IPO Watch

There are three IPO's coming up (two that will start trading on Wednesday next week) that I have been watching and wanted to share with you. I think these might be worth buying if you can get some shares from your broker, even if only a few.

Airbnb (12/9)

Everyone should know about Airbnb, since it has become a popular site for booking travel accommodations, often at a much better price than hotels and delivering a more "authentic" travel experience. While the business took a hit (like all travel industry businesses) from COVID-19, the business has rebounded recently with people taking vacations closer to home, avoiding crowded hotel lobbies and also long-term stays for people who can work remotely and want a change of scenery. What I didn't know is that Airbnb's business, unlike a lot of internet companies that I recall from the 2000's, is actually cash flow positive.

In the Company's Registration Statement, the financials show that for the past four years they were consistently generating positive free cash flow, up until 2020, which is not surprising given the COVID situation.

How the Company performs post-COVID is anyone's guess, but many analysts expect a strong rebound in travel once vaccines are widely available and there's no reason to believe that Airbnb can't participate in that rebound and with it's "asset light" business model generate much better returns than "asset heavy" hotel companies. The IPO will give them about $2.3B - $2.5B of proceeds that they can use to continue to scale the business. Pricing is expected at between $45 - $50 per share and seems likely to open up higher given recent stock market strength and focus on "recovery" plays, which this company certainly seems to fit.

C3.ai (12/9)

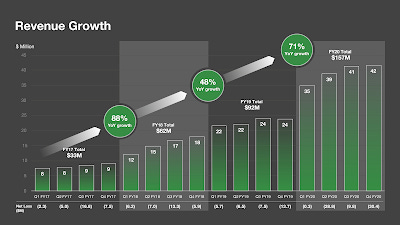

For those are old enough to remember Siebel Systems (the granddaddy of CRM) in the 1990's, you will know the founder Tom Siebel who has a strong track record in the technology industry dating back to his early involvement in Oracle. He later sold Siebel to Oracle after building a $2B business. Well, he has been at it again, this time quietly building over the past 11 years a company called C3.ai. This company provides a customizable layer of AI decision support tools that is database platform-independent and can combine large amounts of data both inside and outside the enterprise to support decision making. He has some great partnerships, including Microsoft, and has seen tremendous revenue growth as shown in the chart below:

Also, this Company is a SAAS model, which means they get 86% of their revenue from subscriptions. While the company posted a loss and there's certainly some risk, the business model and the team that Siebel has assembled should give investors some comfort that they will be able to successfully execute in what will certainly be a rapidly growing industry of enterprise big data AI analytics. It's all I hear about nowadays at my company. What's perhaps most interesting is that in the most recent period, the company reported $17.9M of positive free cash flow for the six months ended October 2020, compared to -$4.9M in the same period a year ago. With the strong revenue growth, positive cash flow, great business opportunity and solid team this one looks like a good bet as well. The stock will price at up to $34 per share.

Roblox (IPO Date TBD)

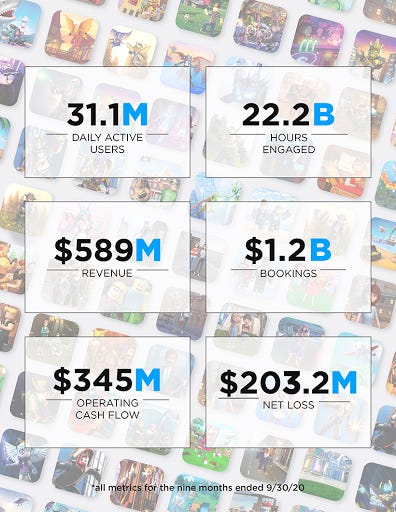

If you have a tween in the house, you have probably heard about Roblox. I have to say I'm amazed at how much time my son spends playing this game (and how much money he's willing to spend to enhance his character and game experience). It's truly something else. Roblox is an online gaming platform that has several unique features, not the least of which is a dedicated group of developers who are constantly creating new mini-games and experiences making the platform more engaging. By the numbers, Roblox although posting a net loss due to noncash charges required for GAAP purposes, is actually generating positive cash flow of $345M for the most recent nine month period ended September. This is pretty impressive and is being driven by 31.1M daily active users who are spending on average about $39 each buying "Robucks" which can be used to purchase in game items (that drives the $1.2B bookings number). Roblox is a great business now and is certainly a big beneficiary of the pandemic, but a key question is how will it do post-COVID? I think this one might be worth taking a position in. Video games will continue to be popular with kids, just like they have been before COVID and unique experiences that combine socializing with friends and constantly changing content that should perform well in the future.

I hope you find this post useful as you chart your personal financial course and Build a Financial Fortress in 2020. To see all my books on investing and leadership, click here.

Stay safe, healthy and positive.