Investing In Volatile Markets: The 5-20 Rule

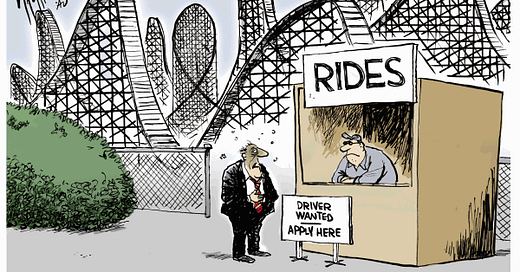

The new year has indeed brought with it more volatility in the stock market and fear is back in vogue. Why put yourself on the roller coaster of the stock market if you can avoid it? Wouldn’t you rather sleep at night knowing that no matter what happens to the markets you are making money? If you Build a Financial Fortress for yourself and your family, you can achieve financial freedom and peace of mind.

I have previously blogged about how huge drops in the stock market (like we have seen in the past and are seeing today) can gut the value of your portfolio; so much so that it could take years to recover what was lost. You should know that the stock market is a rigged game that is setup to benefit big financial institutions and program traders, not the little guy.

Most of us are not day traders and can’t move that fast with our retirement portfolio, especially when the stock market is in free-fall. For most people, their retirement accounts are where most of the money is. So a defensive strategy employed at all times makes the most sense, especially in today’s market environment of extreme volatility.

A few basic principles first:

It’s really important to keep things simple. If you don’t understand it, don’t invest in it.

Also, believe in the power of compounding - slow and steady does win the race and often people feel the pressure to earn great returns and take on too much risk in order to achieve those returns.

Finally, cash is king and positive cash flow should be your primary focus in all that you do, whether it’s your day job, household budget, side hustle or investing approach. Maximize inflows and minimize outflows.

Take a unified approach and look at your portfolio across taxable and non-taxable accounts; tax planning matters, but it should not override your fundamental strategy

I have been recommending a very simple portfolio allocation that really cuts down on the volatility while earning a good return over time with potential for upside. I call it the "5-20 Rule," and it goes something like this:

20 percent cash

20 percent stocks (spread across international, US and all sectors including large and small cap - actively managed seems to be better lately than passive funds; try investing with Acorns if you haven't got an investing account

20 percent bonds and fixed income

20 percent real estate (either REITS or direct real estate investments)

20 percent alternatives including life insurance, royalties, gold / silver, crypto (limit crypto to 1 percent or so of total)

In each bucket, ensure there is plenty of positive cash flow, so the goal should be to maximize yield of each investment. For example, cash yield can be maximized by investing in US Treasury Bills, which are extremely safe and are currently yielding about 2 percent (see my post on this one). Stock yield can be maximized by investing in solid dividend stocks like AT&T, ExxonMobil, Con Edison or Ventas (here's why I like these particular names). Bonds and fixed income yields are usually tied to duration, so best to have a balance of shorter and longer. For alternatives, use a blended approach of both yield (life insurance / royalties - follow links to my previous posts on these ideas) and appreciation (gold / silver and crypto) for upside.

If you have positive cash flow coming in from multiple sources, you can be less concerned when a small portion of your portfolio takes a hit due to market value declines. The goal should be in the worst market scenario to suffer no more than a 10 to 20 percent portfolio loss overall. When you are broadly diversified as outlined, that outcome is very unlikely.

It can take some time to get your strategy realigned and may take a year or two to complete, but better to get started now than wait. If you have cash to invest, put it to work in the new allocation and re-balance your other investments over time, when the opportunity presents itself. What’s most important is that once you set everything up, stay the course and eventually, you’ll see the results. Often times people become impatient with performance and make bad decisions that are not consistent with their strategy, or worse, they have no strategy. Having the discipline and focus to stay the course will help ensure your ultimate success.

For more investing ideas, click here.

Disclaimer: I use affiliate links where I get paid a small amount if you buy the service or product. This helps support my blog.