Is Now a Good Time to Invest in Silver?

Is now a good time to invest in silver? If you have been watching the price of silver versus gold, you know that silver generally tracks gold's price movements over time pretty closely. However, since the beginning of 2017 there has been a widening gap in performance and recently, the gap has widened even more, with gold moving up in value while silver continues to decline. Both metals are good hedges against inflation, are popular with investors and are available in many forms, both physical and non-physical. If you want to learn more about investing in gold and silver, please check out my new audio book Building a Financial Fortress: Investing in Gold and Silver on Audible.

Inflation definitely seems to be a concern in the bond market with the movement of long-term interest rates recently and certainly has the attention of the Federal Reserve as they continue to raise short-term interest rates. While gold has demand from jewelry manufacturing, silver has many industrial uses especially in the high tech and medical industries. As such, the demand for silver is not only limited to investors but also industrial users.

The chart below shows the divergent price movement between gold (the blue line) and silver (the orange line). Silver has reached $21/ounce a couple times in the past 5 years and currently sits at about $14/ounce (a two year low), so there's potential to see a 50% increase in value, assuming silver can return its prior peak. Key drivers for silver will be inflation reading, investor demand and industrial demand (which to a large degree depends on continued economic strength). Back in September, it was reported that the US Mint temporarily sold out of Silver Eagle coins due to strong investor demand, which bodes well on that front.

Gold vs Silver - 5 years (www.macrotrends.net)

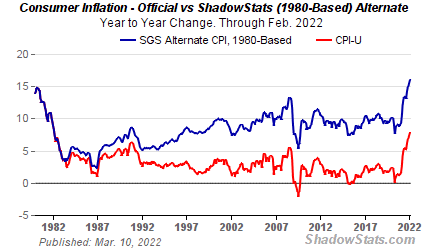

The chart below shows inflation over time. The true rate of inflation is actually much higher than currently reported in the press, due to changes in how it is calculated over time. The Shadowstats alternate shows the true rate of inflation which is about 10%. This is significant and could be a big driver of the price of gold and silver over time.

If you're interesting in investing in gold or silver, check out Money Metals Exchange for a great selection of coins. You might even find a great Holiday gift idea there.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.