Is it Finally Time to Short Long-Term US Treasury Bonds?

I have written in the past about TBT (ProShares UltraShort Lehman 20), a leveraged inverse exchange traded fund that is designed to achieve returns that are inverse to and double the increase or decrease in the 20+ year US Treasury Bond index. For example, if the index decreases 1%, this ETF should go up 2%. When the Treasury rally ends and the sell-off begins, this will be a very powerful tool to achieve outstanding returns as interest rates rise and bond prices plummet.

However as you can see in the chart below, the continuing rally in long-dated Treasury bonds since the financial crisis - Federal Reserve interest rate manipulation, "flight to safety" and investor uncertainty/fear - has resulted in a significant decline in the value of TBT.

Many investors who sensed for the past year or two that this is a "no brainer" bet have been burned by another leg down. I still believe this is the next "big short," but as with any time you are betting on the decline in the value of an asset pumped up into a bubble, timing is everything.

TBT - Time to Buy?Why is this time any different?

Well, for one thing, more and more market observers are noticing investors putting money into stocks. For the last three weeks, equity mutual fund inflows have been almost $25 billion, far exceeding bond inflows. Many individual investors, tired of earning minimal returns in fixed income securities and seeing how well the stock market performed last year have decided to jump back into the market. Many were waiting for resolution of the "Fiscal Cliff" to do so. Also, the economic recovery, albeit weak, continues which bodes well for continued strength in the stock market.

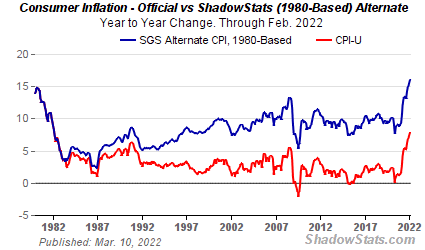

Secondly, as I have written many times before, the easy money policies of the Federal Reserve will light the fire of inflation - it's not a question of "if" but rather "when" the inflation shows up and how much it is. While the Consumer Price Index has shown relatively benign readings lately, many believe this index is manipulated and certainly doesn't reflect reality since it excludes food and oil. The methodology of calculating the CPI has also changed over the years, resulting in lower readings that you would otherwise have if the methodology were kept constant. If you've been to the grocery store or the gas station lately, you know that these items are not getting any cheaper. As you can see in the chart below, one estimate is that we are at roughly 10% inflation now. What is more troubling is that the gap between reported and the alternate measure is widening.

The Fiscal Cliff deal hasn't addressed the annual US budget deficit or the enormous - over $16 trillion - public debt of the United States. The threat of further credit downgrades of the United States coupled with the uncertainty of any real meaningful approach to reducing the public debt will weigh on the price of Treasuries. Indeed, the easiest way to deal with the US public debt is to devalue the dollar.

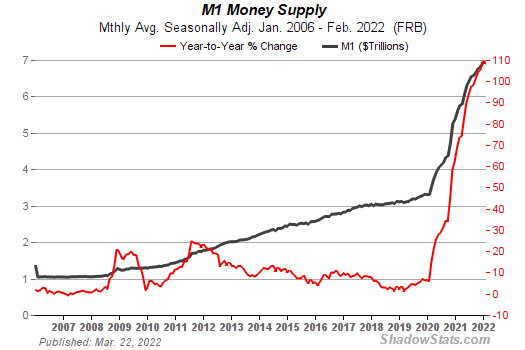

Finally, the biggest concern for inflation is the huge supply of money that has been created over the past few years. There is now over $2.4 trillion in the banking system available to lend to individuals and businesses. More than $1.2 trillion has been added to the money supply since the beginning of the financial crisis (almost doubled). When this starts to go to work in the real economy, the flood of dollars will be a very powerful driver of the economy, as well as inflation.

I do not currently have a position in TBT.

Related articles

Beware The Sharp Rise In Treasury Yields (GS, TBT, TLT, MORT, XHB)

Treasuries Rise Before Fed Purchases as Selloff Brings Buyers - Bloomberg