over-valuation of US stocks, selling to take profits and the huge amount of margin debt currently outstanding, which has spiked tremendously since last year as shown below:

With this amount of margin debt, any significant downturn in the market could cascade into a massive amount of selling as margin calls are triggered and liquidations are forced. For long term investors, these ups and downs are less of a concern as long as you are diversified and positioned well (Financial Fortress), but it's certainly a concern for traders who are trying to make money on short term positions and preferring to front-run this correction by selling early in order to have cash to buy at the bottom of any correction.

For my trading portfolio, I added a couple of hedges recently, buying long term puts for SPY and QQQ to protect in the event of a significant downturn. These aren't huge positions and I view them more as cheap insurance than a trade, although if there is a significant downturn there's an opportunity to sell to generate cash to use to buy "bargain" stocks. I'm planning to add to those hedges a small position in UVXY which is a leveraged VIX ETF that is at or near all time lows and could spike significantly if market selling / volatility rises and therefore has tremendous upside in the event of a significant market correction. Again, I view this more as cheap insurance than a trade but if markets do really go into a significant downturn, these hedges will perform quite well.

I'm also planning to sell positions in Chevron (CVX), MGM (MGM), Sklz (SKLZ) and Qualcomm (QCOM) and buying Junior Gold Miners ETF (GDXJ) and Alibaba (BABA). I think oil prices might not have as much more to run in the near term and are going to hit a lot of resistance at current price levels, especially as the world continues to struggle to recover from COVID. Of course, the tech names have struggled recently as cyclical and value stocks have been more in favor with investors, so best to exit those now with only minor losses (and also collected some good call premiums while I held them).

See oil chart below:

I think gold is undervalued relative to stocks and bonds as I have mentioned in previous posts. A moderating interest rate environment, with continued signs of inflation have helped to wake up gold and silver recently. The junior miners tend to be a bit more volatile than the larger miners (GDX), but much more upside potential if gold is ready to break out, which seems to be the setup. See gold chart below:

Alibaba, a very well known Chinese internet behemoth, is significantly below its 52 week high of $319 and seems like a great bargain at around $210, particularly if investors move their money out of the US (due to a market correction or for diversification) and into emerging markets such as China for better returns. I can also sell calls on this for income with pretty good premiums, if desired. I'm also increasing my cash position slightly to about 9% of my trading portfolio to be ready to take advantage of other opportunities.

My overall outlook for US stocks is cautious for the next several weeks as recent volatility shows that the markets are unsettled and a big move down seems more likely than a big move up. Having a diversified portfolio is the best defense for a small investor but taking advantage of market opportunities with "little bets" with a small trading portfolio is a good way to learn more about the markets, generate cash flow and build your portfolio. Above all, it's important for you to do your research and ultimately make your own decisions about what you want to invest in.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2021. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.